In August 2020, gold updated its historical high, with investment yield amounting to nearly 46%. The coronavirus pandemic that began in January - February broke global economic relations: the quarantine decreased the developed countries' consumption levels, and GDP forecasts became more pessimistic.

Stock indexes reversed down: many investors started transferring money to protective tangible assets, gold industry being one of them. How does gold protect your investment portfolio? Why do gold investors trust this asset? How to gain exposure to gold industry and invest in the yellow metal? Read on to find out!

The article covers the following subjects:

Major takeaways

| Main Thesis | Insights and Key Points |

|---|---|

| Basics | Gold is traditionally viewed as a moderate-risk investment asset, serving as a money equivalent and universal payment. |

| Importance | Understanding how to invest in gold is crucial due to its role as a protective tangible asset during economic downturns. |

| What affect gold price | Factors like interest rates, inflation, GDP predictions, and global events influence gold prices. Ways to buy gold vary based on these factors. |

| Benefits | Investing in gold offers high liquidity, protection against economic crises, and potential long-term profitability. Ways to buy gold capitalize on these benefits |

| Ways to invest in gold | There are multiple ways to buy gold: physical gold, gold certificates, ETFs, CFD trading, and futures. Each has its pros and cons |

| Risk Management | Diversify investments, rebalance portfolios, and monitor fundamental factors to manage risks when deciding how to invest in gold. |

| Summary | Historically, gold remains a key to financial stability. Knowing ways to buy gold helps diversify and strengthen investment portfolios |

Why is gold important?

Gold (AU) is traditionally viewed as a moderate-risk investment asset. Unlike other assets, gold will never devalue for a few reasons:

It can serve as a money equivalent and a universal means of payment.

Its reserves are limited, and the industrial demand never fades out.

Global gold production and the gold price has been rising since the beginning of the '00s.

Some of the reasons for that are a switch to electronic exchange systems and investors’ easier online access to the markets.

How do gold markets operate?

There are market participants there: gold mining companies and refining companies, suppliers, jewelry stores, central banks, precious metals funds, commercial banks, depositories, stock exchanges, mutual funds, traders, and investors. Private persons, legal entities, investment and pension funds, etc., can act as traders and investors.

- You can trade owning physical gold or open an uncollated gold brokerage account. In the first case, it's gold bars, bullion coins, collectible coins, and gold jewelry that you're trading. In the second case, you don't take physical possession of gold bars, gold jewelry, gold coins (for example, Canadian Maple Leaf), etc.; instead, you own derivatives or securities linked to the price of physical gold. You don't physically store pure gold. Gold is traded in exchange and OTC markets. Gold's exchange ticker is XAU.

For more details, you can read our article "What affects gold’s prices? Exploring the Gold Market."

How is the price of gold determined?

Global physical gold prices are calculated in two markets:

The physical gold spot price is calculated in London. Twice a day on business days, the London Bullion Market Association (LBMA) establishes gold quotes (London Gold Fix). The quotes of the gold market's five biggest market makers — Bank of Nova Scotia–ScotiaMocatta, Barclays Bank Plc, Deutsche Bank AG, HSBC Bank USA, NA, and Societe Generale — serve as a basis of calculation. The Fixing system considers traders' orders and sets the XAUUSD's average price as those orders are gradually executed.

- Gold futures contracts’ price is calculated at NY commodity exchange — COMEX (CME Group).

Benefits of Investing in Gold

The advantage of gold investing is that traders are interested in this highly liquid asset at any stage of the market's fluctuation. It cannot devalue like particular stocks or currencies. Inversely, gold bars, gold jewelry, gold coins, etc. prices rise during hyperinflation, developed economies' crises, bankruptcies, wars, or pandemics. In the last century, there even existed the gold standard used for money emission.

Advantages of trading gold assets in Forex:

Moderate market volatility and high liquidity.

No portfolio risk of sharp depreciation.

Low entry threshold.

Long-term profitability exceeds a bank deposit's profitability.

Another advantage of buying gold is relatively easy price forecasting based on the price past performance. Gold quotes don't depend on particular economies. It's definite fundamental and business factors that drive them, such as interest rates, inflation, GDP predictions, the USD rate, the situation at the gold mines, cash flow, etc.

Five ways to invest in gold

There exist several ways of investing money in gold bullions, gold coins, etc. The difference between them is based on a few criteria:

1. The amount of investments:

Small sums can be invested in gold mutual funds' certificates, gold bank deposits, or gold bars. Buying gold jewelry and coins, whose price will be rising simultaneously with gold quotes and numismatic underlying value, is becoming more and more popular. You can also open a brokerage account with a Forex brokerage services.

- Large capital can be invested in overall stock markets: ETFs and mutual funds, gold futures trading , gold mining companies stock.

2. Ways to invest in gold

Directly — buying pure gold: buy gold bars, coins, gold jewelry. When investing money in gold widely circulated coins, one can make additional profits from growth in their numismatic value.

- Investing in gold indirectly - Making money from a difference in exchange rates: investing in securities, gold mutual funds, and CFDs.

Gold investment: pros and cons. How to invest in gold? Let's find it out.

1. Owning physical gold

When you buy physical gold you get direct exposure to gold. That means you buy physical gold for real, and then you can use it at your discretion: keep it at home, in a bank's safety deposit box, or use a safe storage option.

Benefits of trading gold bars and physical metal:

Psychological effect. Physical gold bullion seems to be a more reliable gold investment option compared to account figures.

Usability. Using things and personal ornaments made of gold is a part of everyday luxury. What's more, you can always trade your gold objects in or cover a part of their cost by pawning them at the price of scrap gold.

Cons:

Some banks can impose additional requirements on non-residents if they wish to buy pure gold.

Storage. You can store your gold in a bank, but what if the bank goes bankrupt? You can take it back only if you've been storing it in a safe deposit box. Keeping your gold at home can be risky too. First, you need to be sure that no one will steal your bars. Second, the yellow metal requires permanent care and special storage conditions to avoid oxidation.

Liquidity. You cannot sell gold in a few clicks without leaving your home, like securities.

Mobility. Transportation of physical gold outside the country is regulated by law, and the owner isn't often the one who benefits from that.

- Selling gold. You can easily sell gold bullion back to the bank that sold it. Other buyers may demand an examination. Some countries impose VAT when gold is sold. Total expenses may go up to 20-25% of the metal's value.

2. Gold certificates

In the USA, a "gold certificate" was a security issued by the US treasury until 1934. It used to prove the ownership of gold deposited with a bank. Nowadays, a "gold certificate" means an agreement between a lender and a borrower, under which the borrower (issuer) is obliged to pay back the borrowed money. The amount will depend on the rate of gold. A certificate owner does not own real gold or have the right to physical delivery and isn't secured against the issuer's bankruptcy.

A gold certificate can be compared to a bank deposit. Many investors put a money equivalent into their bank gold accounts but do not buy physical gold. Instead, they get the right to have the money returned with interest at a price valid upon the predetermined period's expiration. Disadvantages of gold deposits:

- High bank margin — around 8-10%;

- Risk of losing your deposit: the Deposit Insurance Fund does not secure gold deposits in case of bank bankruptcy in some countries.

3. Buying gold ETFs and mutual funds

An investor purchases shares of ETFs and mutual funds that make investments in the global market's gold physical assets. The SPDR Gold Shares ETF, iShares Gold Trust are example of such gold funds. That's the world's largest investment fund whose assets are 100% backed by its own gold.

An alternative to gold ETFs would be investing in gold mutual funds (such as Franklin Gold and Precious Metals Fund). Investors have to contact an asset management company and entrust their money to that company (mutual funds). Then they receive a certificate that grants them the right to have a deposit with interest income.

Pros:

To invest in mutual gold funds, one does not have to access a stock market directly.

- High liquidity of gold ETFs' shares.

Cons:

Entry threshold. To buy ETF gold stocks, one needs to have access to a stock market exchange, which incurs exchange fees, brokerage fees, and management fees. An investor must qualify as a "qualified investor."

Liquidity. In most cases, investing in mutual funds does not allow one to withdraw money earlier without paying early withdrawal fees. Also, an investor can lose both profits and capital if a mutual fund has turned out loss-making by the certificate expiry date.

Bankruptcy risk.

4. Gold CFD trading

A CFD stands for "contract for difference." It's an agreement between two parties to pay the difference between the quotes effective on the agreement's commencement and termination dates. Technically, it looks like the following: a trader from wherever in the world opens an account with a broker, has himself/herself verified, tops up the account, and opens trades to sell or buy assets. The broker earns a commission. CFDs are tied to XAU quotes. Just like in the case of certificates, the trader doesn't own real gold. Note that CFDs are complex trading instruments, and thus before using them and taking any investment decisions seek advisory or brokerage services.

Pros:

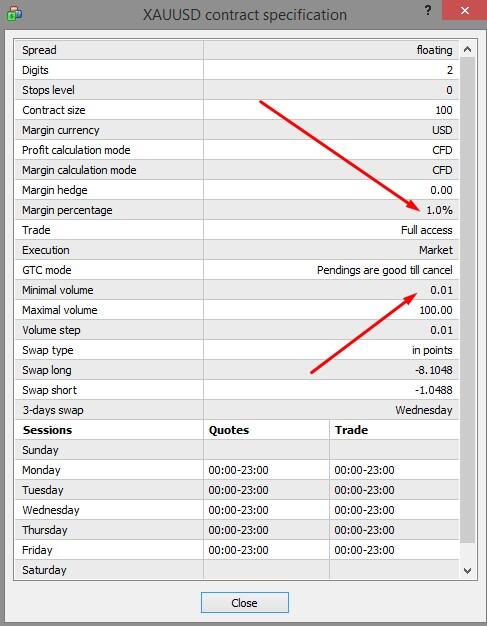

Low entry threshold. For example, the XAUUSD's contract terms at LiteFinance specify that the minimum trade volume is 0.01 lots, the margin size is 1%, and leverage is 1:100. One lot size is 100 units.

If the XAUUSD costs 1,730 USD, to buy the minimum volume of 0.01 lots, you will need as little as 17.30 USD (1,730*100*0.01*0.01), which is less than the minimum deposit of 50 USD.

Lowest fees. There aren't any stock exchange fees. There are only spreads, swaps, and a small fee per each lot traded in an ECN-account.

The opportunity of opening a short position. With a Forex broker, you can earn from investing in CFDs on XAU even if the price of gold falls.

1:100 Leverage. Stock market brokers’ leverage does not usually exceed 1:10.

You do not have to be a "qualified investor."

Cons:

Low volatility makes this type of gold investment inappropriate to scalping and short-term strategies.

As you have to use bigger leverage and increase trade volumes, this kind of gold investment is associated with bigger risks compared to currency pairs.

You can open trades in the XAUUSD free and without registration right now! Click on "For beginners" - "Open a demo account" in the menu bar on top of LiteFinance's site. Then click on "Trade" and choose the XAUUSD in the "Precious Metals" tab in the left menu.

5. Gold futures and options trading

Gold futures trading and options trading is similar to CFD gold trading: a trader opens an account with a broker, has himself/herself verified through QUIK, Thinkorswim, or any other platform of that kind, and sends a broker orders to open trades. The difference is that the trader becomes the real owner of securities registered by a depositary. Gold can be delivered only under the terms of commodity futures contracts, but non-deliverable gold futures are even more interesting to private traders.

Pros:

Guarantees. Regulators and stock exchanges strictly control stock brokers. The purchased securities are automatically registered with a depositary.

Cons:

High entry threshold. To buy the minimum lot and pay commissions, at least 1,000 USD is required. Non-U.S. citizens will need a sub-broker authorized to work with US brokers to trade gold in the US stock markets.

Complexity. Futures and options are derivative financial instruments. Their terms of use are more complicated than those of CFDs or exchange-traded funds, so traders should understand the specifications well.

Limited choice of securities if one is not a "qualified investor."

5 Ways comparison table

I made a table to compare all the above-mentioned cons and pros.

Investing advantages | Investing disadvantages | |

Physical gold |

|

|

Gold certificates |

|

|

ETF gold |

|

|

Gold CFD trading |

|

|

Futures and options |

|

|

How to manage risks when trading gold?

There are several ways to cut risks:

Diversification. Investing in such assets inversely correlated to gold as gold mining stocks, indexes, treasury bonds, deposits. The Gold price's fall is covered by stock assets' growth. Conversely, stock assets' fall will be partially covered by growth in the XAUUSD's quotes.

Periodic portfolio rebalancing. For example, reducing loss-making assets' share in favor of more profitable assets.

Fundamental factors control: macroeconomic statistics, currency rates, stock markets' quotes, supply and demand in the gold market, inflation, global GDP predictions, geopolitical arena, etc. Control correlated markets too.

And the main gold investment advice for long-term traders would be the following: don't rush to get rid of your gold investment when the price of gold goes down. History says that quotes' moves are wavy. That means the precious metals will grow to new highs after a fall.

Gold investments Summary

Historically, gold has been subconsciously viewed as a key to financial stability. The US dollar is just a piece of paper that people trust. It can be printed in whatever quantities and increase the national debt. Greece and Cyprus have already shown how "reliable" state bonds can be. Hypothetically, if a global crisis occurs and the major currencies hyper-inflate, they will devalue compared to gold because it's gold that remains the world's safe-haven asset.

Who can be interested in gold investments:

Active investors who want to diversify risks and balance investment portfolios.

Conservative investors. The precious metal is less volatile than stock assets or cryptos. Despite some periods of declining gold prices, gold will always trend up in the long term, compared to currencies. Inflation explains that.

Investors who can afford to freeze their spare money for at least ten years.

What do you think: is buying gold for five, ten, or fifteen years a promising strategy? Let's discuss that in the comments section. Also, feel free to ask any questions on investing or trading in the comments section. Open a demo account and have a go at conducting your first trades! Believe in yourself, and you'll get everything you want!

Investing in gold FAQ

Yes, it is a good investment. Advantages of gold investments:

- Gold protects your investment when global economic crises occur.

- Compared to other precious and semiprecious metals, gold is the most liquid.

- It's a reliable financial instrument. Historically, gold used to back up money and continues doing that psychologically.

- The asset isn't tied to a particular country's economy. It belongs to central banks' reserves used to support a country's financial system and realized in domestic markets. Gold reserves back up national currencies.

- Gold mining reserves are limited, and the price depends on the demand for physical gold as a commodity.

- The main participants on the gold market include: gold mining companies, central banks, streaming and royalty companies, gold dealers, private dealers, producers (such as Barrick gold), gold mutual funds and etfs, regulatory bodies (such as world gold council), online retailers (such as JM bullion) and more.

1. Diversification of investment portfolio. Gold’s prices rise when stock indexes and global GDP fall, and the loss is this covered.

2. Gold quotes are unlikely to collapse. The price is supported by industrial demand and central banks.

3. Compared to currencies, gold is less dependent on speculative fluctuations and is almost always up in the long term.

It depends on the investment amount and term:

1. "Little money", "Long term":

- Gold deposit account — you don't have to pay margin and fees, and you earn interest.

- Buy gold bars. Selling them later can be not easy.

3. "Little money," "Short term": you'd better pick a different liquid asset.

4. "Lots of money," "Short term": Certificates of short-term investment funds.

- "Speculation" Open an account with a Forex broker and earn from CFD gold trading when gold prices rise or fall.

Yes, when you buy gold you can profit. From 2000 to 2020, the gold price grew from 280-290 USD to 1,500-1,600 USD, which makes 517% or over 25% per annum.

Gold investment can be unprofitable in a few cases:

- You make a short-term investment for a few months. The yellow metal gets cheaper in crisis times, and you risk facing a temporary drawdown in the short term.

- You purchase gold bullion. Physical gold's margin may go up to 25% plus some countries' taxes. There are also some issues related to certification or oxidation, caused by improper storage, which can arise when selling physical gold.

- You don't invest in real gold but in gold mining companies’ shares. Gold won't devalue, but gold stocks will turn to paper if a gold mining company goes bankrupt.

The portfolio diversification theory suggests holding 10%-15% of your investment in gold. The value is subject to your profitability goals and risk levels. Rebalance your portfolio from time to time: invest in more gold if its price is expected to be growing. The optimal investment period is 5-15 years.

If you are looking for the best way to buy gold, here are some of them.

1. Ways to invest in gold:

Buying physical gold:

- Buying bars;

- Buying gold jewelry and bullion coins;

- Opening a gold account (unallocated gold accounts). You don't take physical possession of gold, but it is stored in a bank account. If the gold price grows, you earn interest on your gold deposit.

3. Buying certificates of the funds that invest in gold assets.

4. Forex trading: buying and selling gold CFDs.

You need a broker to invest in ETF gold mining stocks or futures contracts in the stock market. The entry threshold can be 1,000 USD at least as there are minimum trade volume requirements and commissions. An alternative option could be to buy gold CFDs in the Forex market. You don't have to be a qualified investor there. The entry threshold is just 50-100 USD, and you can use leverage and earn from price fluctuations in either direction.

To invest in gold stocks, follow the steps below:

1. Pick a broker that has access to the real stock market. Check trading conditions, such as minimum trade volume and the broker's or stock exchange fees.

2. Top up the account.

3. Open a trade.

You can buy:

- Gold futures;

- Shares in an exchange-traded fund investing in metals;

- Gold mining companies shares.

Find a broker to purchase gold online. Only brokers have access to stock markets and OTC markets when one invests in gold, paper gold, or gold CFDs. So, to make long-term investments in securities and profit from rising prices of gold, one will need a broker. Short and long positions in gold CFDs can be opened through a Forex broker.

Gold quotes started growing in the 00s. Since then, gold has grown by over 500%. The deepest drawdown was in 2013-2019, but in mid-2020, gold updated its historic peak.

When investing in the short term, you may face a drawdown from a few weeks to a few months. In the long term of 10-15 years, gold's average profitability exceeds inflation levels and other assets' profitability. So, long-term gold investments are profitable. To conduct your wealth management, check the XAU/USD chart on LiteFinance's platform and buy gold!

P.S. Did you like my article? Share it in social networks: it will be the best "thank you" :)

Ask me questions and comment below. I'll be glad to answer your questions and give necessary explanations.

Useful links:

- I recommend trying to trade with a reliable broker here. The system allows you to trade by yourself or copy successful traders from all across the globe.

- Use my promo code BLOG for getting deposit bonus 50% on LiteFinance platform. Just enter this code in the appropriate field while depositing your trading account.

- Telegram chat for traders: https://t.me/litefinancebrokerchat. We are sharing the signals and trading experience.

- Telegram channel with high-quality analytics, Forex reviews, training articles, and other useful things for traders https://t.me/litefinance

Price chart of XAUUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.