In order to trade and earn money on Forex, you need to have your own Forex trading account with real money. On today's Forex markets, almost all well-known Forex brokers and trading platforms offer their clients a wide range of accounts. Each type of account is suitable for solving a particular problem. Opening a trading account is now so easy that it only takes a minute and anyone can do it regardless of their computer skills.

The article covers the following subjects:

Major takeaways

| Main Thesis | Insights and Key Points |

|---|---|

| What is Forex account | A Forex account allows individuals to participate in the Forex market. It's essential for trading and earning money on Forex |

| Types: | The article discusses various forex account types: Standard, Demo, Mini, Micro, Cent, ECN, STP, PAMM, MAM, Copy Trading, and Swap Free |

| Which account type is best for beginners | The Forex demo account is ideal for beginners. It mirrors real conditions but uses virtual money, ensuring no risk to the forex account holder's real funds |

| How to choose: | Choosing the right forex account depends on individual needs. Factors include risk tolerance, deposit amount, trading experience, and desired features |

| Comparison: | Each forex account type has its advantages and disadvantages. For instance, Standard accounts offer high leverage, while ECN accounts provide interbank trading. |

Standard Trading Accounts

Standard Forex retail investor accounts were the most popular type of trading account a few years ago. You can often see another name for this type of account — CLASSIC. My broker LiteFinance lists the standard account type as Classic.

Although this account type is no longer as popular as it used to be, Forex traders still use it as it often has a fixed spread.

The advantages of these retail investor accounts include:

Higher quote accuracy;

Market execution of orders;

No requotes;

No Stop or Limit levels;

High leverage up to 1:1,000;

- Low minimum deposit of $50.

The disadvantages of a standard account should also be mentioned:

Some brokers and trading platforms don’t bring positions the interbank market in this type of account; in this case, the broket itself is often the counterparty to your transaction;

High spreads;

No accumulative annual rate;

Possible delays in the execution of orders.

LiteFinance has a classic account with competitive spreads and fast execution. If the trading conditions for this account type look attractive to you, you can find out more and open it here.

Demo account

Forex demo account is the most popular account for learning how to work on the Forex market. This account is completely identical to standard retail investor accounts in terms of the conditions, but in contrast, to a live account, it uses virtual money for trading Forex. In other words, with demo trade, you risk nothing, and in case of failure, you can always top up the balance again and again.

The advantages of a demo retail investor accounts include:

Real quotes from a liquidity provider;

Scalping and market news trading are allowed;

No requotes;

There are no restrictions on the duration of the position;

Full access to all trading instruments, including complex instruments such as CFDs;

No risk of losing real money;

- Ideal for trading strategy testing and learning.

There are not many disadvantages of this account:

You cannot withdraw the earned profit;

- When trading Forex and other financial instruments, there is no emotional pressure, the investor does not experience stress as on the real market.

If the trading conditions for this account type look attractive to you, you can find out more and open it here.

Also, I recently wrote a large review article on the use of a demo account, and you can read it here.

Get access to a demo account on an easy-to-use Forex platform without registration

Mini account

Forex mini account is a special type of Forex trading account that uses a deposit reduced by 10 times with standard Forex trading conditions. In other words, if you deposit only $100 to this account, you will see an amount of 1,000 currency units in the trading terminal. When working on such Forex trading accounts, 1 currency trading lot costs 10,000 instead of 100,000 and is called a mini lot.

The advantages of this account are as follows:

It allows you to gradually get used to Forex trading with real money;

Your risk warning is 10 times less;

There are no significant differences in the execution of transactions as compared to other types of Forex trading accounts;

Well suited for testing the trading platforms’ conditions;

- Often used by experienced traders in the PAMM system to demonstrate the yield curve.

The disadvantages of such accounts are as follows:

Broker orders are executed last;

Sometimes trading platforms don’t bring the trades to the interbank market;

Possible delays in the execution of orders;

Not suitable for short-term positions.

Micro account

Micro Forex account is a special type of trading account which uses a deposit reduced by 100 times with standard trading conditions. In other words, if you deposit only $10 to this Forex trading account, you will see an amount of 1,000 currency units in the trading terminal. When working on such accounts, 1 currency trading lot size is 1,000 instead of 100,000 and is called a micro lot.

The advantages of the micro trading account are as follows:

It allows you to get used to trading real money with minimal conditions;

Your risk warning is 100 times less;

There are no significant changes in the execution of transactions as compared to other account types;

Well suited for testing the broker’s conditions;

Often used by Forex traders in the PAMM system to demonstrate the yield curve;

Often used for testing strategies instead of demo accounts.

The disadvantages of such accounts are as follows:

Broker orders are executed last;

Sometimes the broker doesn’t bring the trades to the interbank market;

Possible delays in the execution of orders;

Switching to a standard lot can be emotionally difficult.

Cent account

Forex cent account is a special type of trading account which uses a deposit reduced by 1,000 times with standard trading conditions. Cent accounts are also called NANO accounts. In other words, if you deposit only $10, you will see an amount of 10,000 currency units in the Forex trading terminal. When working on such accounts, 1 lot of currency costs 100 instead of 100,000.trading accounts.

The advantages of this account are as follows:

You can trade all lots: nano, micro, and mini;

Your risk warning is 1,000 times less;

There are no significant differences in the execution of transactions as compared to other account types;

The most popular account in the PAMM system for demonstrating the yield curve;

Often used for testing strategies instead of demo accounts;

Ideal for those who want to skip demo trading;

Suitable for testing new trading instruments and trading CFDs;

Often used to test trading robots.

The disadvantages associated with these account types are as follows:

Broker orders are executed last;

Sometimes the broker doesn’t bring the trades to the interbank market;

Possible delays in the execution of orders;

Profit not worth the time.

In general, all types of Forex accounts from mini to nano are just a way to reduce the initial deposit and high risk when trading. The names of these accounts correspond to the standard designation of fractional lots.

These types of Forex trading accounts are not very suitable for professional trading, since the main obstacle in trading is the emotional stress, and these accounts artificially lower it. These accounts do not make good money, and they are all good for practice only.

If your goal is to earn money, all the conditions of a fractional lot are also provided by standard ECN. On it you can trade both mini and micro lots.

You can read in detail about the lot in foreign exchange trading in this useful article, where the lot for trading CFDs or currencies is presented as an international designation rather than a fantasy of a private broker.

If you are interested in foreign currency trading on a cent account type, you can try it yourself by clicking here.

Forex ECN accounts

ECN is currently the most popular type of trading account and is suitable for absolutely any investor (including a Forex trader) regardless of their goals. An ECN account is the real choice for professionals and those who want to achieve perfect order execution and price accuracy. With ECN you are trading on the interbank market, thus completely eliminating the broker from the process. The recommended deposit starts from $500.

The advantages of ECN accounts are:

Guaranteed entry to the interbank market;

Highest quotation accuracy;

Instant order execution and no requotes;

The ability to trade lots: 0.01, 0.1 and 1;

Maximum leverage from 1:1 to 1:500;

Minimal (sometimes zero) spreads;

Ideal for scalping;

The possibility of accruing annual interest up to 2.5% in the account currency;

Minimum deposit of $50;

The ability to trade without leverage.

Despite the impressive list of advantages, there are also disadvantages:

Possible slippage;

Spread may widen as volatility rises;

Brokers often set a large initial deposit.

ECN accounts use the NDD or STP trading model, which means that your broker has dedicated servers. And for a trader, working on ECN implies the knowledge and skills that you can get by reading this article.

If you are interested in trading on an ECN account, you can register and start trading by clicking here.

Start trading with a trustworthy broker

STP accounts

STP is for Straight Through Processing. An STP account is an account that transfers your orders directly to a liquidity provider that is a partner of your broker.

Usually a bank or several banks act as a liquidity provider, each offering its own price. The price closest to the client's order appears in the trading terminal.

The advantages of STP accounts are as follows:

Guaranteed entry to the interbank market;

Highest quotation accuracy;

Instant order execution and no requotes;

The ability to trade lots: 0.01, 0.1 and 1;

Leverage from 1:1 to 1:500;

Minimum spreads;

Best price guarantee;

Typically multiple partners;

The minimum deposit can start from $10.

Despite the advantages, there are also disadvantages:

Possible slippage;

Possible partial slippage of pending orders.

PAMM Forex accounts

PAMM accounts are special Forex accounts types created for investing. A PAMM account Forex is one of the first ways to invest on the Forex market if you don't have the knowledge and time to trade.

PAMM accounts involve trust Forex account management on behalf of the investor. But at the same time, there is no transfer of money, and the Forex account money manager does not control the distribution of profits to investors. Your personal trading account is simply linked to the trader's trading account and trading takes place. The private investor only sees the final result and cannot evaluate the trading process itself.

The advantages of this type of account are as follows:

The speculator who manages money on a PAMM account does not have access to investors' money;

The investor risks only the amount that they transfer to the PAMM account.

The trader does all the work, and the investor just gets the result;

Low entry threshold and the ability to work on mini-accounts;

Adjustable loss system, when the investor determines the threshold.

This account type also has disadvantages:

The investor does not understand the trading process, but only sees the result;

The money on the PAMM trading accounts is frozen, and the investor does not have access to it;

Sometimes experienced traders create favourable statistics on micro-accounts, attracting investments that are 100 times or more higher than the trader's own assets;

Forex managed account — MAM (Multi Account Manager)

MAM trading accounts or Multi Account Manager is a special type of account money manager created for investing. The MAM managed accounts differs from the PAMM account in that it allows the investor to intervene in the trading process. In other words, the investor can see the trader's process and close the positions if they believe it’s the right thing to do. They are also called Forex managed accounts.

The advantages of the managed accounts in Forex are as follows:

The managing trader on the MAM account does not have access to investors' money;

The investor risks only the amount that they transfer to the MAM account;

The investor can close the trader's positions at their own discretion;

Low entry threshold and the ability to work on mini-accounts;

Adjustable loss system, when the investor determines the threshold;

Possibility to open additional trades on the MAM account.

The disadvantages of this type of account are as follows:

By interfering, the investor can disturb the trader's strategy, which can lead to losses;

Additional trades opened by the investor may overload the account, which will prevent the opening of a trade;

- Sometimes experienced traders create favourable statistics on micro-accounts, attracting investments that are 100 times or more higher than the trader's own assets, which is a high risk for an investor without trading experience.

Copy trading accounts

Social Trading, or a copy trading system, is currently the most advanced and safe way to earn income from trading, both for the trader and for the investor.

The main feature of copy trading that differs from any other system is the easy copying of the positions of any investor you like. In this system, the investor has full control over their account.

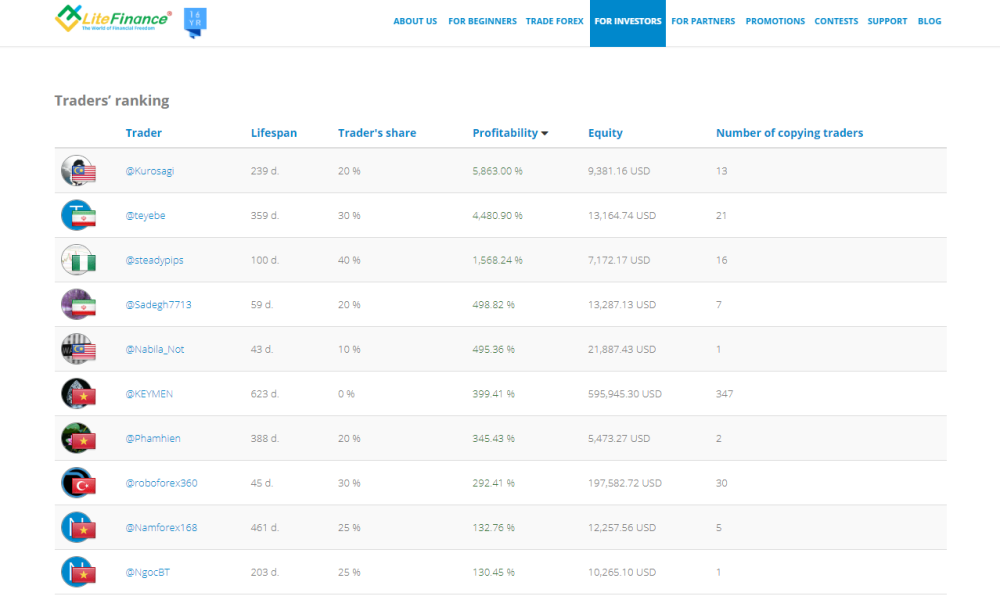

The system provides a ranking of traders, which are compared according to several key parameters: profitability, amount of own funds, duration of work, share for management and risk management of trading.

Advantages of the copy trading system:

This type of account does not create any additional burden on the trader whatsoever;

Investor has complete independence;

Investor has full control over the account;

You can copy part of the trader’s volume;

You can understand the trader's trading system;

The trader can earn additional income;

No need to create additional accounts.

Disadvantages of the copy trading system:

Excessive investor’s control, which often affects the result for both the trader and the investor;

It is difficult for a trader to rise in the ranking if the account was created recently.

Investor account

In order to become an investor in the copy trading system, you just need to choose the trader that suits you and copy their trades.

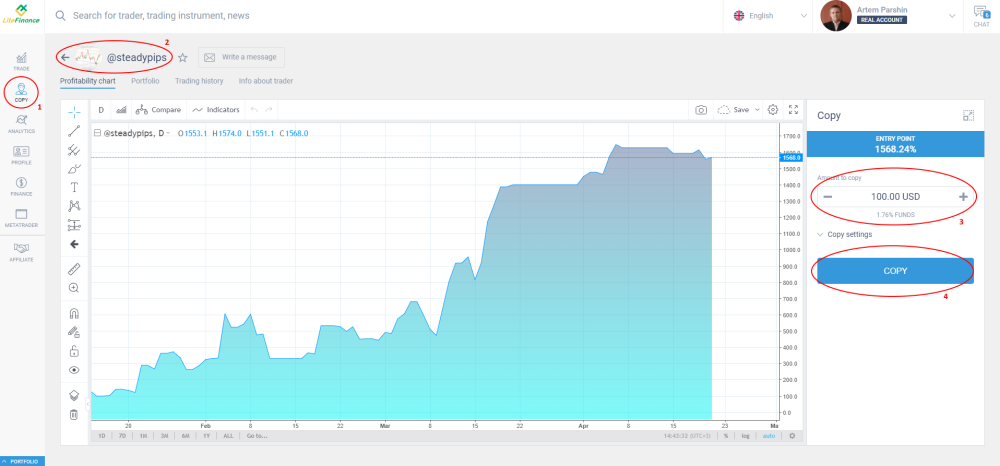

To start copying trades of successful traders, you need to register a personal cabinet on the broker's website, create a trading account, and go to the Copy tab.

Then you need to choose a trader that best suits your expected return and risk warning criteria, after which you need to go to this trader’s page.

In the window that opens, you will see a yield chart, and on the panel on the right, copy settings will become available. The first thing you need to do there is set the amount for copying the trades of this trader.

After setting up all the parameters, click on the “Copy” button.

After that, as soon as the trader opens a new position, it will automatically open on your account, and copying will begin.

Copy trading is a new investment approach

You can start your Forex journey with profits even if you haven't got any trading experience yet. Copy professional traders’ operations onto your accounts.

Trader account

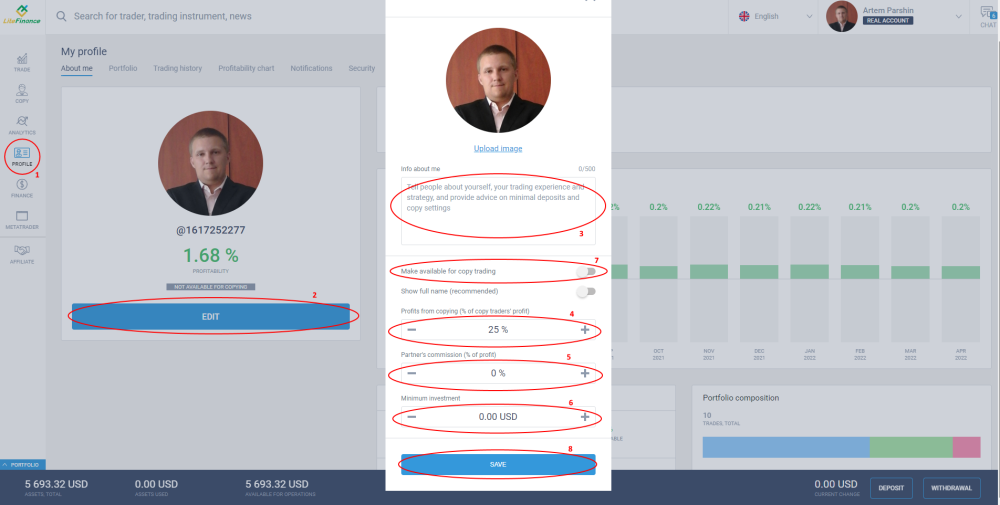

In order to become a trader in the copy trading system, you just need to register a personal account with the broker and make a deposit. Naturally, you also need to have a working strategy.

Once your account is ready, click on the “Trade” tab on the main panel.

In the opening window of your profile, click on the “Edit” button.

In the window that opens, you need to fill in the information that will help the investor choose you.

Next, you need to set the percentage that you will receive from investor’s profitable trades.

If you have partners, set the percentage of the partner's income as well.

Next, set the minimum deposit amount to copy your trades. When setting this option, keep in mind that often copyers are newbies who do not always understand the intricacies of copying.

After setting the parameters, move the slider to the right in the column “Make available for copying”.

Finally, click the “Save” button.

After saving the parameters, your account will appear in the traders’ ranking, and investors will be able to copy your trades. You will receive additional income in addition to your own profit as a percentage of the profits of investors copying you. This is a very good way for professional traders to increase their income on Forex. However, to limit your risks and avoid losing money rapidly, it’s advisable to be aware of various trading tools from technical analysis.

Platform where traders earn more

Trade on LiteFinance’s high-tech ECN platform and open an account so that beginner traders can copy you. Earn a commission for copy trading and boost your income.

Forex swap free account

Swap-free Forex trading accounts are accounts that have no overnight fee. These accounts are often referred to as Islamic accounts and are suitable for clients who wish to follow the principles of their religion.

Islamic swap free accounts don’t have any commission in the form of interest, since according to the laws of Islam, Muslims are prohibited from receiving income in the form of interest. These accounts were created specifically for them.

Now, anyone can open a Forex swap-free account, but to do this you need to submit a special application to your broker or trading platform.

Conclusion

To sum up, there are many different types of accounts on today’s Forex market. The trader has complete freedom to choose how and what to trade. However, when choosing an account, you should ask yourself a few simple questions: Do I have sufficient knowledge of how the Forex market works? How much do I want to earn? How long am I willing to wait for my results? What level of risk am I willing to accept? When you’ve answered these questions, you will see clearly what the ideal type of account is for you.

As for me, I believe that an ECN account is the ideal choice for any trader. These accounts allow you to start with a small amount of capital and eliminate the role of a broker in your trading, thus avoiding unnecessary high risk in the event that a broker provides dishonest services.

Forex account types FAQs

A Forex account, or a regular Forex trading account, is a special account that is created in your broker's personal cabinet. After depositing funds to it, the client gets access to trading on the international currency market.

Forex account type is a system for evaluating the parameters of a trading account, which allows the client to choose the best account option for them in order to trade and earn on the Forex market. Different Forex account types have different options and serve various goals.

To open a Forex trading account, you need to register on the page of the chosen broker and open a trading account of the type you have selected, in your personal cabinet. Usually the link to open an account is located on the main page of the broker's website.

A Forex demo account is a way to learn how to trade on the Forex market with absolutely no risk. Trading on a demo account is useful for traders to learn how to work on the exchange and in the trading terminal without risking their money. In other words, this is the perfect practice account.

A Forex cent account is a way to take your first steps in trading with real money while risking an insignificant amount of 10 - 20 dollars. Cent accounts are convenient for testing trading strategies on real money and as a transitional stage from a demo to a real account.

A trading account is an account opened in the name of a client with a brokerage company, where the client's real money is stored, which is necessary for making transactions for buying and selling trading instruments. There are different types of accounts available for traders, such as raw spread accounts, demo accounts, swap free accounts, standard accounts, etc.

The main difference between a micro or mini Forex account and a standard account ECN or Classic trading account is that a reduced volume system is used when trading on mini and micro account. The mini account uses 10% of the real volume and the micro account uses 1% of the real volume.

The type of account depends on the trader’s goals and objectives. When choosing an account, you should focus on the amount you want to earn and your trading strategy. If the goal is to earn a lot, mini and micro accounts will not work. In general, an ECN account is a perfect choice.

It is best for beginner traders to train in several stages. The first step is to start working on a demo account, where you don’t risk losing capital. After the demo, you can switch to a cent account, and when you have a profitable system, open an ECN or Classic account.

A client of a modern Forex brokerage company can have an unlimited number of trading accounts. Moreover, you can create trading accounts of different types and trade on them simultaneously on multiple devices.

STP stands for Straight Through Processing. In simple terms, an STP account means direct transfer of your order to a liquidity provider that is a partner of your broker, usually a bank or several banks.

ECN is a type of trading account that allows you to trade on the market using an electronic trading system that eliminates the role of an intermediary. ECN trading is carried out through an ECN broker, which enters the transactions of its clients into the system for a small commission.

You don't need any money to open a Forex account. The process of opening a trading account is free. You make a deposit after its opening and at your discretion. There are accounts where you don’t need to deposit any real money at all - demo accounts.

This is a type of account that does not charge a swap, i.e. it doesn’t have a commission in the form of interest. They are often called swap free accounts. You can open Islamic accounts by sending an application to your broker.

Usually there is no need to close a Forex trading account, since you don’t have any obligations towards it. However, if you want to delete your trading account, you can apply to your broker through your personal cabinet and the broker will close your account.

ECN and STP are very similar. In both cases, the transaction goes directly to the counterparty. The only thing that differs is that when trading on an ECN account, all participants in the ECN system act as a counterparty, while when trading on an STP, the counterparty is a bank or several banks.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.