The history of gold as a monetary value began over 5,000 years ago. Initially, gold was used for forging and minting coins, and gold dust was also used as payment means. With the surge in global production, some countries began to use Au as a temporary national currency. Later, a gold standard, pegging money to a fixed amount of gold, was introduced.

Nowadays, after the gold standard was abolished, the role of gold as the main payment instrument has faded away, giving way to paper fiat money and cryptocurrencies. Today, Au is an investment instrument used as a safe haven asset to diversify the portfolio and hedge against the high risks. XAU is used in speculative trading, long-term investment, and forming the gold reserve. Main participants of the gold industry trading market are central banks, IMF and other funds, commercial banks, stock exchanges, investment and exchange-traded funds, individual traders and investors, gold producing companies, and yellow metal consumers.

Read on and you will learn how to trade gold spot prices and invest in gold markets to make profits.

The article covers the following subjects:

Gold Futures Markets

There are different ways to make money on gold trading assets. Physical metal is most often used for long-term investment, gold futures contracts are suitable for short-term investing.

- Please note that gold futures are exchange-traded securities, which is a contract between a buyer and a seller. This is a contract to a long or short position on yellow metal in the future at the current price which can be different from gold spot price. Gold futures contracts can be delivered and settled. Deliverable futures assume the actual delivery of the metal within the time period specified in the contract. Settlement implies financial offset: if by the time specified in the contract Au has risen in price, then the buyer wins - he/she bought it at a lower price. If the gold spot prices have fallen, the seller wins.

There are other derivatives where gold is the underlying asset (options, spread bets, etc.), but futures contracts trading remains the most popular so far. This is the most straightforward and liquid instrument, which can be sold or bought before its expiration date.

The minimum deposit to enter the gold futures market depends on the type of the traded contracts, target profits, and risk management system. A standard lot for trading gold stocks on the exchange (for example, London metal exchange, New York mercantile exchange, or Shanghai gold exchange) is 100 ounces. So, you will need about 2000 US dollars to open a minimum position of 0.001 lots.

This amount does not take into account the need for a reserve of money to cover the loss. You can use leveraged trading, but stock brokers, unlike Forex brokers, are less generous — the average leverage on the exchange is up to 1:20.

An alternative is E-Mini contracts, they are 0.1 of standard lots. The minimum deposit for the exchange gold futures market remains the same — from 1000-2000 US dollars.

Day Trading Gold

Before covering the peculiarities of intraday gold trading, I will explain the difference between the full lot in trading currency pairs and the full lot in trading gold XAUUSD pair. Understanding how the Forex broker calculates the tick value and the tick movement will help you calculate a potential daily profit based on the average size of the daily candlestick.

How much is one pip of gold?

Forex gold price, which is displayed in the trading platform quotes or in the technical analysis charts, is the price of the troy ounce.

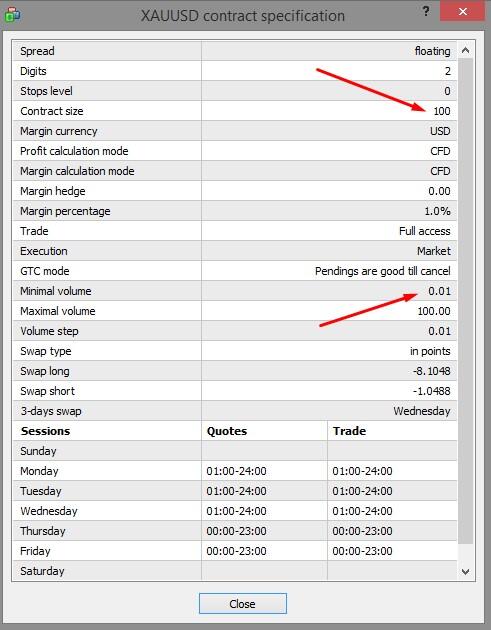

One troy ounce is 31.1 grams. One standard lot is 100 troy ounces, the minimum forex trade volume is 0.01 lots. All these data can be seen in the contract specification. You can find the gold precious metal contract specification in the MT4 in the following way:

Click on the View menu and select the Symbols. Find the XAUUSD pair and press the Show button.

Click on the View menu and select the Market Watch. Right-click on the XAUUSD pair and select the Specification tab.

How to calculate the gold pip price in Forex:

Find the contract size, 100, in the specification.

Define the pip size (point). Gold quotes in the platform have two decimal places, so the pip, unlike in currency pairs, here will be equal to 0.01.

Multiply the trade volume by the pip size: 100 * 0.01 = 1 USD.

The minimum XAUUSD price swing by 1 pip (point) corresponds to 1 USD. Differently put, if you buy gold, one troy ounce for 1800 USD, it corresponds to the trade volume of 0.01 lots. And the price movement up to 1805.35 USD will mean that the price has moved by 535 pips.

For 0.01 lot, the pip cost 1/100 = 1 cent, which means that the profit will be 5.35 USD. Accordingly, for 1 full lot, the profit will be 535 USD.

Now, let us get back to the comparison of the XAUUSD and currency pairs in terms of intraday yield.

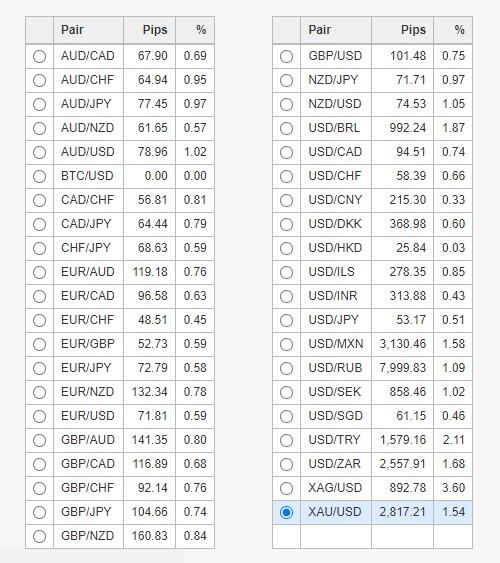

The pip price for the EURUSD is,100,000 * 0.00001 (five-digit quotes), also 1 USD. The average length of the XAUUSD daily candlestick in a non-volatile market is 1000-1500 pips. The average length of a daily EURUSD candlestick is 800-1000 pips. But do not forget about the spread, which is higher for the XAUUSD.

I can draw the following conclusions from this:

The XAUUSD intraday volatility is relatively similar to currency pairs, provided the gold markets are calm and there are no strong fundamental factors

XAUUSD has quite low volatility in one-minute timeframes, so it is not suitable for scalping. However, gold usually features a more consistent trend with fewer intraday reversals.

Day trade gold strategy in the H1-H4 timeframes could yield a profit comparable to the profit from currency trading. But the XAUUSD is sensitive to fundamental market forces, the daily movement can expand up to 2500-3000 points and in the direction opposite to your position.

Recommendations on entering XAUUSD trades:

Enter gold trades in the trend direction, preferably at the beginning of the daily candlestick. If in the daily chart, there a directed movement displayed by two or three candlesticks of the same color, you can spot a trend movement in the hourly chart

Spot the fundamental movement, do not exit the trades on the local corrections.

- Note the price moves of the correlated underlying assets, silver, and platinum. Using such tools as the gold silver ratio, for example, you can develop gold trading strategies based on the positive correlation. Gold also has a positive correlation with oil quotes and a negative one with the USD.

Gold Trading Best Strategy

Each trading plan is based on a purpose and an idea. A trading gold strategy starts with defining your target, that should define the following points:

The amount of money you want to earn. You’d better define the target profit in percent of the deposit amount. You can find out how real the target profit is by comparing the percentage with the average annual return on the underlying asset.

The amount you are willing to invest.

The investment term. Do you prefer a short-term investment strategy with the ability to quickly cash out the asset? Are you willing to “freeze’ the money for a long time, sacrificing liquidity?

The trading strategy type you prefer. Do you want to trade gold actively, which will be your primary job, or start passive investment?

Risk level suggested by the strategy.

Mutual Funds and ETFs are suitable for long-term investment. For a small commission fee, up to 0.5%, a management company will manage your investment. Trading futures contracts or CFD trading in Forex will be suitable for short-term investment.

Strategies for active trading:

1. Scalping. It is rarely used to trade gold. In a few minutes, the price does not have enough time to gain a sufficient move to compensate for the spread and yield a profit comparable to the time spent. There are more profitable scalping trading instruments.

2. Swing trading. Trading on corrections is also really applied to XAUUSD, as the corrections are not deep. Here, trend following strategies are more suitable. However, you can combine swing trading and trend strategies in some cases.

3. Intraday trading. Gold day trading is one of the most common strategy types. Unlike currency pairs, which can many times jump up and down during a day, the gold industry slowly gains speed. However, gold features longer price fluctuations during a day at the moments of fundamental factors’ influence. Differently put, the range of the gold price intraday movements is greater than the currency pairs’ movements. The frequency of the XAUUSD price moves is lower. Below is a screenshot of the average volatility of currency pairs and precious metals over 10 weeks.

4. Medium- and long-term strategies. Positions can be held open for several days if there is a clear trend. But the profits of these strategies are diminished by swaps and exchange commission fees.

5. Technical Indicators strategies. They are trading strategies based on technical analysis. A combination of volatility and trend indicators with multiple timeframes analysis works well here. In an hourly timeframe, the length of the price movement in the intraday range is estimated. If the price is at the beginning of the movement and the trend is clear, you can open a position. You can also add oscillators as auxiliary tools

6. Price Action strategies. They mean trading based on chart patterns and graphic analysis. Since the movement of gold prices is smoother, compared with foreign exchange assets, resistance and support levels are more clearly traced in the chart. Trend exhaustion patterns are a triangle, flag, pennant, etc. Price action patterns trading can be combined with indicator strategies.

7. Trading based on fundamental analysis. The XAUUSD pair is responsive to fundamental market forces. Trading based on fundamentals suggests you find positively or negatively correlated assets. For example, optimism in the stock market means that investors will withdraw the money from gold assets and reinvest into more profitable assets. Negative GDP forecasts, inflation rise, for instance, push the gold price up. You can refer to the Market Sentiment indicator, showing the forecast of the majority.

8. Social trading. Active trading is not only constantly monitoring the price chart and looking for a signal. You can copy trading behavior and signals offered by experienced traders for a small commission fee. In terms of gold trading, you need to choose traders, who enter trades on the XAUUSD more often than other assets. You link your account to the trading account of such traders and signals are automatically copied to your account. You can learn more about this in the article Forex PAMM vs Social Trading. What do investors choose?

Peculiarities of trading the XAUUSD:

Significant influence of fundamental factors. The Fed's monetary policy, the global economic state, geopolitics, macroeconomic statistics - all of this can become a driver for a new gold market trend.

Moderate risk compared to currency pairs for long-term investment.

High level of liquidity no matter with what instruments you trade gold online. The exception is physical gold bars, but they can be quickly sold if a trader agrees with a high margin.

When to buy gold

Gold, unlike currency pairs, is not tied to a single session. The highest volatility of EURUSD is observed during the European session. At the Asian session, volatility and trading volumes decrease. The XAUUSD trading volumes do not depend on the trading session.

Some sources cite an analysis based on statistical data since 1975, which shows the seasonal dependence of the gold spot prices. According to its results, the lowest price for Au is observed in March, the highest - in January and September.

So, we can conclude that the best time to open a long trading position and buy gold is in March, and it is better to sell gold in September.

Technical analysis signals:

Meeting of the moving averages with different periods. If the fast MA crosses the slow one upside, it signals an uptrend.

Signals of trend technical indicators, such as the ADX, Alligator, and so on.

The increase in volatility, according to the ATR; defining the overbought and oversold zones, according to oscillators.

The breakout of the key levels, Fibonacci retracement levels. An example of the Forex gold trading strategy based on the Fibo levels is described in the article What is Fibonacci retracement? How to trade gold online using this indicator?

The breakout of graphic chart patterns, such as flag, triangle, flat channel.

The above listed, are just a few examples of how to spot the time to buy gold or enter short trades. In general, technical analysis is applied to the XAUUSD trading in the same way as to trading currency pairs. The matter is in adjusting the trading strategy and choosing the right indicator settings.

Signals of fundamental analysis:

Stagnation of the world economy or vice versa economic growth. For example, the pandemic that started in early 2020 hindered global economic development. Amid the expectations of a decline in the global GDP, falling corporate profits, stock indices turned down, while Au, on the contrary, reached a new all-time high. In August, after the development of the coronavirus vaccine, investors became optimistic — the stock indexes gained back their spring losses, while the precious metal lost more than 10% of its value.

Macroeconomic statistics. It has a short-term impact. This includes inflation change data, industry forecasts, etc. If the outlook is positive, investors are willing to withdraw the money from safe-haven assets, including gold.

A good time to buy gold is when the price has been down, as it should go up, sooner or later. The matter is to live through the drawdown period.

Fundamental analysis signals do not always work. Example: the gold price drop in 2013 became the strongest in the last 30 years. The main reason is considered to be the problems of the Indian economy, which is one of the largest gold consumers. Another reason is the economic crisis in Cyprus, which showed the high risks of investing in government bonds.

These factors encouraged investors to withdraw money from medium and long-term exchange traded funds (ETF funds) in a panic. This accelerated the gold price fall. Instead of investing in safe havens, investors preferred to cash out.

Is it time to buy gold now? If the XAUUSD price has rolled down from its all-time highs, it is worth buying gold.

How do you buy gold?

Buying gold in the physical form is available only in the banks licensed by the regulator. Only the bank will sell you certified metal with documents confirming its authenticity, fineness, and other characteristics.

You can buy physical gold bars without delivery from specialized companies that guarantee the safety of the metal in their own depositories. But are you willing to take such a risk? Another way of buying gold safely is gold certificates or gold deposits issued by some banks.

The best way to invest in the gold market with no risks and the minimum deposit is to trade gold CFDs. Although you do not buy physical metal, you can sell the asset any time just with a couple of clicks.

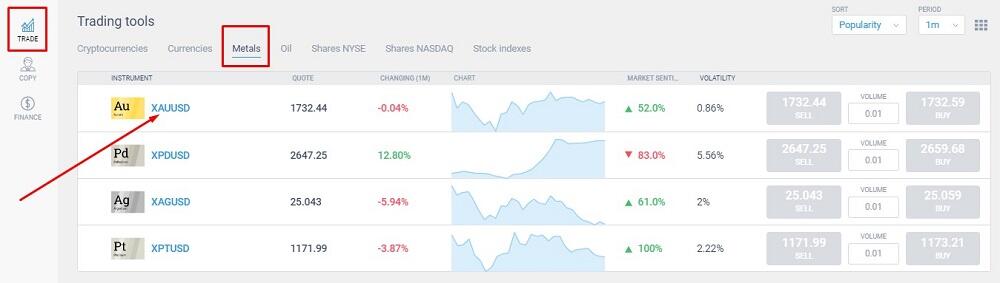

Well, how to get gold in the LiteFinance trading platform? Follow the following steps:

1. Open an account. Click on TRADE FOREX- ACCOUNT TYPES. I recommend the ECN account with a minimum spread. A minimum deposit of 50 USD with a 1:100 leverage will be enough to enter a trade of the minimum lot of 0.01.

2. You must pass verification to op up your account. You can also try yourself on a demo account without any registration or verification.

3. Open the trading terminal and select the XAUUSD pair in the Metals tab.

4. Analyze the gold price chart. The signals to enter a trade include:

The oscillator lines are in the oversold zone; then, oscillators turn around and start moving towards the middle of the range.

Signals of trend indicators and charting software confirm the price movement in the needed direction.

The price of gold breaks out the flat channel.

There appear reversal patterns, Engulfing pattern, a Pin bar, and so on.

Example. Following a short-term uptrend, there forms a consolidation range, highlighted with a horizontal channel.

The channel breakout upside means the start of the uptrend. It will be beneficial if the breakout candlestick and the candlestick of the trend inception will have bigger bodies than the candlestick built in the sideways trend.

The end of the uptrend is signaled by the Engulfing reversal pattern, the body of the falling candlestick should fully engulf the body of the previous rising candlestick. Next, there forms a Doji, the candlestick with no body, showing the equality of power between sellers and buyers. The next red candlestick confirms the trend reversal.

You can buy gold safely, reducing the probability of loss to almost zero, only with a perspective of 10-15 years. On daily price charts, the gold price moves in both directions, so it makes sense to spot a strong trend or try to make a profit from position reversals if the spread size allows. The risk of loss in day trading is higher than the risk associated with long-term strategies.

Gold buying tips:

Focus on the trend gold market sentiment.

Consider the level of spread and swap. In CFD trading, medium-term trading seems less profitable than intraday trading due to swaps. The exception is when you have spotted a strong medium-term trend.

Look for a strong fundamental factor, connected with the world economic prospects. Even a force majeure could send the price up in the short term.

When to sell gold?

1. A sell signal in the long-term investing: the price has broken through the previous all-time high, and the trend is slowing down gradually. At the same time, there are positive forecasts for a decrease in inflation, GDP growth, and a solution to geopolitical problems that have pushed Au upwards up to this point. With the next price reversal a fall of more than 2% - 3%, sell the asset.

2. Sell signals in short-term investment:

Fundamental factor’s effect has exhausted.

The candlesticks’ bodies are getting less. Following an uptrend, the price is moving sideways.

There have appeared reversal patterns.

Oscillators have moved across the center of the range 0-100 and are moving towards the overbought zone.

The price has reached a strong resistance level.

In long-term investing and fundamental analysis trading, it is best to focus on forecasts for gold markets and correlated instruments. You can also use the Market Sentiment indicator, which displays the opinion of the majority.

One of the strategies to exit a trade is the use of a trailing stop. When the price exits the flat range, you enter a trade in the uptrend. When the minimum target profit level is reached, close 50% of the position and insure the rest with a trailing stop.

The distance to the trailing stop can be calculated using the ATR volatility indicator. You can also place the trailing stop just below the local low or the support level.

If you missed the moment of price reversal and the losses have already amounted to more than 20%, do not rush to sell the asset right now. Considering that the average annual return on Au is around 5-15% per year, it is better to wait for the price to return to its highs.

Methods Compared: Trading vs Investing

Trading means active speculative trading with frequent transactions in both directions. The trader buys and sells the XAU several times a day, long term strategies involve holding the trade open for several days or weeks.

Investing is when you buy gold for the long term in order to save spare money from inflation and, if possible, make a profit. Investors buy gold for 5-10 years or more.

The advantages and disadvantages of trading:

Advantages | Disadvantages |

1.The opportunity to make profits from the price fluctuations in both directions. | 1. Commission fees. The more trades are entered, the more commissions have to be paid. |

2. Profitable trading on the fundamental analysis. | 2. Low volatility of gold markets in short-term timeframes. Scalping is irrelevant. In a few minutes, the XAUUSD value does not have time to gain a price difference in points sufficient to cover the spread and make an adequate profit. |

3. Wide variety of trading assets, you can trade gold CFDs and many other derivatives (gold options, futures contracts, spread bets, etc.). |

|

The advantages and disadvantages of investing:

Advantages | Disadvantages |

1. You do not have to monitor fundamentals and technical analysis signals. You do not have to spend much time trading. | 1. Freezing money for a long time. |

2. Long-term profit. History proves that the XAU price movement has a wave nature – after a drawdown gold rises to a new all-time high. | 2. A limited choice of investment assets. Gold CFDs and gold futures are not suitable at least due to exchange commission fees and swaps. Long-term investments are most often associated with buying either physical gold or physical gold assets. |

3. Lower intermediary risks. In trading, there is still a risk of broker bankruptcy, account blocking, etc. In investing, the physical metal is at home or in a bank/custodian. In both cases, the risk of loss is minimal. | 3.High margin for sales. |

| 4. Relatively low yield. |

Both methods have their advantages and disadvantages. The question is which strategy you prefer, what risks you agree to take, and what profitability goals you have.

I can also give another comparative analysis in the form of a table in the context of several options for trading and investing:

| Gold bullion (investing) | ETFs (investing and trading) | CFD (trading) |

Complexity rating (1- easy, 3 — hard) | 1 | 3 | 2 |

Storage costs | Yes | No | No |

Management costs | No | Yes | No |

Exchange fees and broker commissions | No | Yes | Yes |

Entry price (1 — low, 3 — high) | 2 | 3 | 1 |

Leveraged trading | No | No | Yes |

Regulated | No | Yes | Yes |

Comments on the table:

ETFs are classified as both trading and investing assets for the following reason: ETF gold stocks are often used for speculative purposes, that is, for trading. There are mixed funds that invest only part of the money in gold markets- their securities are used to diversify risks. But ETF shares are also in global demand among long-term investors. They are attracted by the fact that they do not need to be responsible for balancing and managing assets, as the management company does this.

Complexity rating implies the time resources, the required level of knowledge, etc.

Storage costs are the payment for a safe deposit box or depository. Depository services on the exchange market are included in the exchange fees.

Management costs are the commission charged by the management company.

You can read more about investing in gold markets in this article.

How to Trade Gold

There are various ways to start trading gold. You can trade gold spot prices in exchange and over-the-counter markets.

Over-the-counter (OTC) or off-exchange trading means Forex online gold trading and binary gold options. Trades here are made in gold CFDs, CFDs are bought and sold without actual delivery of the metal. Also OTC gold trading in the purchase of physical metal through a bank, bank gold deposit. One of the examples, where you can trade gold this way is OTC London market.

- The exchange gold market provides for a wider range of financial instruments. You can trade gold futures and options. Futures can be a physical commodity — with real delivery of metal, and settlement — with offsetting the price at the end of the contract. You can also buy ETF shares on the stock exchange, which fully or partially invest money in the metal. You can buy shares in gold mining (for example, Barrick Gold Corporation) and refinery companies.

Let us explore in detail each of these gold trading and investment options, their pros, and cons.

How To Trade Gold Bullion?

Investment options for an individual gold trader who wants to invest in gold bullion:

You can buy gold bars in a bank. Pros: the investment safety is guaranteed. Cons: the margin on physical gold sale can reach 20%, appropriate storage conditions are required, in most countries, there is a "luxury" tax or VAT.

- You can buy investment gold coin products. They are initially sold in central banks, next, you can find gold coins in secondary markets. The advantage of coins is that they also generate income with an increase in collection value. Disadvantages: not any investment coin quickly rises in price, the cost of the coin includes work, the margin can be 15%-30%. Buying in a secondary market carries even more significant risks and may make to investor accounts lose money. It is the responsibility of the buyer to assess the authenticity of the coin and its condition.

Bank gold deposit. It provides two options. The first one suggests you put physical gold on the deposit and receive open interest payments in cash. The second one means depositing a cash equivalent pegged to gold prices. Advantages: gold bars are stored in a bank. Disadvantages: most often it is not compensated by the insurance payment in case of bank bankruptcy.

You can buy jewelry. Benefit: aesthetics with the expectation of the gold price rise. The drawback is the margin. Most often, jewelry is bought back at the scrap price, losses can be up to 50%.

You can also buy a physical commodity futures contract in the exchange market with the physical metal delivery. Considering the minimum delivery volumes and transport costs, this option is only suitable for companies using gold as a raw material.

Investments in the physical metal may be of interest to those who are not willing to engage in active trading and expect a long-term investment of more than 10 years.

How To Trade Gold Futures CFD

CFDs are contracts for differences, off-exchange financial instruments. An investor buys a XAUUSD contract and sells it at a higher price. Or you can sell at the current price and, when the price is down, make profits from the difference in spot prices. CFD trading is available through Forex brokers.

Advantages of CFD trading of XAUUSD:

Relatively low initial deposit for trading gold futures compared to the exchange market, $50-$100 will be enough for a minimum-size trade.

Minimal commission fees. You need to pay only for spread and swap. No exchange fees or repository fees. The Qualified Investor status is not required.

Liquidity. You can exit the trade at any time in any part of the world if you have an Internet connection.

Trading gold CFDs in Forex is one of the best ways to make money for those gold traders who do not have large capital but have basic forecasting skills and the willingness to take up active trading. However, it’s crucial to remember that they are complex instruments and you need to be ready for a high risk of losing money when trading CFDs.

Follow these steps to trade XAUUSD CFDs:

Select a broker, open an account, go through verification.

Top up your deposit with the minimum required amount. You can start with cent retail investor accounts if they are available with your broker.

Study the XAUUSD trading conditions. Study available leverage level, the minimum transaction volume, the contract size in the contract specification.

Analyze the chart, enter trades, earn money.

How To Trade Gold Options

Trading binary options suggests you should predict where the price of an asset will be by the time the option expires - above the opening price or below. If the forecast is correct, the profit will be 50%-90% of the option amount. In case of an error, the loss is 100%.

Pros of trading binary options:

It is easy. You only need to predict the future price location relative to the level when the option was opened. If you have picked up the beginning of the trend, you will be 99% likely to make a profit. There are no stop-losses and stop-outs, and you do not have to monitor the market all the time. And, most importantly, there is not spread, constantly changing on the volatility.

Quick profit. If you trade turbo options, you can make a profit already in 60 seconds.

- You can earn more than 100% return on the forecast. For example, you can make a more complex forecast for options such as "Ladder", "One touch", "Range".

Binary options are the easiest way to start for a beginner trader.

How to trade in gold options:

Choose a binary options broker, sign up and pass the verification.

Carry out technical and fundamental analysis for the gold options in different timeframes.

Open a XAUUSD binary option: specify the expiration date, the option amount, and the forecast for a higher or lower price.

Some brokers provide an opportunity for early option closing.

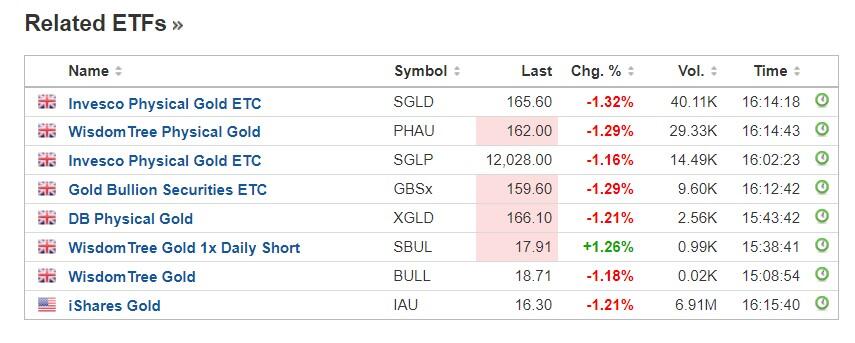

How To Trade Gold ETFs

ETF is an exchange-traded fund. This is a fund that is engaged in targeted investment and whose shares are in free circulation. For example, if the fund invests in the shares of the TOP 50 largest companies, by buying its shares, you are actually investing in these companies.

The same is with gold. There are ETFs that invest all or part of their capitals in gold assets — physical metal, gold futures, etc. By buying their shares, you also invest money in Au. Although ETF stock gold prices do not completely coincide with the price movement of XAUUSD or gold futures, the general trend is similar.

The advantage of investing in ETFs over futures is that you do not need to diversify and balance your investment portfolio. An ETF is already such a portfolio in itself and managers are involved in balancing it. Disadvantages include a high entry deposit of 1000 USD and more, the need to have the Qualified Investor status.

Another problem is taxation. According to the legislation of individual countries, if the ETF invests in physical metal, the investor pays a "luxury" tax - instead of 15%-20%, the tax amount can be 25%-30%.

The world's largest gold ETF is SPDR Gold Shares, founded in 2004. Its assets are 100% secured by gold bars, the volume of which is over 1,230 tons. The main storages are in London, with a management fee of 0.4%.

Other gold exchange-traded funds are iShares COMEX Gold Trust, iShares MSCI Global Gold Miners ETF.

How to invest in ETFs:

Select a broker, having an access to the exchange market where gold ETF stocks are traded.

Study the trading terms and conditions: the procedure of buying and selling securities, brokerage and depository commissions, exchange fees, the minimum investment amount, etc. A list of the largest ETFs can be found on analytical portals, for example, Investing.

Buy the ETF shares.

Trading gold ETFs will suit professional investors with a capital of $1000 and more.

How to Trade Gold Stocks

An alternative to investing directly in gold or gold derivatives is to buy shares in gold-producing companies. The logic is as follows: if the gold prices rise, then the profit of the gold mining company will also grow. And the company's stock will also grow, following the increase in the profit.

Pros:

You can make money on dividends if a decision on payments is made.

You can find companies with a relatively inexpensive cost per share — this can reduce the minimum transaction volume.

High volatility compared to gold trading instruments.

Cons:

There is a significant risk of the company’s bankruptcy.

Influence of microeconomic factors: internal conflicts, lack of competitive advantages, management mistakes, etc. — all this negatively affects the stock prices.

Examples of gold-producing companies: Newmont Goldcorp, Barrick Gold, AngloGold Ashanti.

Investing in stocks of gold mining companies is suitable for risk diversification for professional investors who have enough money to enter the exchange markets.

An example of Forex gold trading strategy

This is a simple gold trading strategy based on a combination of fundamental analysis and technical tools. Since the XAUUSD is a less speculative instrument than currency pairs, it is easier to track the consolidation zones, support, and resistance levels in the chart.

Analyze the daily chart:

In August 2020, the XAUUSD price peaked amid the pandemic. But a gradual decline in the number of coronavirus cases and information about the vaccine development reassured investors, who began to withdraw money from the safe-haven assets, including gold. The daily chart shows a clear long-term downtrend built across five highs. A horizontal channel is also visible.

In May-June, the price of gold moved sideways within this channel. Now, there is a similar movement, the price bounced off the lower border of the channel, moved up, and rebounded down from the channel’s upper border. So, the market should go down.

There are several variations of gold trading strategies:

Open a short position in the daily chart, with a take profit at the support level. The position holding time is seven-ten days.

Switch to the H1 chart and spot the beginning of the downtrend. Next, enter a trade for a few hours and exit is before the swap is charged.

When the short position is opened (29 March 2021), the news background is neutral. In the coming week, according to the economic calendar, there is no news that could drastically affect the daily price of gold chart. Therefore, with a high probability, the daily downtrend will continue to the support level. But within the day there can be local movements in both directions.

Gold trading hours

The global exchange market works around the clock: the working hours of exchanges around the world overlap. If one exchange closes, the second exchange is already working by this time, ensuring the continuity of trading. But depending on what trade session is active at the moment, the trading activity also depends. Below is a timetable for the main exchanges where gold and gold instruments are traded online:

Online trading hours in London, UK: 08:00 to 17:00 (GMT).

Online trading hours in New York, USA: Opening hours 13:20 - 18:30 (GMT).

Online trading hours in Mumbai, India: 04:30 to 18:00 (GMT).

Online trading hours in Dubai, UAE: 04:30 to 07:30 (GMT).

Online Trading Hours in Jakarta, Indonesia: Opening hours 02:30 - 10:30 (GMT).

Online trading hours in Islamabad, Pakistan: 05:00 to 13:00 (GMT)

The working schedule of trading sessions is a reference for developing strategies, taking into account the periods of the greatest and least trading activity. Changes are possible depending on the transition from winter to summer time and vice versa, on national holidays. Exchanges are closed at weekends.

Pros and Cons

Pros:

Gold will never depreciate, as it is a measure of value. Also, gold demand will always be supported by the production sector.

In the long-term outlook, the gold price almost always goes up. One of the reasons is inflation. Money is depreciated in relation to commodities, and gold is among popular commodity assets.

- The XAUUSD trend is relatively easy to predict based on fundamental analysis. When the stock markets stagnate, during a period of economic uncertainty the inflation grows above the forecast level, and the world GDP decline, the XAUUSD grows in value.

Cons:

Relatively low volatility in the short term. XAUUSD is not suitable for scalping and intraday strategies, since the minute and daily movement in pips does not have the same amplitude and speed as the movement of currency pairs.

The need to take higher risks, to increase the volume of transactions by increasing the leverage. It is the result of low volatility.

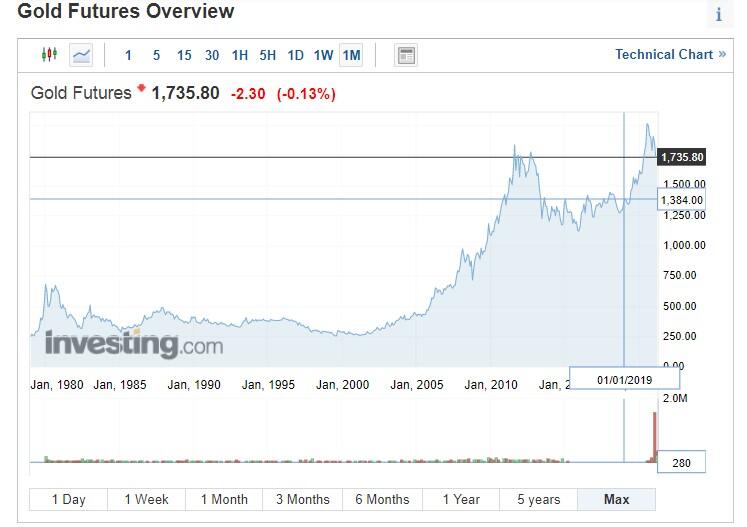

Long-term return on the investment and relatively low profitability. The average return on XAUUSD over the past 20 years was 25.85% per annum. Profitability for the last 5 years - 6% per annum. The yield in the period of 01/01/2013 - 01/01/2020 was negative.

Despite significant disadvantages in comparison with trading currencies and stocks, gold is a safe-haven asset that allows you to balance your investment portfolio risks and not let your retail investor accounts lose money.

Gold trading advice:

Are you an active trader? Use currencies and stocks as main trading assets. To diversify risks and protect your account from losing money rapidly, add XAUUSD assets (gold stocks, futures, gold ETF) in the amount of 10-15% of the total portfolio. When stock markets stagnate and there is economic uncertainty, Au tends to rise, and so you can compensate for the loss.

Are you an active trader preferring short-term strategies? Focus on fundamental analysis. Pick up the beginning of the trending movement on the key news and exit the trade at the next visible reversal.

Are you a trader with considerable capital? Enter derivatives markets and try investing in the ETFs.

Are you a trader with small capital? Open a trading account with a Forex broker and make profits from trading gold CFDs with a minimum commission and the real market liquidity.

Are you a long-term investor? Invest spare money into physical gold, for example in gold bullion with a horizon of 10-15 years.

- Are you a short-term investor without trading experience? Invest in diversified mutual funds. Or you can try yourself on a demo account. This experience could help you define targets and choose your professional investor.

Regulation

Each country has its own structure and rules for regulating the precious metals trading market. The differences relate mainly to the structural hierarchy of regulatory bodies, their subordination to Central Banks, authority, requirements for brokers and individual traders.

The USA. The main regulator of financial exchanges is the Securities and Exchange Commission (SEC). The SEC can independently initiate criminal cases and file claims in court. The regulator is considered the strictest in the world - a non-resident can enter the US stock market only through a sub-broker or subsidiary broker structures. The CFD market in the US is strictly limited.

The United Kingdom. Exchange trading in the UK is regulated by the FCA - Financial Conduct Authority. The regulator's license means that the broker undergoes an annual audit by an independent audit company, submits financial statements, and maintains the capital at the required level.

Gold futures live chart

The XAUUSD started growing rapidly in the early 2000s. Over the past 20 years, the gold yield was 530%, although there were deep drawdowns in the middle of this period.

The current gold exchange rate in real time is 2 494.12 US dollar per ounce.

You can study expert opinion and a relevant gold price prediction for 2023 and beyond.

Choosing the right broker for gold trading

Individual traders do not have direct access to international financial markets, they do not have sufficient capital or technical capability. Such traders need an intermediary anyway. In the case of investment, the intermediary can be a bank or an investment management company with a mutual fund. Active trading requires a broker - a company that has access to exchanges, liquidity providers, or ECN systems.

Almost all brokers can be called universal. If it is a stock broker, it offers services for trading futures, options, stocks, and the underlying derivatives asset is not just gold. The broker provides access to the exchange where there are any trading instruments, including gold derivatives.

The same situation is with the OTC brokers. The broker provides the access to liquidity providers, which are most often the largest investment banks in the world. There can also be provided the access to the ECN platforms. ECN platforms are digital trading platforms where traders from all over the world work.

The range of the trading instruments provided by different brokers differs from each other due to internal development policies and technological capabilities, but each of them has XAUUSD CFDs. There are rare offers of trading synthetic pairs - XAU versus, for example, oil or another currency pair.

Since brokers are almost universal, the choice of an intermediary to trade the XAU/USD comes down to the common rules:

The type and level of the spread. Account type. Since the gold short-term volatility is low, the lowest possible spread is the main condition. The floating spread is lower than the fixed one, so, to trade the XAUUSD, you need an ECN account with a spread of 0 pips.

Order execution speed. On ECN retail investor accounts, the execution speed of up to 50ms is considered good. You can check it in MT4, as well as the spread level, using a script. If you need a launching script file, write in the comments.

Leverage. The higher, the better. However, you must use leverage only in accordance with the risk management rules. You should not employ leverage to increase the position volume if it violates the norms of acceptable risk level per transaction and for the total position volume.

Availability of passive trading services, for example, copy trading. You can subscribe to the MetaQuotes community signals in MT4. If your brokerage company offers a social trading service, it is also a big advantage.

There should be no additional fees. On an ECN account, almost every broker charges a fixed commission for each lot. There should be no other commissions, including withdrawal fees.

Offer transparency. There should be clear and straightforward terms and conditions specified in the documents regulating the trade. Analyze the license availability, professionalism of the support service, etc.

First of all, trading with a broker should be comfortable for you. So, use a minimum deposit or start with a demo account to check. The link to the LiteFinance demo account is here. You do not need to sign up to test the platform.

Gold Trading FAQ

Trading gold means buying and selling XAUUSD or gold instruments to make profits from the difference in gold spot prices. You can trade:

- Physical metal: resale of golden bars, coins.

- Exchange-traded futures and options with and without physical delivery of the metal.

- ETF stocks that invest in gold.

- Contracts for Difference — CFDs.

- Shares of gold mining companies.

You can trade gold in the following ways:

- Stock market: futures, options, gold ETFs share. It is associated with a high initial deposit, additional costs for exchange commissions, and depository fees.

- OTC Market: Gold CFDs. It features a relatively small entry deposit, the ability to enter trades in both directions, instant trade exiting. However, these are complex instruments and you have to accept high risk of losing money when trading CFDs.

- Investing: mutual funds, purchase of physical metal, metal deposits.

1. Sign up on the LiteFinance website and open an ECN account. Complete verification.

2. Top up your account in the TRADE FOREX - DEPOSIT/WITHDRAWAL section. The minimum deposit is 50 USD, the XAUUSD leverage, according to the specification, is 1:100. It is enough to enter a minimum trade.

Open the LiteFinance trading platform and find the XAUUSD chart. Perform technical and fundamental analysis of the gold rate to develop a robust strategy and not let your account lose money when trading. Enter a trade according to the recommendations in this article.

The current gold exchange rate is 2 494.12 USD per one ounce. I recommend you to get familiar with the analysts’ opinion on the gold outlook and study short-term and long-term gold price forecast here.

Buy the stocks of the ETFs, which:

- Have the lowest management fees. The average management fee does not exceed 0.4-0.5% of the value of securities under the management of the fund.

- Provided with 100% physical metal.

- Diversified. They should invest not only in physical metal but also in gold financial instruments.

- Have a relatively large investment portfolio under management.

Answer the following questions:

1. Are you going to invest for several years? If yes, then estimate the location of the current gold price relative to the last historical high. If the difference is more than 10%, the downward movement is over or going to finish, turning more and more into a sideways trend, then buy. If most forecasts for global economic development are optimistic and gold continues to go down in value, take your time and wait for the bottom.

2. Are you going to make money on short-term trading? Estimate the current volatility in a longer timeframe, for example, the H1. Switch back to the short-term timeframe chart and see how much the price has passed since the opening of the daily candle. If the movement reserve is more than 60% and the trend is up, you can buy gold versus the US dollar.

If you want start trading gold, here are the factors to consider:

1. For a long-term trading strategy:

- At the low, which the price hits in the correction from historical or key highs. The correction can take several weeks. After the price starts trading sideways in the daily timeframe, you can buy the precious metal with a horizon from several months to several years. The first target profit is the last all-time high.

- In March. According to statistics, the lowest Au price is observed in March and the highest in September.

Gold is a good investment in 2023 if you aim at a long-term investment for more than ten years and prefer to minimize risk and not lose money when trading rather than the maximum profit. It doesn't matter when you buy gold, historical data prove that in 10 years gold demand will grow and its price will increase at least twice. But it is best to buy gold at the low when the stock markets are at the high and the trend starts turning down.

According to the laws of Islam, investors must not receive or give interest from any type of activity, and lending is prohibited. It is also prohibited to invest in settlement derivatives - futures, forward contracts, and options if they are settled at the end of the term.

In Islam, gold trading is halal in the following cases:

- Purchasing gold and precious metals in banks, their storage in safe deposit boxes (there are some nuances).

- Trading in commodity exchange derivatives, the contracts under which the actual delivery of goods occurs at the end of the term.

- Trading gold CFDs on Islamic FX swap-free retail investor accounts.

You can buy gold in the stock market only through a broker licensed by the regulator, which has direct access to exchange trading. On the stock exchange, you can buy the stocks of the ETFs that invest in gold instruments, deliverable and settlement futures, options, and other derivatives with the XAU or ETF stocks as an underlying asset. To make a transaction, you must pass verification with a broker and have a minimum deposit of at least 1000-2000 USD. In some cases, you may be required to obtain the Qualified Investor status.

Yellow metal is a safe haven asset. It is profitable to buy gold if you follow the risk management rules. In the long-term prospect, the gold rises. When the money devalues by inflation and there is economic uncertainty, on the other hand, there is constant industrial gold demand; gold is a form of hard currency.

In short-term trading, one could make profits from the fundamental price movements both up and down. To increase the efficiency and prevent your account from losing money rapidly, you will need the ECN account with the minimum floating spread and swap.

The LSE exchange (UK) is considered to be the center of physical gold trading, and the XAU - COMEX (New York) is the main exchange to trade gold futures. The leader in the Asian market is the Shanghai Stock Exchange. But financial markets are open 24 hours a day, except the weekends. Therefore, you can buy and sell gold instruments through your broker at any time - the broker will automatically send your order to the exchange that is currently open.

P.S. Did you like my article? Share it in social networks: it will be the best "thank you" :)

Ask me questions and comment below. I'll be glad to answer your questions and give necessary explanations.

Useful links:

- I recommend trying to trade with a reliable broker here. The system allows you to trade by yourself or copy successful traders from all across the globe.

- Use my promo code BLOG for getting deposit bonus 50% on LiteFinance platform. Just enter this code in the appropriate field while depositing your trading account.

- Telegram chat for traders: https://t.me/litefinancebrokerchat. We are sharing the signals and trading experience.

- Telegram channel with high-quality analytics, Forex reviews, training articles, and other useful things for traders https://t.me/litefinance

Price chart of XAUUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.