Trading involves many risks now, heightened by digitalization and faster transactions. The forex market has a daily trading volume of $6.6 trillion, offering profit potential alongside substantial risks. This guide emphasizes the significance of new Forex traders' risk management strategies, covering risk calculation, improving risk-reward ratios, and implementing effective strategies. Whether trading CFDs, pairs, or other instruments, these strategies minimize losses and increase the likelihood of success in Forex trading.

The article covers the following subjects:

What Is Risk Management? Definition & Meaning

Risk management refers to a set of strategies employed by investors to minimize potential losses. It involves analyzing markets, monitoring data, controlling emotions, and safeguarding trading capital.

What is Foreign Exchange Risk Management?

Foreign exchange risk management addresses potential losses caused by currency fluctuations. Like a toolkit, Forex risk management rules guide traders in making informed investment decisions and safeguarding their capital from uncertainty.

Understanding Risk Management and What You Face in Trading

Entering the currency market involves recognizing inherent risks. Effective Forex risk management is crucial to mitigate these risks and avoid unsuccessful trading.

Let's explore specific risks in Forex trading:

- Market risk: Price movements influenced by economic, geopolitical, or global issues can decrease your investment value.

- Leverage risk: Trading with leverage allows for larger positions but can lead to losses exceeding deposits. Beginners should use lower leverage levels.

- Liquidity risk: Some currencies and trading products have higher liquidity, affecting your ability to sell assets at desired prices.

- Interest rate risk: Changes in interest rates can result in significant variations in Fx prices.

- Country risk: Economic and political stability have an impact on currency trading because exchange rate changes affect prices.

- Risk of ruin: Depleting trading capital makes it impossible to sustain trades and achieve expected profits.

To see more detail and gain a deeper understanding, watch this video where a trader shares money management tactics and demonstrates them in real-time.

What Can Go Wrong?

Forex trading risks often arise from market analysis errors, unforeseen events, and human mistakes.

- Market analysis and forecast mistakes: To minimize risks, traders should monitor economic data, central bank decisions, market events, and important news. Recommendations:

- Don't blindly trust media reports or "expert" forecasts; rely on official data and trusted sources.

- Use additional tools like economic calendars and stock screeners.

- Evaluate economic data dynamically, comparing it with expectations and previous reports.

- Force Majeure: Unforeseen political decisions, natural disasters, terrorist attacks, or market surprises can have immediate or long-term consequences.

- Human factors: Stress, lack of attention, burnout, and fatigue can impact trading outcomes. Be mindful of these factors and practice self-management.

What to Do if You've Lost a Lot of Money?

Many Forex traders, regardless of experience, often lose money. Aside from inadequate risk management, common reasons include insufficient capital, aggressive trading, indecisiveness, panic, lack of monitoring, and poor planning.

If you find yourself in this situation, follow these steps:

- Stay calm and respond thoughtfully to minimize further losses.

- Analyse your mistakes to understand what happened and avoid future losses.

- Accept the loss, evaluate the damage, and develop a trading strategy.

- Take time to recover gradually. Consider using demo accounts before returning to normal trading.

Remember, losses are part of Forex trading. Learn from them to improve your skills and grow as a professional.

How to Calculate Risk Management

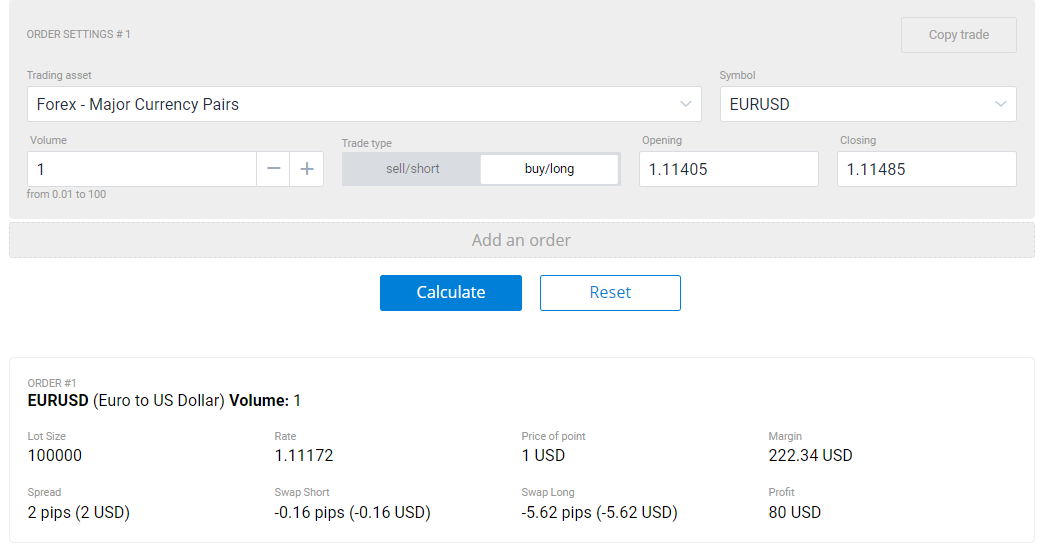

Calculating risk in Forex trading is essential for an effective fx risk management strategy. Use this simple formula:

Trade size = Risk capital / Price movement / 1 point cost per 1 lot

Consider three elements:

- Risk capital: Don't risk more than 5% of your deposit per trade. For a 10,000 USD deposit, the risk capital is 500 USD.

- Price movement: Estimate based on technical analysis or signals.

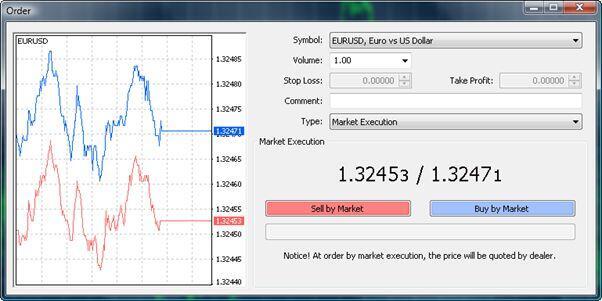

- Point cost per lot: Calculate using a trader's calculator.

For example, if your live account balance is 10,000 USD and you limit risk to 5%, with a forecasted currency pair movement of 80 points, set your Stop Loss at 80 points.

Using the formula:

500 / 80 / 1 = 6.25 lots

Opening a 6.25 lots trade in EURUSD with a Stop Loss at 80 points means risking a maximum of 500 USD.

By calculating position sizing, you can confidently pursue trading ideas while knowing your exact risk amount.

Use a trading calculator to determine your correct position size and price per point:

Forex Trading Risk Management Strategies:

To succeed in Forex trading, effective and Forex trade risk management strategies are essential. Here are popular forex risk management strategies for traders of all levels:

- Continuous Education: Stay updated with articles, videos, courses, and webinars to expand your knowledge.

- Demo Account: Practice with a demo account to gain experience and confidence without risking real money.

- Stop-Limit Orders: Set boundaries using stop-limit orders to manage risk and execute trades at specified prices.

- Taking Opposite Trades: Plan carefully and utilize appropriate stop losses to manage risk when taking opposite trades.

- Position Sizing: Determine the appropriate investment amount based on stop placement, acceptable risk percentage, pip cost, and position size.

- Set Take-Profit Points: Predetermine price levels to secure profits and have a target in mind for locking in gains.

- Consider Currency Correlations: Understand how different currency pairs influence each other with positive or negative correlations.

- Risk Management: Avoid excessive risks by following the one-percent rule and limiting losses to 1-2% per trade or day.

- Leverage Limitation: Use leverage cautiously, especially as a beginner trader, to balance potential profits and losses.

- Realistic Profit Expectations: Develop a sound risk management strategy and avoid unrealistic expectations for quick profits.

- Trading Plan: Create a well-defined plan with entry and exit strategies, risk tolerance, and guidelines for different scenarios.

- Emotion Control: Stay disciplined and follow the trading plan to prevent impulsive actions driven by emotions.

- Portfolio Diversification: Spread investments across different currency pairs, assets, and risk levels for market protection.

By implementing these strategies, traders can enhance Forex risk management, improve decision-making, and increase their chances of success.

General Rules for Money Management

Financial management is an extremely important part of speculative trading, and there are some general rules to follow if you want to succeed. Many beginners end up losing their retail accounts by the time they understand the importance of money management. Let's examine the most important rules:

1. You must have a clear trading plan

Having a clear trading plan is crucial before entering any trade. Determine the entry point and exit points, desired yield, and acceptable loss percentage to avoid impulsive and random trading, which often leads to losses.

2. Trade only high liquidity instruments

Focus on trading leading market moves of assets to avoid losses. In commodities, stocks, and foreign exchange, stick to strong base currencies like the Euro, USD, and Yen. Weaker currencies, often referred to as "exotic," such as the Mexican peso, Turkish lira, or Polish zloty, can be riskier. However, context matters, as there are cases where "third-rate" currencies exhibit strength, and popular currencies from developed countries devalue. Similarly, during a stock market crisis, technology companies and financial establishments tend to fall in price rapidly. It's also worth considering trading indexes like the Dow Jones or precious metals like gold, which can temporarily rise in value during crises.

3. You should trade only at strong pivot points

Avoid entering trades out of boredom or impatience. Some traders use indicators and oscillators to identify strong pivot points in the chart, but it's not an exact science. Mastering this skill requires experience and intuition, which not everyone can develop.

4. You must avoid trades in too short timeframes

While there are short-term trading strategies like scalping, they are challenging to execute properly manage successfully. Position trading is a more reasonable approach, where you hold positions for the long or middle term. When trading, aim for profits that are at least ten times higher than your commission costs. Don't seek to profit from every market move.

5. Buy cheap, sell expensive

Remember that the price can move in any direction. Forex market analysis can improve your chances, but it doesn't guarantee success. Be skeptical of anyone claiming to have a foolproof trading strategy. Test new approaches on demo accounts before using them in real trading.

6. You must apply stop loss to trade safe

Implementing stop loss orders is essential for managing risk. However, blindly relying on them can result in constant closures and rapid account depletion. Determine appropriate stop loss distances based on your trading style and use them consistently.

7. In successful trades, you should let the profit increase

Don't make the mistake of closing a position as soon as you make a small profit. Beginners often take small profits but allow losses to accumulate. Instead, close a position only when you believe the trend is about to end.

8. You must keep your free margin quite large

Don't wait until your position is closed due to a margin call. Avoid making rash decisions driven by emotions, as they can lead to unnecessary losses.

9. Use risk diversification wisely

While risk diversification can be beneficial for many traders, opening multiple positions can also lead to complications. Consider moderate diversification in the stock market, but be cautious in Forex trading where excessive diversification can be risky.

10. Do not make important decisions at the end of the trading session

Making trading decisions right before the market closes, like on a Friday or at the end of the trading day, is not a profitable strategy. It's like trying to catch a wave just as it's about to crash onto the shore – you won't gain any advantages over the market.

11. Improve your skills both in technical and fundamental analysis

Your trading success relies on strong analytical abilities. Think of it like being a detective investigating a case. You need to improve your skills in understanding charts and indicators (technical analysis) as well as analyzing market news and economic factors (fundamental analysis). Utilizing both types of analysis provides dual perspectives for better market understanding.

12. Keep a trading diary

Think of it as your personal trading journal. Write down your mistakes and good decisions to learn from them. It's a valuable tool to reflect on your trades and improve your future performance.

13. By increasing the trading volume you increase the risk

Starting with larger trading volumes may seem like a path to bigger profits, but it also comes with higher risks. Professionals suggest that your daily losses should not exceed 2% of your deposit, and monthly losses should not exceed 10%.

14. You should make a pause after a series of losing trades

It's important to know when to step back and recharge. The number of losing trades that trigger a break may vary for each trader, depending on their strategy. Sometimes, a fresh perspective can make all the difference.

15. Make up a trading plan

Think of it as your roadmap to success. If you overcomplicate it, you'll get lost in the market's maze. Determine which market you want to trade, such as forex, stocks, or commodities, and understand why you've chosen it. It's like choosing your battleground wisely. Learn from textbooks and gain the knowledge you need to navigate effectively.

16. Don’t enter or exit too often

Opening and closing positions too often can hinder your success. It's like trying to catch a butterfly with a net that has big holes – you'll end up catching nothing. Be patient and wait for high-probability opportunities. In a strong bullish market, you can enter multiple trades, but always maintain a safe distance between entries or exits.

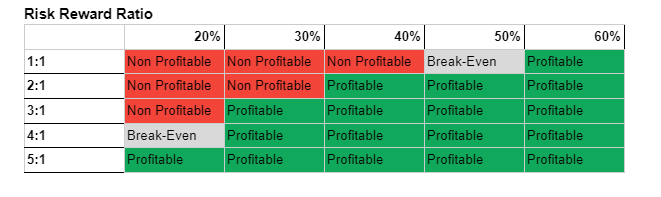

17. 1:2 – lose 10 dollars, gain 20 dollars

This means that for every $10 you risk losing, aim to make $20 in return. However, this ratio may not always suit every market or trader. Some traders are satisfied with smaller profits, while others seek greater rewards. It's like choosing between a small but sure win or taking a bigger risk for a potentially larger reward.

18. Don’t go against the trend

Experts say that trends are your friend for successful trading. While there are times when going against the trend can be profitable, it's a risky approach. It's like swimming against the current; making progress is more challenging. Effectively trading against the majority requires experience, skill, and proper training.

19. Don’t try to guess where the trend will reverse

Avoid attempting to predict trend reversals, as it often leads to failure. Analysts use various tools and indicators but struggle to consistently identify pivot points. Don't waste time on this. Instead of always being right, focus on achieving a high success rate. To hit the target, you need to shoot accurately, not just rely on your wishes. The same principle applies to trading.

20. Never use averaging

It will damage your trading account. While averaging down or up for short period may seem tempting, it often leads to significant losses. Averaging down in a bullish market or forex can be especially dangerous.

21. Save what you gain

When you earn profits, treat them with respect. Remember, it's your hard-earned money. Don't risk it unnecessarily in the market. Exit trades when your profits are increasing, not decreasing.

22. Never trade at night

The forex market will always be there, but your money might not. Take care of your well-being and get enough sleep.

23. Live an active life

Don't spend all your time in front of the computer. Engage in physical activities like going to the gym or participating in sports. It's important to have a well-rounded life.

24. Take big profits in small parts

If you aim to turn $100 into $1000, break it down into achievable milestones. Gradually increase the risk involved your capital from $100 to $200, then $300, and so on. Remember, professionals rarely risk a large portion of their capital in a single trade.

25. Trade the instruments you know and understand

Stick to markets you have experience and knowledge in. If you're familiar with commodities, focus on those that are easier to predict. Specialize in what you know best.

26. Choose a proper financial leverage

While brokers offer high leverage options, it doesn't mean you should max it out. In stock trading, leverage ratios of 1:10 or 1:20 are common, while in forex, it is higher leverage that's typically 1:100. Using maximum leverage can quickly deplete your account. However, too little leverage can be boring. Find a balance that suits you.

27. Accept losses easily

Keep your losses small and take them in stride. Focus on making significant profits instead. Some traders employ pyramiding, where they add positions one after another, but they also set stop orders to limit potential losses. Be prepared for zero or losing trades, as they're part of the market's natural ups and downs.

28. Automated trading

Opinions on robot-traders vary among traders. Some avoid them, while others find it useful. Automated trading offers advantages such as round-the-clock operation and consistent execution. However, caution is necessary as software is created by humans who may lack trading expertise. Use it judiciously.

Summary

High risk is inherent when trading Forex pairs. It varies based on an individual's risk tolerance, but it cannot be eliminated. Therefore, a proper Forex risk management plan and strategy is crucial for controlling profits and losses.

Develop a personalized strategy aligned with your goals and traits. Stay realistic, avoid panic, set stop losses, monitor currency risk systematically, and follow a Forex trading plan based on market analysis.

Forex Risk Management FAQ

Forex risk management involves actions to reduce losses and improve risk reward ratio in the FX market.

Risking no more than 1% of your portfolio per trade is a common recommendation among professional traders.

The minimum amount to trade in Forex depends on your individual circumstances and investment goals. It can range from a few hundred dollars to several thousand.

Forex signals can be useful for traders of all levels, providing guidance for trading strategies and risk management. Finding reliable signal providers can be difficult due to the abundance of scams.

Numerous online educational resources, such as articles, videos, webinars, and courses, offer comprehensive guidance on Forex risk management.

Forex trading risks encompass market, liquidity, leverage, interest rate, country, and human factor risks. These risks can be mitigated through a strong trading strategy and effective risk management.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.