Today, I have a great debt payoff story. I’ve known Lauren for years – pretty much ever since I started Making Sense of Cents years ago! She was one of the first blogs I read actually.

Lauren Mochizuki is an ER nurse, wife, and mother. She and her husband paid off $266,329.01 in 33 months. They also purchased their fixer-upper dream home, and renovated it without going into debt. Enjoy her story below!

The Background

Female, age 25, nurse, recently married, living her life with no regard to finances. Frequently dines out, goes to concerts, travels to foreign countries, never volunteers to work any extra shifts, lives beyond her means. Purchased a brand new Subaru Forester, husband also purchased a brand new car, lives in an 1,100 square foot condo.

Total debt owed: $266,329.01.

My Story

My name is Lauren, I’m a registered nurse, wife, mother, blogger, and firm believer that you can live an amazing life within your means! I didn’t have a clue what budgeting actually meant.

When my husband first brought up the idea of budgeting, I was incredibly resistant. I thought that budgets were boring, restrictive, and I didn’t want to compromise my spending habits. I couldn’t have been more wrong about my ideas surrounding budgeting.

Looking back eight years ago, I realized that change is difficult, but the outcome was worthwhile. We are now debt free!

Other debt payoff stories:

- How My Wife and I Paid Off $62,000 in Debt in 7 Months

- 37 Crazy and Creative Strategies To Pay Off Debt From Real People

- How We Paid Off Almost $10,000 in 10 Weeks

- How I Paid Off $40,000 In Student Loans in 7 Months

- Best Side Hustles For Nurses

Want to see how I built a $5,000,000 blog?

In this free course, I show you how to create a blog, from the technical side to earning your first income and attracting readers.

Inspiration to Become Debt-Free

Eight years ago, we had some friends that were doing radical things to become debt free. We thought they had lost their minds. They were working lots of overtime, and paying down their debt. At the time, it sounded very extreme, and obscure.

Then one day, after reading Dave Ramsey’s “Total Money Makeover” and having a long discussion with our aspiring debt-free friends, he said “I want us to become totally debt-free too.”

I was ready to give my husband a swift karate chop when I heard that. It never occurred to me that we had money problems. Our bills were being paid on time, we put aside some money in savings, but most of all, we were having so much fun with our money!

Our debt breakdown was:

- Credit card bills: $1,871.31,

- The balance owed for two new cars: $31,211.10,

- Mortgage balance for our condo: $233,346.60.

Total Debt $266,329.01.

Figuring out my “Why”

My husband kept pitching the idea of “Financial Freedom” to me, and that sounded pretty amazing, and at the same time daunting. I wanted to support my husband, and if becoming debt-free was something that was important to him, and in reality important for US, then I decided that I should give it a try.

I went from 0-60 very quickly. I not only took on this journey of debt-freedom; I lived it, breathed it, and became incredibly passionate about it. I also read “Total Money Makeover”, which fired me up even more. It was an easy read, for a “free-spirit” like me.

Accountability Partner

My husband and I became budget accountability partners. He is the President of the Budget, and I’m the Vice-President.

Together, we make decisions about how our money is spent, our work schedules, family schedules, and our future. Having an accountability partner is something that is helpful for being successful on a budget. Whether it’s a friend, sibling, or coworker, find someone you trust, and respect, and most importantly hold you accountable for your decisions.

Establishing our Monthly “Budget” Meeting

At the end of each month, my husband and I decide how we are going to spend our money for the following month. We call it our monthly budget meeting.

For example, if we made $5,000 one month, we would assign each dollar to a budget category (examples: utilities, mortgage, toiletries, work expenses, groceries, savings, etc.) for the following month.

I am the social events planner for our family. During our budget meetings, I always have our monthly calendar open. This step is key to having a successful budget meeting. We check the following month events for birthdays, showers, events, or weddings so that we can budget appropriately. This helps to avoid any budget surprises.

We would also plan out all of the extra shifts we would be working during this time to cover these expenses.

It took us nearly 6 months to really get the hang of budgeting and tackling any issues that would arise. It felt like the first several months, we kept discovering new budget categories that needed to be added.

We also started planning for big expenses all year long such as: yearly memberships, property taxes, car and house insurance. We were also mindful of bills where a discount was given for yearly payments instead of monthly payments.

Special holidays such as Christmas, is a budget category that we allocate money to all year long. This allows us the freedom to enjoy the holiday without wondering how we are going to pay for it.

Establish Rainy Day Savings

Unexpected costs had occurred, and we weren’t prepared. Thankfully we had some money saved, but we realized it wasn’t easily accessible if we needed it for an emergency!

We quickly transferred that money into a different account (from a whole life insurance plan into a regular savings account) where it could be readily available to us. It’s a good idea to have 3-6 months in your emergency fund.

Reducing our Expenses

After reviewing our monthly mortgage payment, we decided to refinance. We changed our mortgage from a 30-year-fixed mortgage to a 20-year-fixed mortgage. This single-handedly saved us thousands of dollars in interest.

Next, we checked every single utility bill and figured out how to bring down the monthly costs. We were very successful with this process, by shopping around for utility providers, to decreasing our consumer habits (figuring out ways to use less water, electricity, etc), we managed to decrease most of our monthly utility bills.

Two other areas we changed to save additional money: meal planning and thorough review for big purchases. I started weekly meal planning, and I try to only grocery shop on a full stomach. Don’t allow yourself to waste food and money if there isn’t a specific meal plan in place.

If there were big purchases that my husband and I would want to make that were over $50, we would have a conversation with each other, and sleep on it. If we still wanted the item after a few days, and if there was money in the budget, then the purchase was justified.

We inadvertently had lots of no spend weekends. A really frugal, and fun weekend for us would include time spent with friends and family at the beach. Bonfire, barbeque or dutch oven meals would help reduce weekend spending, and they were delicious (my favorite are the dutch oven nachos)! A major discovery in this whole process was that time is one of our most precious assets, and spending time with others is priceless, and doesn’t require additional money.

Increasing our Income

In order to achieve our goal, we HAD to increase our income.

We were both incredibly thankful to have the opportunity to work extra shifts at our jobs. I acquired a second job as an emergency room nurse, and my husband and I worked as if our lives, our future, and dreams depended on it.

I’m talking: multiple 16 hour shifts a week for myself, and 60-120 hour work weeks for both myself and my husband (we were intentional to make sure that our mental and physical states were not in jeopardy). We were on fire for this “financial freedom” that we were working towards. As Ramsey would say, we were “gazelle intense.”

We attended money conferences (we saw Dave Ramsey speak several times), listened to financial podcasts (You Need a Budget), and read blogs (Making Sense of Cents, Mr. Money Mustache), and books (The Millionaire Next Door, Start, The Go-Getter) that would encourage, and inspire us to keep working towards a debt-free life.

Selling items also became a means to make more money. We had garage sales, and sold things on eBay, and craigslist. We wanted to be good stewards of our resources, and therefore sold items we no longer needed. For several months, we were living off of 30% of our household income.

Related content:

- How To Make $100 A Day

- Ways To Make An Extra $1,000 A Month

- Here Are 17 Of The Best Online Jobs To Make $1,000+ A Month

- 12 Work From Home Jobs That Can Earn You $1,000+ Each Month

The Visual Aid and Celebrating Milestones

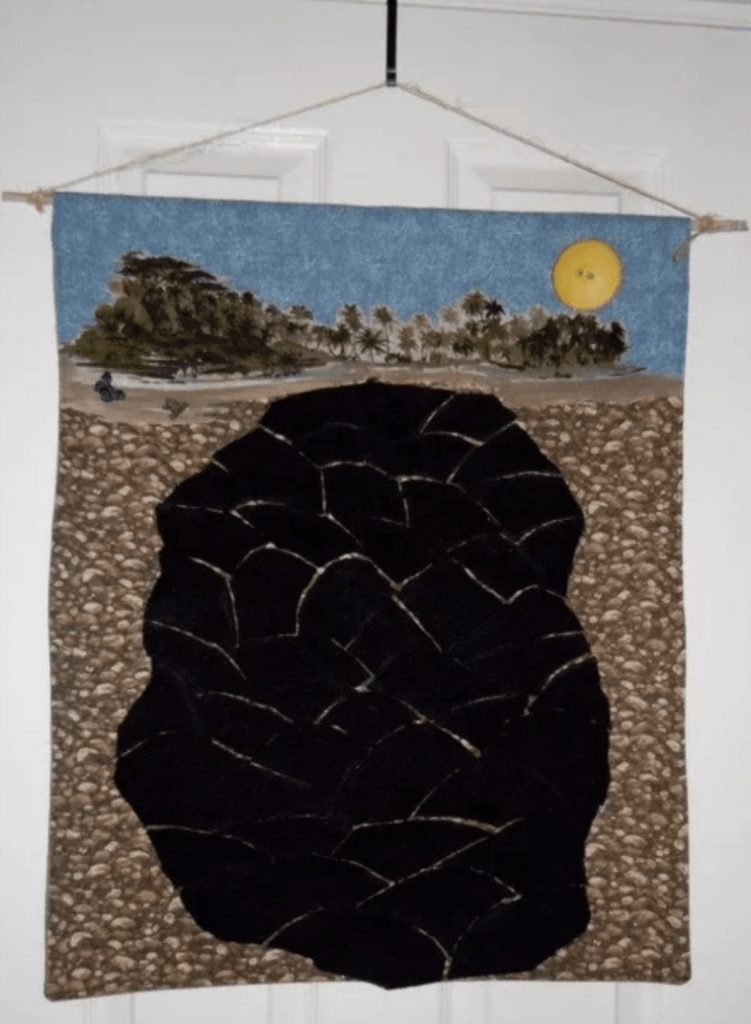

My husband and my mother-in-law pulled their creative resources together, and created a visual aid! It was a picture made of felt material, of a mound of dirt, broken into many pieces that sat beneath the ground and a beach scene (our happy place).

We kept the visual aid in our bedroom. It would be one of the first things I saw every morning when I woke up, and one of the last things I saw before I went to sleep. It was a great reminder of our debt-free journey.

My husband and I created many different milestones to celebrate along our journey.

- We celebrated every time we paid off $5,000, and we would remove a piece of dirt from our visual aid.

- We printed out our mortgage amortization schedule, and celebrated every time we turned a page in our mortgage amortization schedule, and every time we saved another $5,000 of interest on our mortgage.

- When the principal became greater than our interest on our mortgage payments, we celebrated. It felt like we were constantly achieving a different victory!

- Every month after a budget meeting, my husband and I would take a picture with our visual aid, we would write down the month, and if we celebrated any milestones that month!

- Our “celebrations” would include apple cider or champagne toasts, making a nice dinner at home, or simply reflecting on our goals accomplished that month.

After thirty three months, when we finished paying off all of our debt, I put all of the pictures together and made them into a photo album for my husband! It’s so rewarding to look back and reflect on all the sacrifices, and all that we accomplished together! I still get teary-eyed when I look at it, and enjoy sharing this book with our children.

This journey was one of the most challenging, and meaningful things we have ever done together.

Keep your eyes on the prize

Don’t play the comparison game. I was the most successful when I kept my focus on our own progress. It was very distracting when I looked around at what everyone else was doing. I kept reminding myself that I didn’t want to be like everyone else, I wanted to be debt-free!

This whole process was difficult, challenging, life changing, and incredibly rewarding! There were times when I felt like giving up, and just burnt out. When I felt like giving up, my husband would continue to encourage me to keep going. He reminded me what we were working towards, and that we were positively changing our financial trajectory forever.

Work Hard, and Stay the Course

Thirty-three months can seem like an eternity when you are in the thick of it. If you are living radically, any time spent during this season can seem like a long time.

We had a few months where life’s challenges happened, and things would get in the way of our goals. We didn’t let that deter us, instead, it gave us more motivation to continue on.

After a laborious thirty-three months, we became totally debt-free! We were also expecting our first child. I still remember the day we went to the bank to pay our final mortgage payment, and the day we called in to the Dave Ramsey radio show and did our “debt-free” scream.

One year later, we purchased our fixer-upper dream home in Orange County, California. We paid half of the total price of the home as our down payment. Three years after that, we completely renovated the home without going into debt. We have a mortgage now, but it is very reasonable, and it’s the only debt that we have. I no longer have to work full-time, but work per diem as a nurse, and my husband rarely picks up any overtime shifts.

We now enjoy spending lots of time together as a family.

Plant Seeds of Joy and Generosity

Maya Angelou once said “When we give cheerfully, and accept gratefully, everyone is blessed.”

I would highly encourage being generous with your resources because it’s good for the soul, whether it’s writing someone a kind note, buying someone’s coffee behind you, or giving to a non-profit organization or church.

During our entire debt-free journey, we donated 10% of our income, and it was always the first thing we budgeted. This may not be for everyone, but we discovered that there is lots of joy to be had when things are given from a grateful heart.

We were first inspired to become debt free because of our friend’s story. We now share our story in the hopes of inspiring others, and that it is possible if you are willing to work for it. The timeframe for becoming debt-free might be long, and difficult, but it will definitely be worth it.

If you are thinking of becoming debt-free, find your passion, and don’t let anything stop you! As Colin Powell once said “A dream doesn’t become reality through magic; it takes sweat, determination, and hard work.” You can do this!

Author bio: Lauren Mochizuki is an ER nurse, wife, and mother. She and her husband paid off $266,329.01 in 33 months. They also purchased their fixer-upper dream home, and renovated it without going into debt. On her blog www.casamochi.com, she is sharing her home renovation story, encouraging others to become debt-free, and that one can live a great life while being on a budget.

Do you have dreams of being debt free?

Leave a Reply