Who earns more on the financial markets: an automated trading expert advisor or a real person? The best Forex robots can analyze the situation thousands of times faster, sort through the possible options and choose the best one. In addition, advisers are not susceptible to human emotions. However, a human can make decisions in emergencies, take high risks in accordance with his risk tolerance, be flexible and trust their intuition, which is sometimes more effective than mathematical algorithms applied. Forex trading bots are a tool in the hands of a currency pairs trader, but it’s up to the individual to decide.

In this review you will learn:

- What Forex trading robots are and how they can help in trading;

- How effective algorithmic trading is and whom it suits best;

- How to install an Expert Advisor in MT4/MT5 and gain experience in auto trading.

The article also discusses Forex trading robots with different mathematical algorithms — from grids with a Martingale coefficient to complex and good trading systems based on neural networks.

The article covers the following subjects:

- Major takeaways

- What Are Forex Robots?

- How Does Forex Robot Work?

- Do Automated Forex Trading Robots Really Work?

- Pros and Cons of Automatic Trading Systems

- Criteria We Used When Choosing the Best FX Robots

- Main settings of the trading robot

- The Top 10 Forex Robots

- Forex Hedging Robots

- Forex Scalping Robots

- Best Forex Robot for Gold

- Forex Android Robot

- Review of EA Builder

- Forex robot for sale

- How to Avoid a Scam FX bot

- Key takeaways

- Trading Robots and Expert Advisors FAQs

Major takeaways

- The article discusses using Forex trading robots or expert advisors (EAs) as automated trading systems in the Forex market.

- While these robots offer benefits such as time-saving, instant decision-making, and eliminating emotional stress, their lack of flexibility and the need for regular optimization are major drawbacks.

- The effectiveness of Forex trading bots depends on the trader's ability to select proper settings and assess risks.

- The article highlights the shift towards neural networks with machine learning, which can adapt to market changes, but these advanced bots are currently mainly utilized by large investment companies.

- It also suggests learning to use Forex trading bots through free options and testing the advisor.

- Forex robots can be valuable tools, but they require careful monitoring and customization to ensure optimal performance in a dynamic and volatile market.

What Are Forex Robots?

Forex trading robots or expert advisors (EA) are automated trading systems based on algo signals that open and close Forex trades according to the algorithm specified in the code for a fixed period of time without human intervention.

Algorithmic Forex trading appeared in the 80-90s with the development of computer technology as it became necessary to speed up and partially automate the trading Forex process.

Some interesting facts:

A signal travelling a fiber-optic cable from New York to Chicago takes an average of 6.55 milliseconds;

To boost the speed, some companies have switched to micro-radio waves. With their help, the signal travels the same distance in 4.25 ms - this difference gives a competitive advantage in making orex trades.

Spread Networks laid a fiber-optic cable between Chicago and New York through the shortest possible way and punched a hole in the mountain for this. The investment amounted to 300 million US dollars, but the signal transit time decreased to 3 ms.

- On average, an HFT Forex trading robot earns 0.09 cents when they trade Forex. In 260 ms, it makes about 5,000 Forex trades.

According to various trading rules, transactions using HFT Forex robots, machine learning and artificial intelligence reach 60-80% of the total turnover. It is hard to give an exact figure, since technically many of different trading strategies violate the law. In addition, regulators cannot track all transactions - there are millions of them and they are completed in milliseconds.

In private trading activity, Forex trading bots perform a similar role. Their main task is to instantly make a trade where a person would waste time on analysis and making trading decisions. They also make trading Forex fully automated, thus removing the human emotional burden and allowing you to save time.

How Does Forex Robot Work?

Forex trading advisor (foreign exchange bot) is an automated trading algorithm that performs in compliance with algo signals and does the following tasks:

Instantly processes a large amount of data. Some fully automated Forex trading robots even perform fundamental analysis;

Automates trading Forex. Performs actions instead of the necessity to trade manually;

- Manages high risks. The risk management system embedded in the code eliminates the emotional factor.

The fully automated trading adviser works as its code directs it. The simplest Forex trading different robots have several settings that determine the trade volume, give Forex trading algo signals for certain events, and set stop orders. A complex Forex trading bot has dozens of those. For example, they can be divided into blocks, each responsible for a separate adviser trading strategy. Unique features can be added: spread control, automatic selection of settings in case of a change in the Forex market situation, etc.

Example. You have developed a Forex trading system, according to which the trading signals to open a trade appear when the stochastic oscillator is above the level of "80" and the intersection of two MAs with different periods. You set the stop order at a distance of 20 points, take real profit - at 30. A programmer writes code based on this system, you install the launch file on the Forex trading platform and, after activating it, the adviser performs the actions specified in the code by itself.

You can read about the types of Forex trading advisors in this review.

Do Automated Forex Trading Robots Really Work?

You can find hundreds of paid and free fully automated Forex trading robots online. It is reasonable to assume that all of them cannot be profitable. Their effectiveness depends primarily on the Forex robot trader’s ability to select the proper settings, understand the moments when it is better to stop the Forex trading bot, assess the risks, etc. A Forex trading bot is not the Holy Grail. This is a tool that makes life easier for those who know how to handle it. And if a person does not know how to use a tool properly, they can only make it worse. The “monkey with a grenade” principle is a sure way to lose money.

How to learn using Forex trading bots:

Start with the free options. You need to understand what technical analysis custom indicators it uses (some Forex robots offer binary options trading as part of their platform, while others are specifically designed for binary options trading), what assets and timeframes it can be used on, how Forex trading signals are formed, how the trade volume is calculated, and how risk management and trading parameters are set.

Use a demo account. Practice on a demo account until you get the desired result. Or at least until you understand the principles of algorithmic Forex trading.

Test the adviser. Start with a cent account. After testing, you should have growing equity and statistics in front of your eyes. If things got worse on a live Forex trading account, look for reasons.

- The use of Forex trading advisors makes sense in the following situations:

Scalping/HFT trading. Different trading strategies where the speed of opening/closing Forex trades and the speed of decision making are important. Foreign exchange Forex trading different robots are often used in the price acceleration of cryptocurrency. Read more about this in the review “Cryptocurrency Pump&Dump: How to Avoid Being Scammed”;

Combination of manual and algorithmic trading strategies. While the Forex trading bot can trade automatically, you can be working with manual trading strategies. You should take into account that an automatically opened trade will lower the margin level;

- You have a proven manual trading strategy. If you have a proven Forex trading algorithm — translate it into code (some programming skills will be necessary), this will help save time. If you have account monitoring, you will be able to sell it later.

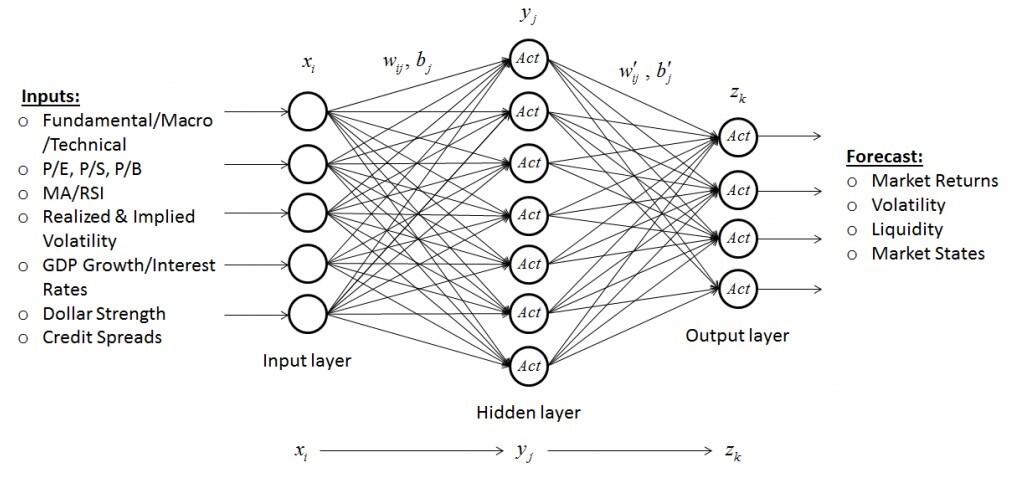

Gradually, classical Forex trading bots are being replaced by neural networks with machine learning. Based on the input data and set targets, the best Forex trading robots are able to calculate thousands of mathematical algorithms, choose the best one and independently adapt to Forex market changes. So far, the best Forex robots are used only by the largest investment companies.

Pros and Cons of Automatic Trading Systems

Pros of Forex trading robots:

They save the professional trader’s time. Forex EAs perform Forex market analysis and search for trading signals.

The speed of managing trades and discipline. In situations where an instant decision is needed, the cause of error is the human factor. Denial, hope, greed, doubt, fatigue take their toll. The Forex trading robot automatically follows the risk management and trading rules embedded in it.

No emotional stress. The reason many traders, including advanced traders and inexperienced traders, make mistakes is often the mental pressure and fatigue — using a Forex trading advisor eliminates them.

Automated trading. Forex trading bots are able to collect initial information and, based on mathematical calculations, evaluate the statistical probability of an event, for example, a positive trend beginning. Based on it, they can make a trading decision.

- Auxiliary tools. In addition to automatic Forex robot trading directly working with trades, there are scripts that perform an auxiliary function. For example, searching for emerging patterns, assessing the current spread, drawing Forex trading sessions in the chart, etc. Scripts give the professional trader the necessary information for manually trades.

Another advantage is combined autotrading. Many trading platforms support the simultaneous use of several Forex trading bots, even in one asset. This is justified if they contain different trading strategies that do not put pressure on the deposit at the same time.

Cons of Forex trading robots:

Lack of flexibility. The Forex market is volatile — it is influenced by fundamental factors, the actions of Forex markets makers, and unexpected events. They cannot be foreseen and embedded into the code. Therefore, trading bots need to be regularly optimized by changing the settings or the Forex trading algorithm. However they can drain your minimum deposit before you get a chance to do that.

It’s not worth it if you use several trading strategies. A trader needs to create custom indicators, a Forex trading system, spend money on code development, do testing - all this takes time. If the trading strategy is long-term and involves opening 1-2 trades per day, is it really worth it to spend the resources on developing a robot?

Code mismatch. If the Forex trading bot code does not match the trading platform code, it will not work. If you’ve found an interesting Expert Advisor with a different code, you will have to rewrite it to fit the code or change the trading platform. For example, MT4 supports MQL4, MT5 supports MQL5, cTrader supports C#. Some trading platforms do not support custom automated software programs at all.

No guarantees. And it's not just about profitability. If the advisor has not yet been tested, you have no idea at what point a bug may appear. No one is immune from errors.

- They need to be online 24 hours a day. A solution to the problem is to rent a VPS (virtual private server). In this case, the trading platform with the adviser will be located on it, and not on the computer.

Although the point of Forex trading bots is to eliminate the human factor from the trading process as much as possible, they still need constant monitoring. Sometimes it is better to stop the Forex trading robot and close the trade manually.

Criteria We Used When Choosing the Best FX Robots

Before using anything in your Forex trading, I recommend testing it in a tester or on a demo account. This will help you understand what is the best Forex bot for your trading strategy.

You will surely see beautiful profitability charts on Forex trading websites with ads of profitable advisers, something deep inside you will stir, you’ll get a thought like “what if it’s true”, and it will make you feel very warm. Unfortunately, it is the same greed that whispers to people who lose money in slot machines. And the more willing you are to listen to it, the worse for your financial situation. Don't let greed defeat your common sense as you will be risking your real deposit. That inner voice cannot make up for what you lose if it fails.

Without understanding the tools you are using in Forex trading, you cannot be sure of success.

Here we need to clarify that Forex trading is not only profitable trades, but also unprofitable ones, which are emotionally uncomfortable. There is also a concept of "serial trades". If you have a well-established profitable Forex trading strategy, and you understand in which periods it works better and in which it works worse, you will be almost indifferent to a series of losing trades. The simplest example: you have a positive trend trading strategy based on 2 moving averages, and a flat has formed in the Forex market at the moment. The profit mechanism here is as follows: during directional movements you have more profitable trades, and during non-directional/lateral/flat movement you have more unprofitable trades. If during a flat such a strategy gives a series of losing trades, you will be ready for this, because you know that this is a working moment for this trading strategy. Now imagine how you will feel if you DO NOT KNOW what the trading Forex algorithm is based on, and you close the 3rd trade in a row with a loss, then the 4th, 5th and so on. It will surely bring discomfort. And it's completely justified. A person might feel the same discomfort if their car engine suddenly stops while driving. They don’t know how serious the breakdown is, and so they are worried.

If you have a well-established profitable Forex trading strategy, and you understand in which periods it works better and in which it works worse, you will be almost indifferent even to a series of losing trades.

Let me give a recommendation: if you decide to try automated trading systems with Forex trading bots, the right decision would be to use the Forex trading robots whose mechanism is clear to you, at least in general. Do not be fooled by general phrases like “the advisor is based on a super-profitable algorithm that instantly adapts to Forex market changes and protects against sudden price spikes” or “the advisor’s algorithm is too complicated to describe, it has a lot of latest technical analysis indicators (MA, support and resistance levels,etc.), but it perfectly selects time and place for trades”. It's like when buying a car you believe the seller that says "the car is good, I would drive it myself, but I don’t have the money" without even taking a test drive. You don't do that in real life, do you?

How to choose the best Forex robot for automated trading systems:

- Understand the mechanism of the automated trading Forex robot. The best Forex trading robots are built on 1-2-3 main latest technical analysis indicators and 1-2 confirming ones. A risk management mechanism must be provided with different robots.

- Pay attention to the following aspects:

- Code. Closed code (.ex4 for MT4) means that you cannot view and correct it. Programmers close the code so that it is impossible to copy the idea and pass it off as your own. For an investor, this is a disadvantage. Look for open source Forex trading bots (.mq4 for MT4);

- Settings. On the one hand, many settings are an advantage, as they allow you to customize the adviser for individual tasks. On the other hand, at times it complicates the optimization. It’s even worse if there are no settings at all;

- The principle of position volume calculation. There are Forex trading bots with Martingale coefficient, they increase the position volume in case of a loss. They are high risk Forex trading robots.

Run the Forex trading bot through the tester. When your Forex robot runs continuously, pay attention to the following points:

Character of the equity. The deposit curve should be ascending and as smooth as possible. Sharp drawdowns point to Martingale and the instability of the Forex trading system during consistent market changes. Pay special attention to the last section of equity - if it goes horizontal or you can see a downward reversal, the adviser is not working correctly;

Maximum drawdown size. The bigger it is, the worse. Because on a live account it is difficult to say at what point you should the advisor ahead of schedule manually in order to save at least part of the minimum deposit;

A series of losing trades. It must be within reasonable limits. 5 or more losing trades in a row is already too much;

- The ratio of profitable and unprofitable trades. Ideally, their ratio should be approximately equal. If there are significantly more losing trades, it means that the Forex trading bot opens many small losing trades and covers them with one large profitable one. Such a trading strategy is acceptable, but it is high-risk.

Look at live account monitoring. A Forex trading bot that has never been used on a live account is no good.

- Calculate the profitability (for paid Forex trading bots). The initial information is the profit on the test period.

If, after backtesting, the Forex trading robot has drained the deposit, do not rush to reject it. There are Forex trading bots that sooner or later drain the deposit due to the algorithm, but in the profitable area they are much more effective than their conservative counterparts. Your task is to analyze all sections, determine the moment of the equity reversal and have time to exit the Forex market in time. Sometimes such a risk is justified by the rapid growth of the deposit. An example of such a Forex trading bot is Ilan, which will be discussed below.

How to install a Forex robot in MT4 / MT5?

To start the entire process, let’s look at the installation of any automatic Forex trading advisor. Fortunately it is the same for all types of Forex trading bots:

1. Metatrader 4/5 trading Forex advisors usually have one of the two extensions: .ex4 or .mql. However, sometimes they come with a number of technical indicators and libraries that need to be installed for correct operation as they are not included in the standard configuration of the Forex trading terminal.

2. Copy the advisor file (.ex4 or .mql).

3. Open the folder where the MT4 terminal is installed.

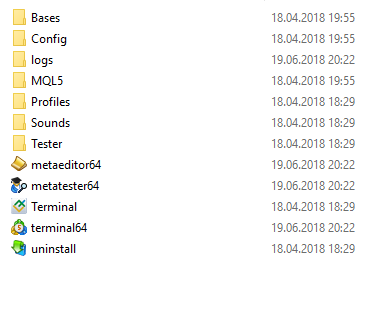

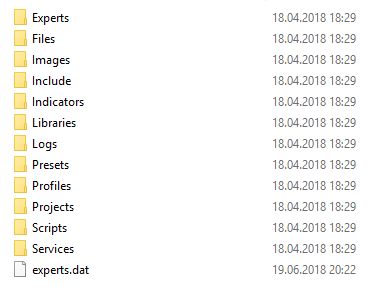

4. Find the MQL4 (or MQL5) folder, and in it the Experts folder, into which you need to insert the trading bots file (.ex4 or .mql). Auxiliary files do not need to be copied here.

5. Now let's deal with the auxiliary files. Depending on the permission, we will copy these files to the relevant folders. They can be either in Experts or in MQL5:

- if the file extension is .set, copy it to the Presets folder;

- if the file extension is .dll, copy it to the Libraries folder;

- if the bundle includes files with indicators (they also have the .ex4 or .mql extension, you can distinguish them from the Expert Advisor (EA builder) by their name) — copy them to the Indicators folder.

6. Check if you’ve placed all the files in folders correctly.

7. If everything is fine, launch MetaTrader 4/5 (or restart if it was open before).

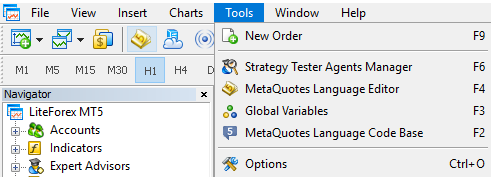

8. When the terminal opens, at the top find the “Service” tab, click on it and select “Settings”.

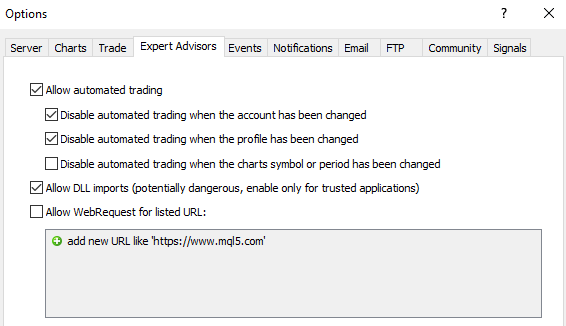

9. Now you need to let the advisor run. To do this, select the "Advisors" tab, check the boxes as in the below screenshot and click OK.

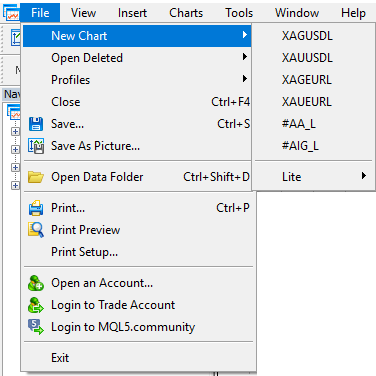

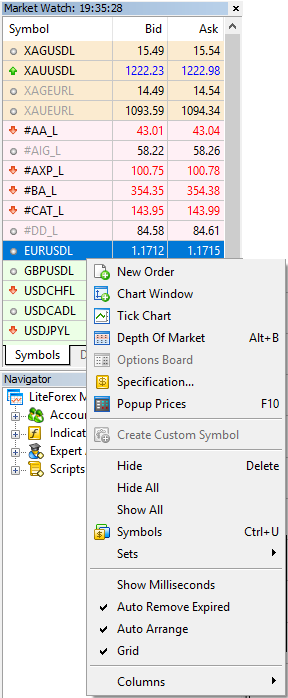

10. After you have given the adviser the permission to manage your personal finance (real or virtual) according to its Forex trading strategy, you need to determine which currency pair you will allow it to trade. To do this, open the chart of this instrument:

At the top of the terminal, select “File”, then “New Chart”, after which select the instrument you need;

In the Market Watch window, right-click on the desired instrument (trading preference) and select Open Chart.

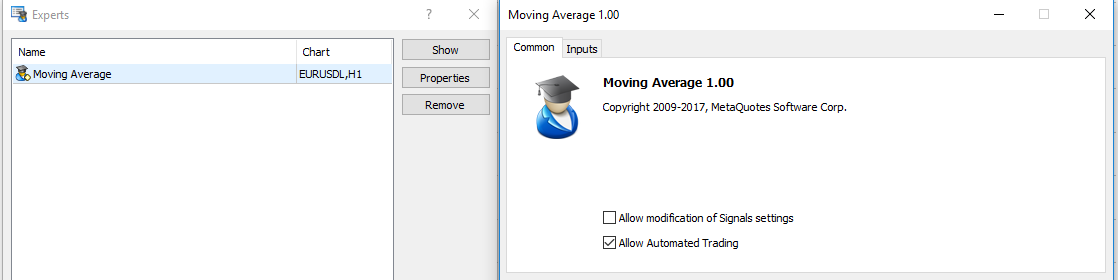

11. Next, you need the "Navigator" window. It’s either there, or you need to add it yourself. You can do this by selecting “View” at the top of the terminal and then “Navigator”.

12. Now you need to add trading bots to the chart of the instrument you have chosen. To do this, in the "Navigator" window, click the plus sign opposite the "Experts" section.

13. Find your adviser by name and drag it to the chart by holding the left mouse button.

Important! Pay attention to the timeframe displayed in the chart. Sometimes the advisor is designed to only work on a certain time period - this is indicated in the description.

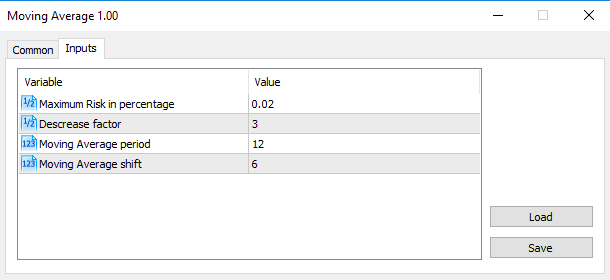

14. After the above operation, a window with the settings of the Forex trading bot should appear (see figure).

Depending on the risk management parameters, the deposit size on the Forex market, as well as your intention to follow the recommended existing technical trading rules for using the adviser, you can set the settings as you wish.

If the goal is, for example, to test an adviser with basic parameters, and it comes with a settings template file (.set), you can simply download this template. To do this, press the button "Download" and select the settings file in the folder Presets. We’ve covered finding it in paragraphs 4 and 5.

In addition, if you have changed the settings, you don’t have to set them every time you enter the terminal - you can save them as your own template by clicking the “Save” button.

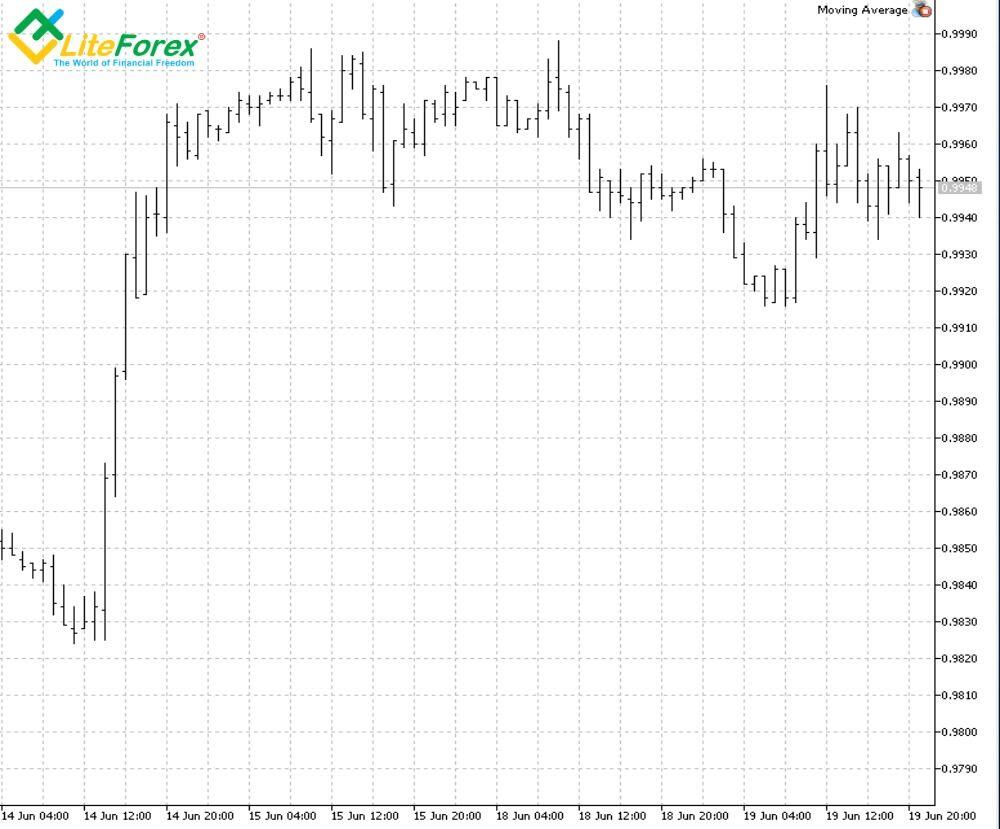

15. After you’ve figured out the settings and set them up, click the "OK" button. A smiley icon and the name of the advisor should appear in the upper right corner of the chart.

You also need to make sure that the "Autotrade" button is green. If it is red, click on it.

That’s pretty much it. From now on, if you’ve done everything correctly, the advisor will trade according to the algorithm embedded in it. If you want to disable it, just click on the “Autotrade” button so that it turns red again. As long as it’s red, automatic Forex trading will not be carried out.

Main settings of the trading robot

Let's move on to the part where you can show some creativity. Just remember that your creativity should be limited by the risk management trading rules on the Forex changing market and consistent with the size of your minimum deposit (more on that later). Of course, that is if your goal is to consciously work on profitable Forex trading rather than gamble.

Settings are usually numbers (for example, a Forex trading lot) or on/off (or true/false) toggle.

So if you want to enable some parameter, set it at “true”. If you want to turn it off - set "false".

Now let's move on to the most common settings:

- Lot Size — the size of the Forex trading lot with which the EA will open trades.

- MicroLots — enable/disable the ability to trade micro-lots (0.01,0.02,0.03, etc.).

- Money Management - by enabling this option, we give the adviser the permission to choose a Forex trading lot.

Before enabling this option, I recommend that you:

Understand the principle by which the adviser decides to increase/decrease the Forex trading lot;

- Compare this principle with your risk management and trading rules for consistency.

In my personal opinion, it’s quite unlikely that they will coincide. It is better and easier to give the adviser personal recommendations on the trading Forex lot, so you don’t have to worry about its decisions.

Comment — you can comment on the trades made by the Forex trading robot. It is used for the convenient collection of statistics. When you study the Forex trading history of an adviser, you can use this comment to distinguish its trades from your own positions that you trade manually, or from the trades of other advisers used on this instrument.

- MagicNumber is the code by which the EA distinguishes its positions. It prevents the Forex robot from closing your personal orders along with its own. Keep in mind that if you have several Expert Advisors trading at the same time, you cannot use the same MagicNumber for them.

That’s it for the settings. There may be other parameters - their purpose is usually also indicated in the descriptions for advisors.

I recommend not to bother with additional settings and test even the best Forex bots on standard parameters. If it doesn’t show a positive result with them, then, most likely, it needs some specific consistent market conditions for profitable Forex trading.

Someone will decide that they need to adjust the settings and determine the best parameters for the current changing market, but in my opinion, this is a waste of time. You don’t know when market conditions will change again, and I would feel nervous. It’s like sitting on a barrel of gunpowder and wondering: “is everything okay or is it time to change the parameters again?”

It reminds me of hiring: one employee does their job calmly and methodically, and another is an impulsive person who can give an excellent result one month and fall into a deep depression the next. The choice, of course, is yours. In my opinion, the more versatile the Expert Advisor is in terms of market conditions, the better. Even if it brings less profit in the long run. You test it, install it and forget about it to go about business (testing other advisers, for example). The goal is a clear EA algorithm and gradual profit with small drawdowns.

The Top 10 Forex Robots

In this block, we will take a look at the best Forex trading robots, which have shown relatively good results over several years of work on live retail investor accounts. They are based on automatic Forex trading with pending orders and good trading systems, positive trends and scalping algorithms, some use Martingale. Most of them are intended for using at certain market moments and require periodic optimization. Many Forex robots are able to learn and trade automatically adapting to the market, but they mostly do not allow for free download.

Review of Odin

This Expert Advisor was developed for the MT4 platform by Forex Robot Trader. It works on a pending order grid system, which helps to catch local trend reversals and corrections.

- Algorithm. When the events specified in the algorithm occur, the Forex robot places pending orders at an equal distance from each other. The distance is selected by the trader, taking into account the average volatility. Failed orders are deleted.

- Application area. Major currency pairs and cross-rates. Timeframe - from M15 and above.

- Settings. Basic indicator settings: grid size, risk management system settings.

- Advantages. Multicurrency. The recommended deposit is from 500 USD.

- Disadvantages. Mainly paid versions. High level of risk.

- Conclusion. Forex trading by building a grid of orders is high-risk, since immediately after triggering, a reversal may occur. But the backtest on different instruments indicates that the adviser works.

Review of Force Trader

A multifunctional long-term Expert Advisor built based on a version of Alexander Elder's system. It contains a set of indicators: strength index, RSI, Momentum, DeMarker, WPR. The uniqueness of Forse Trader is that it works simultaneously on several tradable currency pairs, taking into account the filters set up in the settings.

- Algorithm. The entry signal is formed in a complex manner in accordance with the conditions for each indicator. If even one of the conditions does not match, the trade will not be opened. All orders of the Expert Advisor use stop loss and take profit, and additionally set a trailing stop. The recommended deposit is from 1,000 USD.

- Application area. Major currency pairs and cross-rates with majors. Timeframe - D1.

- Settings. The Expert Advisor has a complex set of settings consisting of several blocks. For example, SL and TP settings, several market exit blocks, trailing stop setting and other parameters are divided into separate blocks.

- Advantages. High efficiency.

- Disadvantages. A large number of settings. Infrequent trade opening.

- Conclusion. Professional advisor for long-term strategies with complex settings and optimization. The use of daily timeframes is justified by opening trades on several assets simultaneously, taking into account filters and correlation of assets. On short intervals, it can show a temporary loss, which then turns into a surplus and is insured by trailing..

Review of Ilan

One of the most controversial trading bots often criticized in the Forex trading community. However it’s one of the most popular Forex robots. There are at least three versions of it: 1.0, 1.6 (dynamic) and 2.0. Forex traders criticize it for the ability to quickly drain the deposit. It is true in the long term, but in the short term it allows you to quickly accelerate it.

- Algorithm. It uses a series of orders with a proportionally increasing lot. It is conceptually impossible to consistently profit from it if you let it run for an indefinite time.

- Application area. Major currency pairs, timeframes M5-M15.

- Settings. It has more than 15 settings that determine the conservative or aggressive nature of Аorex trading.

- Advantages. Most versions are free. Has a high yield.

- Disadvantages. It belongs to the group of high-risk Аorex robots as it uses the Martingale coefficient when calculating the position volume. The recommended deposit is from 10,000 USD to withstand deep drawdowns.

- Conclusion. An adviser for those who have Forex trading experience in algorithmic trading process, are ready to take risks and know how to stop in time.

Review of Greezly

In 2007, this Expert Advisor was in the TOP-10 in the automatic Forex trading systems championship. Although it wasn’t just a few clicks to find confirmation of this, there are many reviews about it online.

Algorithm. Uses several sub fully automated systems depending on the market situation. In most cases, sets pending orders.

Application area. Major currency pairs.

Settings. A large number of settings to adapt the adviser to Forex trading styles. Several lot calculation options: as a percentage of free margin, fixed lot, etc.

Advantages. Profit expectation is 80-85%.

Disadvantages. You often encounter a paid version.

- Conclusion. A professional constructor Forex robot for those who like to learn something new and complex.

Review of Breakout

The Expert Advisor was developed in 2017. It is based on an indicator big breakout EA trading strategy with a clear algorithm - deviation from the conditions specified in the code is not allowed. Therefore, trades are relatively infrequent and are opened to hold for several days.

- Algorithm. The size of the previous (closed) candle is compared with the value of the minimum/maximum channel width. MA is below/above the minimum/maximum of the candle by MA_Otstup points. If both conditions are satisfied, a pending order is placed.

- Application area. The EURGBP pair in the European session, timeframe - H4. There are no deposit recommendations.

- Settings. About 10 settings: pending order placement and deletion time, moving average period and offset, maximum and minimum channel width, trade volume, safety order settings.

- Advantages. Understandable simple algorithm.

- Disadvantages. Lack of flexibility — fixed position size, no trailing. Relatively infrequent trades.

- Conclusion. A simple Forex robot for those who are just starting to understand algorithmic Forex trading. An excellent training option for a demo account.

Review of FX-Agency Advisor 3

A trend advisor for fully automated Forex trading developed in 2013 for the MT4 and MT5 trading platforms. You can find at least 2 years of live monitoring of this Forex robot’s operation on the analytical portal MyFxBook. It has a narrow specialization — it works only with the GBPUSD, EURUSD, and some other currency pairs, closing all trades before the weekend.

- Algorithm. The detailed algorithm of the Forex robot is not disclosed by the developers. It is known that it is based on the use of indicators and mathematical analysis. Based on the past price history, the promised performance is at least 75% of profitable trades. Used strategies: trading on a strong trend after a rollback, aggressive scalping after a trend, Forex trading on a countertrend.

- Application area. 4 currency pairs, timeframe - M15. The recommended deposit is from 1,000 USD.

- Settings. No information.

- Advantages. Fast profit.

- Disadvantages. It exists mainly in the paid version, but the developer is ready to return the money within 60 days, if your results are worse than those declared at the time of purchase.

- Conclusion. According to the developers, the EA does not need optimization. It contains a self-recovering algorithm and is allowed to work with default settings. In other words, it adjusts to the market automatically like neural systems.

Review of Wallstreet Forex Robot

One of the most famous expert advisors in professional circles available in basic and advanced versions. The newest version Evolution has added functionality: spread control, stealth mode, hourly filter, and news flow filtering module. The EA works simultaneously on 5 currency pairs.

- Algorithm. This is a trending Forex scalping robot that opens trades on rollbacks of the main trend. Forex robot indicators: CCI, MA, ATR, WPR, which are included in their own mathematical algorithm for estimating the probability of an event.

- Application area. Multi-currency Expert Advisor showing the best results on the GBPUSD, USDJPY, NZDUSD, EURUSD, and AUDUSD pairs. The recommended timeframe is M15.

- Settings. Standard and advanced settings related to the individual capabilities of the Forex robot.

- Advantages. There are no high-risk tools in the algorithm, such as order grid, Martingale coefficient, or averaging.

- Disadvantages. The full version is paid. Trades are opened relatively infrequently.

- Conclusion. You will find a lot of information and positive feedback about this Expert Advisor and its developer. It can be classified as universal, with a risk level below average, which is also suitable for novice Forex traders. The best result of the adviser is 90% profitable trades with a total return of 40-60% per month with an aggressive strategy.

Review of Milky Way

A reliable medium-term Expert Advisor that opens trades on trend rollbacks. It works on several currency pairs at the same time with no maintenance. The algorithm opens trades based on the Bollinger Bands channel indicator, the rebound from the channel borders is regarded as a signal. Additional filters — DeMarker and Ozymandias.

Algorithm. Trades are opened at moments of a sharp surge in volatility on rollbacks after an impulse surge. Trades are closed by stop order, take profit or Forex trading signals from MACD, ATR, and stochastic indicators.

Application area. Major currency pairs and cross-rates containing majors. Timeframe — H4.

Settings. The EA has more than 30 settings combined into several blocks: entry and exit blocks with settings for each indicator, stop and trailing settings, money management, and service settings.

Advantages. No high-risk instruments (such as binary options) are used, including the Martingale coefficient.

Disadvantages. On short intervals, it can be at the breakeven level - the result is visible on the medium-term interval.

- Conclusion. A good Forex trading robot as an additional tool. Does not require constant monitoring. Although it does not show a high level of profitability, the Forex robot belongs to the category of trading programs with minimal risk - stop orders are rarely triggered.

Review of Survivor

Hybrid multi-currency Forex trading robot working simultaneously on several strategies for the exchange and CFD markets. The signal is found by channel and trend indicators with a grid placement. The indicators used are Bollinger Bands, RSI, ADX, DeMarker, Moving Average.

Algorithm. For analysis, Survivor uses averaging: the Forex robot monitors the dynamics of the value of complex instruments (for example, binary options) and selects local corrections. Trades are opened taking into account the maximum allowable spread specified in the settings.

Application area. Currency pairs EURUSD, GBPUSD, USDCHF, USDJPY. Timeframe - M5-M15. The recommended deposit is at least 500 currency units per lot 0.01.

Settings. More than 20 settings consisting of blocks: parameters of the first entry, subsequent entries and reverse, stop loss and take profit settings.

Advantages. One of the few trading bots whose algorithm is resistant to fundamental force majeure (Brexit, Non-Farm, etc.). A small level of maximum drawdown. There are independent monitoring accounts.

Disadvantages. Trades need to be monitored regularly.

Conclusion. A peculiar Expert Advisor in terms of settings management, but successful in terms of a combination of strategies. I recommend testing it on a cent account.

Trading robots from Itic Software

The small company BJF Trading Group appeared in 2000. Initially, it was engaged in the development of computer programs for Forex trading, and later focused on trading programs for algorithmic trading. Since 2009, BJF Trading Group has become a corporation, one of whose companies is ITIC Software. Its profile is the development of expert advisors for experienced Forex traders, indicators, and programming languages for MetaTrader, cTrader and other Forex trading platforms.

Some interesting trading advisors from ITIC Software for advanced traders:

VIP Crypto Arbitrage Software. Expert Advisor for inter-exchange arbitrage trading - a scalping trading strategy based on the difference in quotes. More than 10 exchanges are integrated into the computer program, including Binance, Poloniex, Kraken, etc.;

News Auto Trader Pro. The EA is developed for cTrader, jForex and FIX API platforms. It collects news from several major information providers. Since the same news can be broadcast by several suppliers, the Forex robot reacts to the very first one and opens a trade a few milliseconds before the impulse movement starts. This allows you to get ahead of the market by opening a position before the majority reacts to the news. The Expert Advisor is available in two versions: for US and UK servers;

- IPsChanger. Auxiliary software that changes the IP address. The tool is useful for Forex traders, both experienced traders and beginners, who have several accounts opened with the same broker under different names.

The fact that the company has existed for more than 20 years suggests that its advisors are in demand among Forex traders, despite the relatively high cost. Buying a license for one account will cost 200-700 USD.

Forex Hedging Robots

Hedging and locking are similar high-risk strategies, but they are often used in trading bots to boost the deposit. Hedging involves opening multidirectional trades for different instruments, while locking uses one instrument at a time. Whichever direction the price goes, there will be a profit in one position, and a loss in the second one. The essence of the strategies is to close a losing trade at the right time and / or increase the volume of the profitable trade. Read more about this in the review "What is Hedging on Forex".

One of the many Forex robots that are interesting for hedging and locking unprofitable positions in the algorithm is HEDGE GATE. Its developer is a company that has been creating algorithmic trading programs since 2008. The latest modified version of the hedging trading Forex robot is already the third one. The developers have added new modules to it:

- Target profit within the day;

- Target profit from the set date;

- Hedging the loss in the most unprofitable trade at the expense of a part of the profit received from other currency pairs;

- Opening a trade with a pre-set grid of pending orders within the boundaries of the calculated intraday profit channel.

The Hedging Expert Advisor is developed for MT4 and MT5 automated trading platforms.

- Algorithm. The direction is calculated according to the algorithm of the Gann Square theory. The indicators used and risk management are unknown.

- Application area. Major currency pairs and cross-rates including majors. Timeframe - H1-H4.

- Settings. The EA has more than 7 main blocks of settings. When you receive a demo version for testing, the developers provide basic recommendations.

- Advantages. Efficiency - 75-85% of profitable trades. The average trade time in the market is 10 hours without swap costs. Trades are insured by a stop loss, Martingale is not applied.

- Disadvantages. Relatively high price. The cost of a license is 900-1200 USD. There is a monthly rent option.

- Conclusion. The key advantage is that the EA does not require re-optimization. This is a self-learning system built on a mathematical algorithm, which the developers do not disclose. The trading statistics are impressive, but it takes time to set up all the parameters. More precisely, it takes time to figure them out.

Forex Scalping Robots

The advantage of expert Forex bots in Forex scalping is speed. Fractions of a second are important in high-frequency trading, and a trader may not have time to analyze the market, look for Forex trading signals and respond to changes.

One of the best advisors in this category is Vzlomshik Pro. This is a multi-currency trading Forex robot for scalping that works on Forex using three different strategies. The Expert Advisor exists in several versions, the most successful of which, according to users, is 1.14.

Algorithm. The EA sets a grid of orders, and identifies pivot points and impulse corrections. The hourly interval is used to smooth out price noise.

Application area. Major currency pairs and cross-rates including majors. Supports highly liquid assets with high and medium volatility. The recommended deposit is at least 1,000 currency units for every 0.01 lot of a currency pair. Timeframe - H1.

Settings. Standard parameters: calculation of position volume for a grid of orders taking into account the Martingale coefficient, distance between grid orders, risk management system, etc.

Advantages. A multifunctional adviser that allows you to quickly boost the deposit.

Disadvantages. It uses Martingale, so it will eventually completely drain the deposit. The trader needs to earn enough up to this point and withdraw at least 100% of profit. Allows deep drawdowns.

- Conclusion. High-risk scalper Forex robot with periodic profit withdrawal. A lot of settings divided into 3 blocks, each responsible for its own scalping trading strategy. Recommended for Forex traders, both experienced traders and newbies, who already know how to work with advisors.

Best Forex Robot for Gold

Happy Gold. The idea of the adviser belongs to a German developer who used the fundamental volatility of gold and precious metals. The main indicator is ZigZag. The indicator’s algorithm is similar to scalping: the Forex robot builds key trading levels, finds the beginning of a trend movement and captures it after the level is broken.

Algorithm. The modified version of ZigZag draws key resistance and support levels by extremums. A pending stop order is set at the level, and in the event of a breakdown, the volume of the trade increases in the direction of the sudden price movement. The trade is insured by a trailing stop to take most profit on the trend, exit by stop loss is possible.

Application area. Precious metals, timeframe — М30-Н4.

Settings. Standard settings: risk level in percent per trade for dynamic lot calculation, trailing stop, stop loss, etc.

Advantages. The recommended deposit is from 100 USD.

Disadvantages. In most cases, this Forex bot is available in the paid version, although there are free download versions too. By contacting the developer directly, you can buy a full-package Forex bot license for 2 or 5 accounts. The license includes 10 trading bots for MT4 and MT5, including Happy Gold.

- Conclusion. A simple and user-friendly Expert Advisor Forex bot that uses classic wave theory, impulse movements and patterns.

Forex Android Robot

The difference between mobile algorithmic trading and desktop trading lies in the installation method. Desktop algorithmic trading involves downloading the platform from the broker and installing a Forex robot into it. Registration is required on the website of the adviser developer - the broker must be selected from the list of their partners. An example of such a financial Forex robot is Daxrobot. Its free version is suitable for both desktop trading via an emulator and Android.

As for the popular MT4/MT5, mobile algorithmic trading system does not work directly here. Metatrader on Android is not designed to run trading bots. There is an alternative option though — a VPS server. The user rents the remote capacity of the server on which the desktop version of the platform is installed, and Expert Advisors Forex bots are launched on it. An application on the smartphone provides remote access to the desktop platform.

Review of EA Builder

EA Builder is a free Expert Advisor EA builder based on basic or custom indicators that allows you to automate manual strategies without learning how to code. Constructor features:

Development of advisor templates for auto trading in currency pairs and futures on the MT4 and MT5 automated trading platforms. The user enters a step-by-step strategy algorithm into the constructor editor: indicators, trading signals, etc. The result is an Expert Advisor that can be exported to the platform;

Generation of risk management block;

The generated templates can be tested both in the constructor and in the Metatrader.

In the version with basic functions, the constructor is free. To gain access to the full version, you need to subscribe. There you can add an EX-file of the indicator, there is no limit on the number of generated trading bots, etc.

Forex robot for sale

In addition to free versions of Forex bots, there are also paid versions. Their price is set by the developer. The developer is interested in selling, since for them it’s a quick income without the need for investment. For the buyer, paid versions have their own advantages:

Paid advisors are supported by the developer. If you have questions about settings or operation of Forex bots, ask the developer, they are always interested in helping the client;

A paid Forex bot is inherently unique. The developer sells their idea in the code;

- From an economic point of view, buying an adviser may be more justified than subscribing to trading signals or social trading.

An investor has three options for investing in trading Forex bots:

Buying an advisor. Finding one is another question. There are many suggestions on forums, but there is a risk of wasting money on an inefficient or free product. There are brokers or platforms offering their computer program, but it's expensive.

Ordering a Forex bot. If you don’t know how to code, create your own trading system and order code written based on its algorithm. You can find out how to do this for MT4/MT5 in the review "How to Order an Expert Advisor".

- Creating an Expert Advisor on constructor platforms. You don’t need to know how to code. An example of such a platform is System Creator. You can find an overview and step-by-step instructions in the article "Creating a Forex Expert Advisor".

How to Avoid a Scam FX bot

The most common scam on the part of sellers of trading advisors is selling a free Forex robot. A trader cannot possibly know about all the existing free versions, which is exactly what the scammer abuses. At best, the seller makes minor changes to the code and sells it as copyright. At worst, they just sell the free version.

How not to get scammed when buying a Forex robot:

- Buy directly from major developers. They can be brokers or independent companies. They also provide technical support and updates to their software as a bonus;

- Ask for an investor password. If there is no monitoring on a live account - leave immediately. An honest seller will give you an investor password to see the results of the adviser on a live account;

- Ask for a backtest. The Forex bot’s avatar is its backtest - its trading statistics. One of the tricks of scammers is to fake a backtest or run an adviser on a demo account. The authenticity of a backtest can be determined by manually calculating individual statistical indicators if you know the formulas.

You want to buy an adviser but you’re afraid of scammers? Order the development of an adviser based on your own algorithm. You can do this, for example, on the MQL5 platform freelance exchange (the owner is MetaQuotes).

Key takeaways

What a novice trader needs to know about Forex robots work and algorithmic trading:

1. Forex trading robot is software that allows you to automate the management of trades. A Forex robot is a program that works according to the algorithm specified in the code. It is installed in the trading platform provided that they are compatible.

2. The Expert Advisor allows you to:

- Instantly open/close trades with a gap of a few milliseconds;

- Analyze the flow of incoming information, sort through possible scenarios and find the best solution;

- Automate trading by eliminating behavioral and emotional factors.

3. Advisors can be paid or free. It is better to buy paid advisors directly from the developer or your broker. Paid Forex robots have a more complex core, which can consist of several blocks, have add-ons, etc. You can order the development of an adviser code for a manual forex trading strategy.

4. The performance of an Expert Advisor is determined by the nature of equity and statistical parameters: profit factor, maximum drawdown, etc.

5. The effectiveness of an Expert Advisor depends on the settings and the market situation, under which it was optimized in the tester. Both paid and free advisors can be equally effective.

6. An Expert Advisor is not the Holy Grail that will immediately start bringing you profit. This is your assistant, automatically performing actions that you used to do manually.

Trading Robots and Expert Advisors FAQs

The effectiveness of the best Forex trading bots depends on the following factors:

- Settings. You need to change the settings regularly to adjust the adviser to the changing market situation;

- Trading financial circumstances. A Forex robot designed for scalping will not be effective on the daily timeframe and vice versa;

- Market conditions. For example, some Forex robots are more effective in a flat, others are more effective on trend movements;

- Fundamental factors. The Expert Advisor works according to its embedded algorithm and does not react to fundamental factors. Therefore, it can quickly drain the deposit. It is better to suspend trading bots during news releases.

There is no perfect trading advisor. Much depends on the settings, timing, etc. A few tips:

- Read the description of the Forex robot. The developers of advisers usually give recommendations for their use: type of asset, nature of the market, etc.;

- Run the Expert Advisor on historical data in the tester. Examples of testers: built-in MT4 and MT5 testers, applications for MT Forex Simulator, Fx Blue. Analyze trading statistics. Pay attention to the type of equity, maximum drawdown, and number of losing trades in the series;

- Run the Expert Advisor on a live account, monitor the results. If during live trading the EA deviates from the test statistics for the worse, stop it and optimize.

- Request live account monitoring. An advisor running on a demo account is not suitable for buying.

- Ask for a backtest. Check the backtest for fakes - if possible, recalculate 2-3 statistical indicators.

- Order a custom-made trading Forex robot.

- Depends on the trading conditions of the broker. Most brokers do not impose restrictions on the use of algorithmic trading. But some of them do. For example, a ban on the use of high-frequency Forex robots overloading the server. These restrictions are specified in the offer. In case of violation, the broker has the right to cancel the results of orders or, in the worst case, block the account.

- Depends on the goals. The very use of Forex robots is not prohibited, what is prohibited is price manipulation. Therefore, launching, for example, an HFT Forex robot or a spoofing Forex bot (placing an order and instantly cancelling in order to create the appearance of trading volumes) can be regarded as a violation.

There is no clear answer to which are the best Forex trading bots. The most profitable is usually the one that you have optimized best. Profitability depends on many factors, so the best and most profitable Expert Advisors do not exist. Any adviser can bring profit today, and drain the deposit tomorrow - it all depends on the volatility of the market situation. It’s crucial to note that investing involves risk and you can lose money, even if it’s done this trading bots, thus when you start trading it’s necessary to continuously educate yourself and practice strategies on demo accounts.

It’s for you to decide if a Forex bot is good or not. Algorithmic trading saves time, reduces physical and emotional stress, and helps where speed of trading decisions is important. But at the same time, trades still require constant monitoring and sometimes manual intervention since they imply risk and you may not only gain profit but also lose money.

Forex trading robots can be:

- Free. These are Forex robots that many traders have been using for a long time, so their code is open-source. Their effectiveness depends on your professionalism. You can also find copyright free Forex robots online. They are uploaded for testing purposes, so they may contain code errors.

- Paid. The cost is determined by the author: cheap ones cost 20-100 USD, while the price of unique software can reach 1,000 USD or more. Their disadvantage is that the developer does not guarantee the profitability of the Forex robot. Also there are often advisors sold on the market that can be found in the free version. But the developer makes minor changes to it and sells it.

This is the algorithm for developing a trading advisor:

- Develop a trading system. It must answer the following questions:

- What indicators are used in the system?

- What are the conditions for opening and closing trades?

- How is the trade volume calculated?

- What risk management methods should be used?

- Test the trading system manually.

- Write code.

An Expert Advisor is a program that performs the actions embedded in the code. The code is an algorithm that specifies what it must do when certain events occur. For example, opening a trade at the moment when the oscillator value is more than 80% or less than 20%. The code also specifies the conditions for closing trade, as well as the risk management and trading rules. You can specify any conditions for the advisor in the code — it all depends on the goals and imagination of the developer.

For the user, the advisor operation algorithm is as follows:

- Add the advisor to the trading platform and launch it.

- Enter settings.

- Monitor the work of the advisor.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.