Many people associate silver and gold with investing. It seems that investing in stable and hard precious metals is guaranteed to bring returns and provide better capital protection, unlike more volatile currencies or stocks.

Despite the arguments in favor, such as industrial demand for metals and the regular increase in their value during periods of inflation, this investment asset is no different in terms of risks. Investing in silver is not limited to stock trading, but its pricing does have peculiarities. This article will explain how to trade silver, invest in the precious metal, and increase the efficiency of your investments.

The article covers the following subjects:

- What is silver?

- Should I Trade in Silver?

- Silver Futures Markets

- How to Trade Silver

- Silver trading hours

- Silver trading Pros and Cons

- Silver trading best strategy

- Day Trading Silver

- Silver vs. Gold

- When to buy Silver

- Methods Compared: Trading vs Investing

- Choosing the right broker for Silver trading

- XAGUSD trading FAQs

What is silver?

Silver is a noble metal that was previously used for the manufacturing of coins. Even now, people talk of silver and gold claiming to be reserve currency. Currently, silver is valued in industry for malleability and ductility, and in jewelry, among other things, for easy maintenance. The metal is used not only for production, but also for investment purposes. It is traded on the stock exchange in troy ounces - one ounce is approximately 31.1 grams.

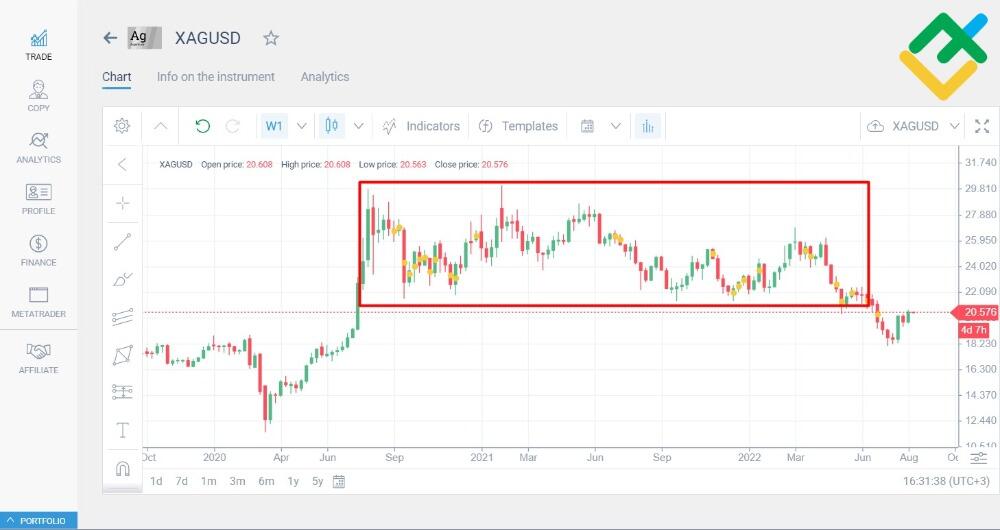

From the point of view of technical analysis, since mid-2020, the metal has been in a flat between $21.21 and $29.78, from which a downward movement occurred in June 2022.

The most common types of investments in silver are:

coins;

bars;

shares of silver mining companies;

unallocated bullion account;

investing in silver exchange-traded funds (ETFs);

derivative instruments (for example, futures or options);

spot contract (purchase of silver on the exchange).

Largest producers of silver

On the global silver market, the largest volumes are mined by:

Mexico (about 6,000 tons per year). About 200 silver mines are used for mining in the country;

Peru (about 4,300 tons per year). The largest silver production is the Antamina mine, which produces primarily copper rather than silver;

China (about 3,500 tons per year). The largest producer in the country is Silvercorp Metals;

Poland (about 1300 tons per year). It is second in the world in terms of the number of explored deposits, along with Australia.

The largest players on the silver market are the following companies:

1. Industrias Penoles SAB de CV:

revenue: ~ $4.2 billion for 2021;

market capitalization: $6.5 billion.

Based in Mexico. It also produces sodium sulfate, gold, zinc, and lead.

2. Polymetal International PLC:

revenue (TTM): $2.25 billion for 2021;

market capitalization: $11.8 billion for 2021

This Russian company also mines copper and gold.

3. Fresnillo PLC:

revenue (TTM): $2.2 billion for 2021;

market capitalization: $12.5 billion for 2021

This company mines silver in such Mexican states as Sonora and Durango. It also has subsidiaries in South and North America.

4. Pan American Silver Corp.:

revenue (TTM): $1.41 billion for 2021;

market capitalization: $8.1 billion for 2021

This Canadian company has mines in Argentina, Bolivia, Mexico and Peru. The explored reserves of silver will be sufficient for about 30 years at the current rate of production.

Should I Trade in Silver?

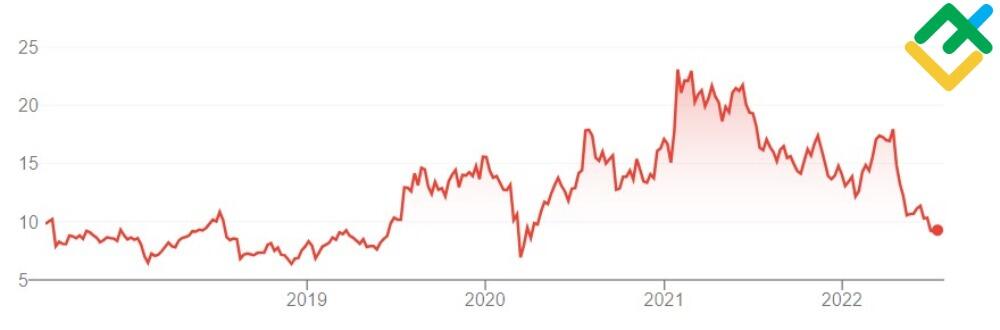

Compared to the most precious metals like platinum, palladium, and gold, silver has the lowest price per troy ounce at around $20.26. For example, 10,000 ounces of palladium cost about $2,200, which is equivalent to about a million ounces of silver. This makes it attractive and accessible to a wide range of investors, including beginners and traders with modest capital.

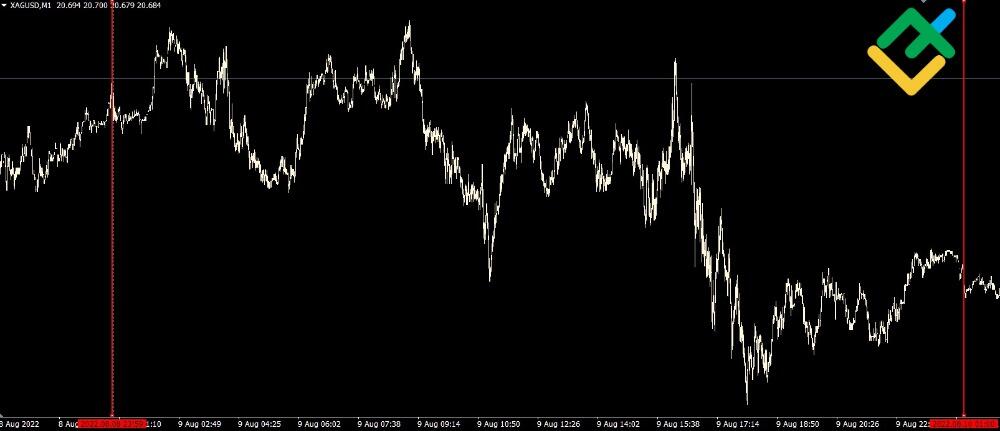

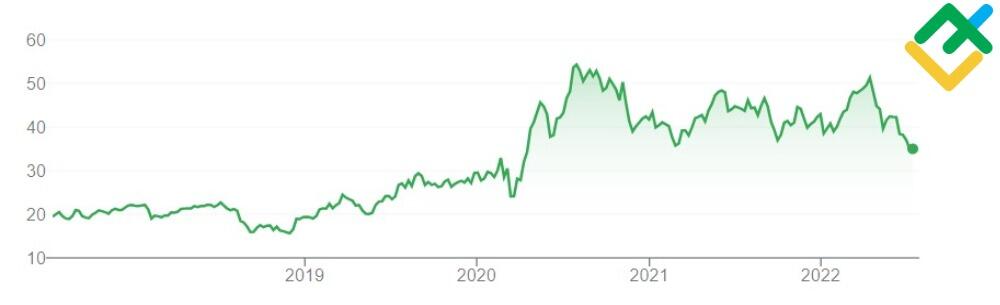

Palladium chart:

Unlike buying real silver, investing in silver-related instruments comes at a lower cost: a lower bid/ask price and fewer commissions with lower rates. The second advantage is the freedom to choose the investment horizon. Buying physical silver makes little sense in the short to medium term, while futures, options or CFDs on silver can provide good returns.

Plus, silver instruments are more liquid than physical silver, since you can sell your futures on almost any exchange.

Silver Futures Markets

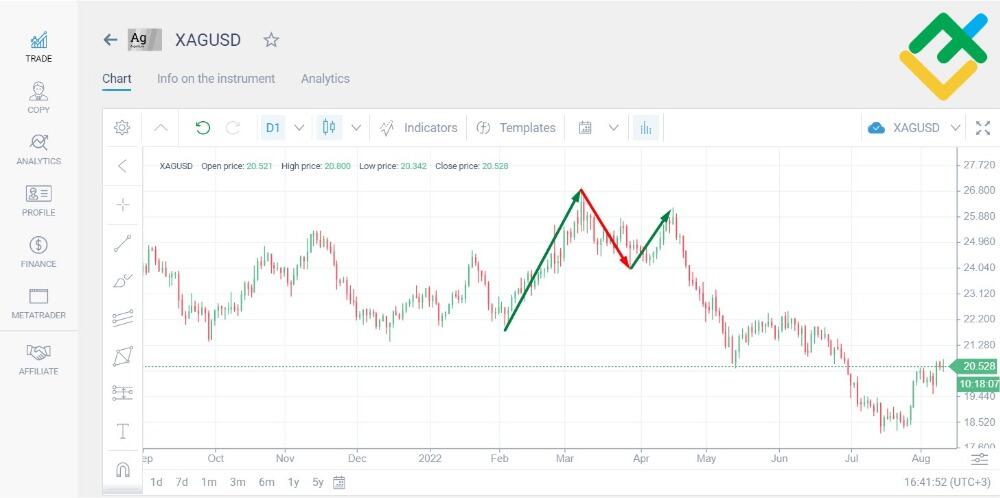

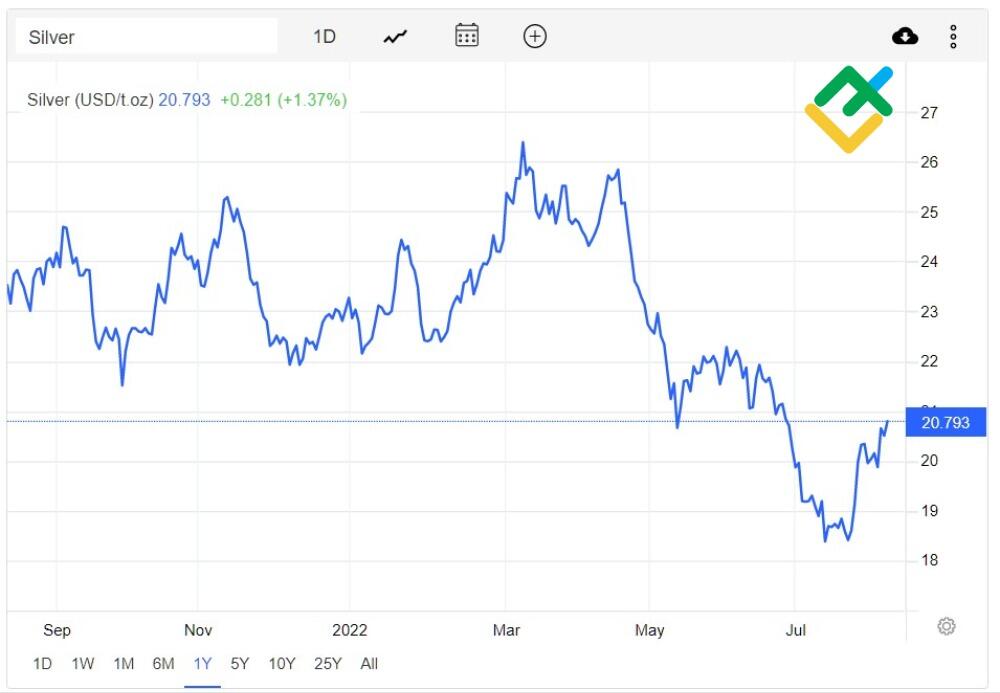

Against the backdrop of political tensions in the world, in February 2022, the silver futures contract showed a steady increase from $22. On March 8, it reached a peak value of $27.49 per contract, after which it began to decline - the Fed raised interest rates by 25 basis points. By the end of the month, the silver contract dipped to $23.92, but rose to $26.2 by mid-April:

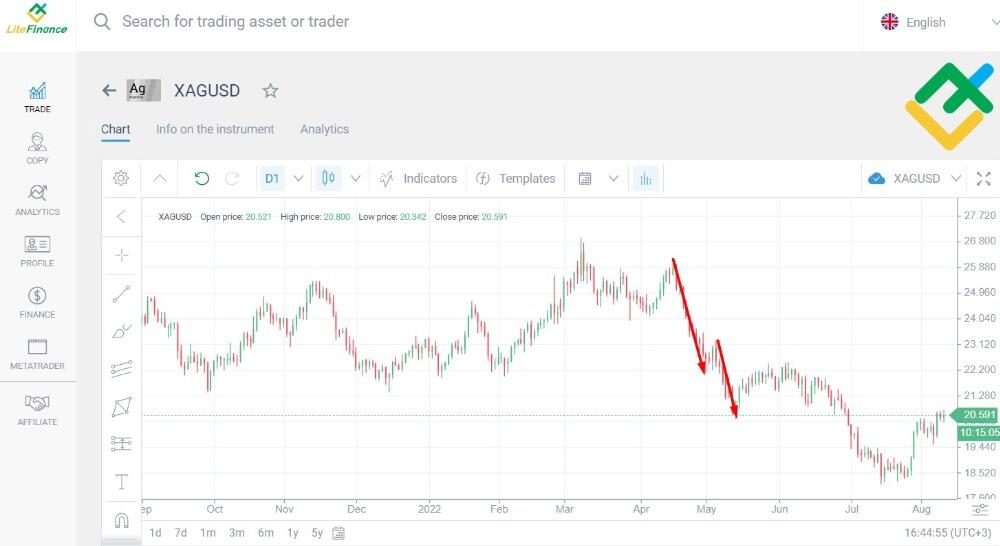

By May 4, 2022, silver had lost about 23% due to the expectation and then the actual rate hike by the Fed by a record 50 basis points. By May 13, the contract hit a low of $20.42:

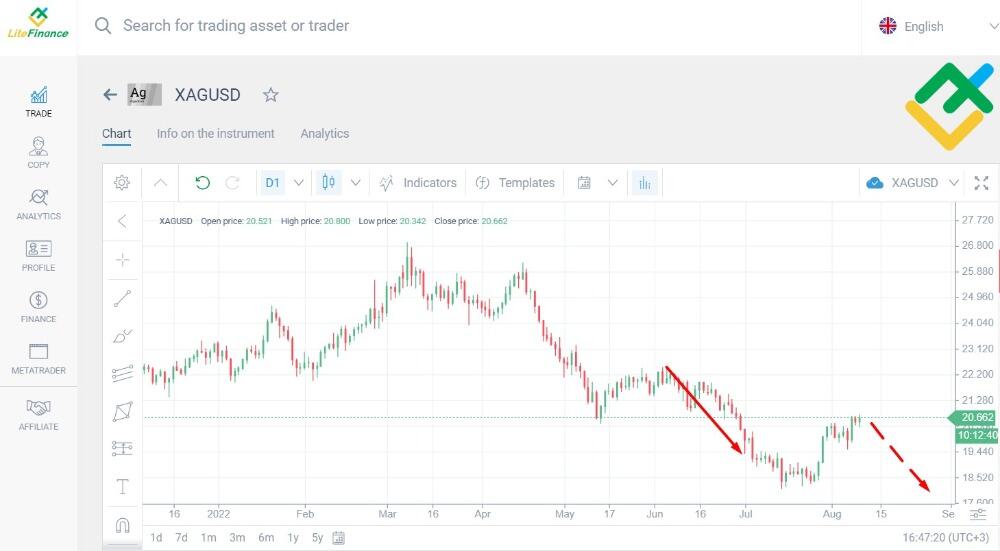

Another record rate increase, this time by 75 basis points, occurred on June 15. The last time the rate was increased this much was in 1994. From that moment, the price of silver futures began another decline from $21.97. By June 30, 2022, the contract was worth around $20.35.

The decline is expected to continue in the coming months. However, in 2022, a record increase in industrial production of silver is expected - 8% compared to last year. The demand for finished products, mainly electronics, is also expected to increase.

How to Trade Silver

First, you need to select the trading instrument: spot, futures, options, or some other. Based on this, choose a broker that provides access to the market where the selected instrument is traded. For example, futures are exclusively an exchange instrument, while contracts for difference (CFDs) are traded on Forex.

Before signing up, pay attention to the cost of service. For a trader with a small deposit, the cheapest one will do best. If your funds allow, choose the broker with the highest order execution speed. In addition to commissions, find out about the spread. It should be minimal to avoid a negative impact on your trading.

Some brokers have web terminals for trading. You can use them to trade silver, gold, as well as other instruments provided by the broker.

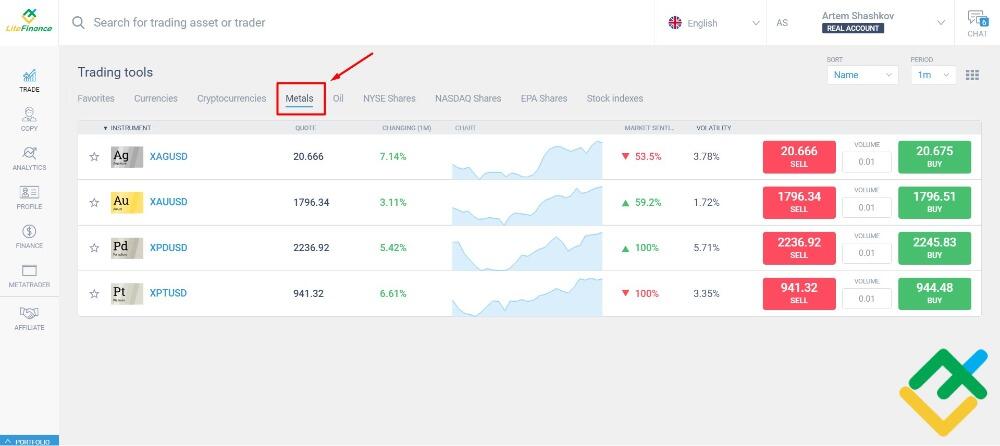

Below you can see the metals section of the Litefinance web terminal:

To practice trading silver with a Forex broker, you can open a demo account that does not require depositing any real funds. Its exchange analog is demo orders: they are executed virtually, i.e. they are not actually placed on the exchange and do not require real money on the balance of your trading account.

Silver can be bought and sold at the current price or through pending orders if the trader wants to trade at a price that is higher or lower than the current price. For mid- to long-term trades, it is recommended to keep track of the news calendar for news related to silver mining and production.

Silver Bullion

Silver bullion bars are suitable for storage in a bank cell, as they take up little space. A standard bar weighs 1,000 troy ounces, which is equivalent to about 30 kg. However, you can invest in silver weighing from 100 gr. The difference in price between silver bullion and stock quotes is typically around 10%, which makes this option the most profitable compared to other tangible forms such as coins or jewelry.

Depending on the country, the sale of bullion may be subject to capital gains tax or value added tax.

Futures CFD

CFDs are the best way to invest in silver for traders with a small deposit. The instrument is available on Forex, so look for brokers listing silver CFDs, preferably those that have been in business for a long time. For example, LiteFinance. The company has good order execution speed and spread for such an illiquid instrument.

Silver requires a more substantial deposit than currency pairs. The cost of 1 price tick is $0.05 when trading with a minimum volume of 0.01 lots. The quote for this instrument is three-digit, so the minimum price change is $0.001.

When you open a trade with a minimum volume of $9.37, this amount is reserved from your account. This value will grow in proportion to the volume of the transaction. For example, if you buy 0.03 lots of silver, your account must have 3 x $9.37 = $28.11 to secure the trade.

CFDs are traded 23 hours a day, so they are suitable for everyone regardless of the time zone.

End and start times of CFD trading in silver are indicated in this screenshot from the Metatrader 4 terminal:

The instrument is suitable for all types of trading and investing, except for scalping and intraday trading.

Silver Options

There are two types of options: call and put. A call option gives you the right to buy silver at a predetermined price referred to as the strike price. If the silver spot price is higher than the strike price, the trader exercises their right and makes a profit. If the price falls below the strike price, the trader may not exercise his right and only pay the so-called option premium, which is the cost of the option itself.

A put option works the other way around: the trader will have the right to sell the asset at a predetermined price. Therefore, if the price of silver is below the strike price, it is beneficial for the trader to exercise their right. If the price rises above the strike price, there is no point in exercising the right, and then only the option premium must be paid.

The further the strike price of an option is from the current price of silver, the cheaper the option itself, since the probability of its exercise is lower.

Options are an exchange instrument. Therefore, if you want to try your hand in option trading, you need to find a broker that provides access to one of the exchanges.

On the Chicago Stock Exchange, silver options trade under the ticker SO.

Silver ETFs

Let's say you have a portfolio of silver mining stocks:

- 40% - Industrias Penoles SAB de CV;

- 30% - Polymetal International PLC;

- 20% - Fresnillo PLC;

- 10% - Pan American Silver Corp.

Let us further assume that the shares of the first two companies (with 40% and 30%) went up, and the shares of the 3rd and 4th (20% and 10%, respectively) went down. As a result, the value of the portfolio increased. After seeing your successful investor experience, I will definitely want to join it. But I don’t have to draw up my own portfolio, I ca buy a part of yours. This is exactly what an ETF does.

An ETF is a security that resembles a stock. Only in the case of stocks, you get a share of the company, and in the case of ETFs, you get a share of the portfolio of securities. If the portfolio falls or grows in value, you will get a loss or profit according to your share in this portfolio.

Dividends from ETFs in some cases may not be paid out, but rather reinvested. Then, in order to make a profit, EFT can be sold, since with an increase in the value of the portfolio, its EFT will also grow.

An ETF is an exchange-traded instrument, just like an option. Therefore, if you are interested in this instrument, you will need a stock broker. One of the most famous silver ETFs is the iShares silver trust (ticker: SLV) launched in 2006.

Investing in silver ETFs is more attractive due to the higher liquidity (up to 0.5% of the underlying asset price) than buying this precious metal from banks (approximately 5% of the underlying asset price). When choosing, be guided by the past performance of the fund, in particular, by the profitability and maximum drawdown values.

Silver Stocks

The choice of stocks of silver mining companies depends on the size of your deposit. For example, the share price of Wheaton Precious Metals Corp. (stock ticker - WPM) is hovering around $35, and Silvercorp Metals Inc. — $2.39. The higher the price, the higher the potential return. But with a small deposit, it is better to start with cheaper securities.

When buying shares for the long term, you should analyze the fundamental factors. For example, due to internal problems of the company, its shares may not react in any way even to an increase in the price of silver.

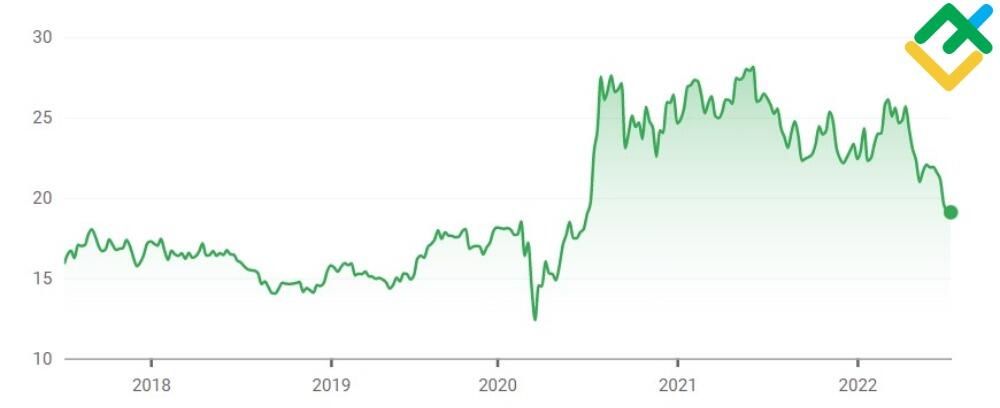

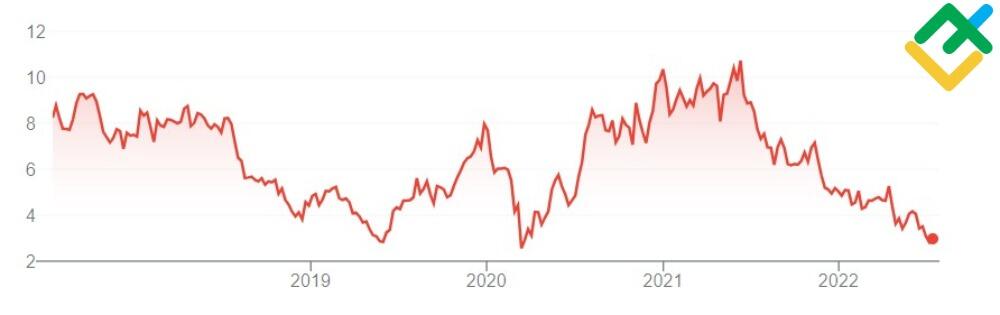

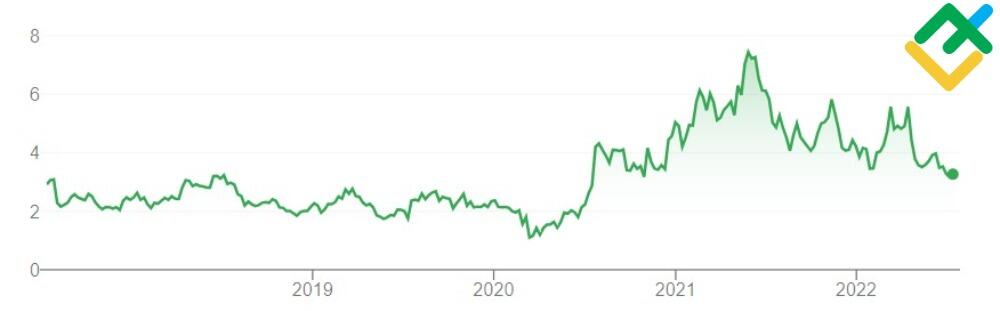

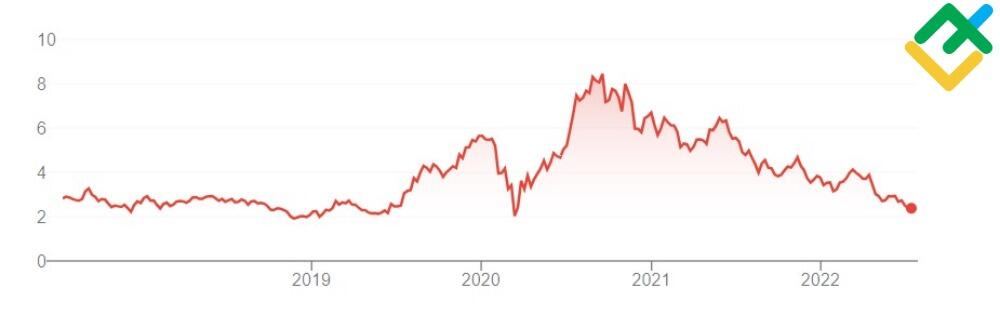

Below is the dynamics of silver prices over the past few years. When buying stocks, it is important to select the ones that rise stronger and fall weaker than silver prices. For selling stocks, on the other hand, look for those whose prices fall more and rise less than silver.

In 2022, I recommend taking a closer look at the stocks of the following companies:

Wheaton Precious Metals. The company has shown a steady upward trend since 2019. At the moment, it is at the lower border of a flat. The dynamics is more positive than the price of silver.

First Majestic Silver. The last 3 years have seen a downward trend: the stock grew weaker and fell more strongly than silver.

Coeur Mining. Sine 2021, performance has dropped even more than First Majestic Silver. The share price is lower - suitable for a small deposit.

Endeavor Silver Corp. The growth is less significant, but the price drops are more smoothed than those of silver. Suitable for both buying and selling.

Silvercorp Metals Inc. (SVM). While silver fluctuated sideways, the stock steadily went down, which it continues to do.

These are just a few examples - there are many more publicly traded silver mining companies. There are no stocks here that follow the price of silver exactly. However, they may also be of interest, for example, if they are cheap and you do not want to take risks. But if the price is high, there is no point in trading them when there are options that grow and fall more dynamically.

Silver trading hours

Silver is traded on the London, Shanghai and New York stock exchanges. Exchanges working hours (European time, GMT+2 in LiteFinance trading terminal):

- London: 10.00 - 18.30;

- Shanghai: 5.30 - 11.00;

- New York: 13.00 - 23.00.

Therefore, silver trading hours are 5.30 to 23.00 Monday to Friday (LiteFinance terminal time).

It is preferable to make trades during the European or American trading sessions because of the highest liquidity.

Silver trading Pros and Cons

Let's take a closer look at the pros and cons of trading silver:

Pros | Cons |

High volatility | Large spread |

Multiple ways to invest | Requires a substantial deposit |

Affected by fundamental factors | |

Cheap compared to other metals |

Advantages:

the volatility of silver provides for long-term price movements that increase the trader's profit potential;

you can invest in silver through various instruments, depending on the amount of capital and risk appetite of the investor;

Since silver is not only an investment object, but also a commodity involved in industry production, its price is more affected by fundamental factors than, for example, gold. Therefore, by analyzing the stocks of industry companies, production growth rates and the state of the global economy for crises or pandemics, one can predict further price dynamics in the medium and long term;

Compared to investing in other metals, silver is one of the most affordable options - the price is one of the lowest.

Disadvantages:

low liquidity generating a wide spread. As a result, ultra-short-term (scalping) trading is simply not possible with silver, and intraday trading is difficult;

the minimum change in the price of silver is 5 times more expensive than in currency pairs. As a result, for equal comfort in trading, you will need 5 times more deposit.

Silver trading best strategy

The general principles of trading silver are the same as for any other asset: trade only in the direction of the trend + sell from the upper border and buy from the lower border of the flat.

For trend trading, we will use trend lines + the RSI indicator. It is better to draw trend lines on broader price movements - this will increase the potential of your trades.

If you draw trend lines on local movements, most likely it will be a chaotic and unprofitable trade.

I will analyze the H4 timeframe. I will use RSI levels 60 and 40 (instead of 70 and 30) with a standard parameter (14) so that it analyzes the last 14 candles. You can use any other parameter.

A sell signal appears under the following conditions:

downtrend: the trend line drawn at the price highs is directed downwards;

RSI (14) above 60 at the time of touching the trend line;

after touching, a pin bar or bearish engulfing candlestick pattern is formed.

Example of a sell position entry. The blue dots indicate the highs on which the trend line was built. The arrow shows the entry point - the engulfing pattern simultaneously with the overbought signal from the RSI (14):

Profit to risk potential is 2/1 if the stop order is placed according to the rules of the pattern - above its first candle:

Buy signal:

uptrend: the trend line drawn at the price lows is directed upwards;

RSI (14) below 40 at the time of touching the trend line;

after touching, a pin bar or bullish engulfing candlestick pattern is formed.

Example of a buy position entry. The arrow indicates the pin bar pattern, after the formation of which we enter the trade:

With a stop loss behind the tail of the pin bar, the trade yields a 3/1 profit/risk ratio.

Don’t worry if the price does not reach the trend line a little or goes beyond it - trading is not an exact science.

When a candlestick pattern (pin bar or engulfing) is formed, the RSI will usually be below 60 for sell positions or above 40 for buy positions. This is normal, as the RSI is used to identify suitable conditions, and the pattern is used as a trigger.

What if silver is in a flat? You will probably be surprised, but when you trade with the help of trend lines and the RSI, a flat will go unnoticed. There will also be directional movements within it, based on which you can build trend lines.

In some cases, there will be no entry signals in a flat.

The lows are declining, but the highs are at the same level. Therefore, if you draw a trend line on them, it will be horizontal. Plus there is no signal from the RSI.

Fundamental Analysis: What factors influence the silver price?

In fundamental analysis, 3 indicators are of the greatest importance:

1. Supply/demand. Demand is affected by the situation in industries where silver is used as a production element: medical equipment, electrical appliances, jewelry. Supply is affected by production growth rates.

The indicator can be analyzed by looking at the stocks of the major companies of the respective industries.

2. Situation in the world economy. During periods of economic uncertainty, investors move away from other assets into silver and gold.

Investor expectations can be tracked using the VIX index, which is an indicator of the volatility of the American economy. The higher it is, the higher the expected instability of the stock market and, as a result, a crisis in the near future.

3. Correlation with the price of gold. Interest in silver will increase with the growth of the GSR ratio. If you do not want to look for the GSR ratio chart, you can compare the gold charts and the silver chart.

Silver Technical Analysis principals

The main principle in the technical analysis of silver is to start from the monthly timeframe (MN) and go down to no lower than M15. Silver has rather low liquidity and, as a result, a large spread. Therefore, short-term trades do not make sense.

At the same time, low liquidity is also an advantage. Thanks to it, silver has greater volatility, price movements are longer and more unidirectional than in currencies and other popular instruments. Silver will provide more profit potential than, for example, the EURUSD.

On global markets, silver is traded 23 hours a day (instead of 24), on local markets - during the open hours of the exchange. You should keep this in mind when using indicators with parameters including the number of periods. For example, if you analyze the H1 timeframe and want to calculate the moving average for a day, then in the case of silver, you need to indicate the period 23, not 24, and on the exchange you need to indicate the number of hours during which the exchange is open.

High volatility will be noticeable from the H1 timeframe and below. Various breakout strategies (not lower than the M15 timeframe) and trend indicators, such as the Moving Average and Bollinger Bands, will do.

Here is an example of using the Bollinger Bands indicator on the M15 timeframe. A position is opened based on the trend after the candlestick closes beyond the borders: buy if it’s above the top, sell if it’s below the bottom:

The price went in the direction of the breakout in all cases except #3.

I do not recommend using breakout entries on timeframes below M15. During the execution of the order this will reduce the profit potential. On smaller timeframes, a breakout entry can be done where it’s time to exit by take profit.

Otherwise, the technical analytics of silver is no different from any other financial instrument.

Day Trading Silver

I would not recommend trading silver intraday on Forex. The XAUUSD CFD has a fairly large spread, which will bite off a significant part of the profit, both when opening and closing the position.

This will have a significant impact on your trading results, since in intraday silver trading, the take profit value and the profit/risk ratio are limited by the distance that the price travels per day.

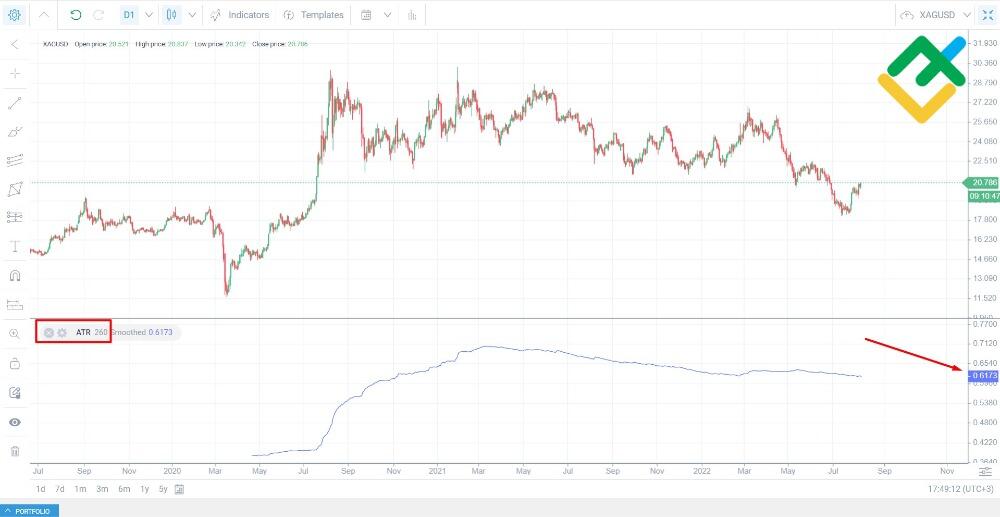

I took a screenshot of the chart on the D1 timeframe with the added ATR (14) indicator. The indicator shows the change in the distance that the price travels per day in one direction:

From April 2021 to July 2022, volatility remained almost unchanged, and the indicator fluctuated around the value of 0.85 (equivalent to 850 pips).

Exchange instruments associated with silver are also not very liquid, so I do not recommend intraday trading in them either.

Silver vs. Gold

Copy successful traders

Make profits from the first day of trading without training. The best traders from the whole world gathered on the same platform to share their money-making strategies.

Gold is clearly better suited to intraday trading due to higher liquidity and, as a result, a smaller spread compared to silver. However, in the medium and long term, this difference is insignificant.

In absolute terms, over the past 22 years, the price of gold has risen from $250 to $2,075 at its peak, and silver from $4.25 to $49.65. As we can see, historically, silver has shown a more significant return - 10,680% (average 40.45% per calendar month) against 7,300% for gold (an average of 27.65% per calendar month).

The largest drop in the price of silver was 76.78% (from $49.65 in April 2011 to $18.52 in March 2020), and for gold - 45.68% (from $1919.7 in September 2011 to $1042.8 in December 2015). If the goal is to preserve capital, gold looks more attractive than silver, since its drawdowns were much smaller.

Silver chart with the largest price drop:

Gold chart with the largest price drop:

To measure the average daily volatility for the year for both metals, I used the ATR indicator with a parameter of 260 on the D1 timeframe. 260 is the number of trading days in a year.

Silver volatility was 617 ticks:

Gold volatility - 2553 ticks:

Thus, gold is preferable for trading, since the longer the price movement, the greater the potential for earnings.

To sum up, I recommend gold for beginner investors and traders.

Silver, in my opinion, is only good for medium- and long-term trading, as well as for arbitrage strategies, i.e. when the entry is made at the moment of the largest divergence between the prices of gold and silver, and the exit is at the moment of convergence.

Silver and Gold Correlation

Gold and silver have historically had a direct correlation for a number of reasons: both metals are precious and both are preferred as an investment in times of economic instability.

Silver is characterized by industrial use, while gold is more of an investment tool. Therefore, the economic performance of mining and silver producing companies has a significant impact on metal quotes. Companies associated with the gold market have less influence on gold quotes, respectively.

GSR index (Gold/Silver Ratio)

The GSR index is the ratio of the current prices of gold and silver. It is similar to the EURUSD currency pair, in which the value of the euro is expressed in dollars. One of the common trading strategies using the GSR involves accumulating one of the two metals.

For example, a trader invests in gold for a long time while tracking the GSR index. Let's assume that the index reached previous highs around 100 ounces of silver for 1 ounce of gold and began to show signs of a reversal. This indicates both an increase in demand for silver and a fall in demand for gold. Therefore, a trader may decide to exchange gold for silver at the current rate. Suppose they accumulated 10 ounces of gold, which they then exchanged for 1,000 ounces of silver. Subsequently, if the forecast about the fall of the index is confirmed, the trader can make the reverse operation, but on more favorable terms. If the GSR falls from 100 to 50, then the trader will receive 20 ounces of gold for their 1000 ounces of silver, thus doubling their deposit.

GSR chart since 2000:

GSR index analysis is also used to hedge trades in both metals. For example:

the trader opened a long position in gold;

the trader opened a short position in silver.

As long as the GSR index continues to rise, the combined result of these two trades will be positive. An increase in the index means one of three things:

gold is growing faster than silver. Therefore, the profit from a long position in gold will be greater than the loss from a short position in silver;

gold falls more slowly than silver. Then the profit from a short position in silver will be greater than the loss from a long position in gold;

gold is rising and silver is falling. A trader earns from both long and short positions.

Therefore, if the dynamics of the GSR index starts to change, this will be a signal for the trader to reconsider their positions in gold and silver.

I only gave examples of successful trades to illustrate the point. The GSR index is not an easier way to analyze the market. After the first signs of a reversal, it may well continue to move in the same direction. Traders who have made trades according to the reversal forecast will not be in any better position than when trading currency pairs or futures when quotes go the wrong way.

When to buy Silver

Historically, the growth of silver quotes has coincided with pessimistic expectations regarding inflation: investors are beginning to invest in metals in order to hedge against the risks of capital depreciation. Thus, the best time to buy silver in the medium and long term is when general inflationary expectations are rising.

Let's take a look at what creates alarming expectations for inflation:

rising prices for basic commodities. The population may begin to buy them for the future, which will lead to an increase in demand and, as a result, to a further increase in prices;

reasons for the weakening of the national currency compared to foreign currencies. Imported goods rise in price in this scenario;

global cataclysms, like financial crises or the recent COVID-19 pandemic. During these periods, the economy cannot fully function;

an increase in the interest rate as part of the state's monetary policy. On the one hand, this measure strengthens the national currency, and on the other hand, it is applied only against the background of expectations of inflation growth in the future.

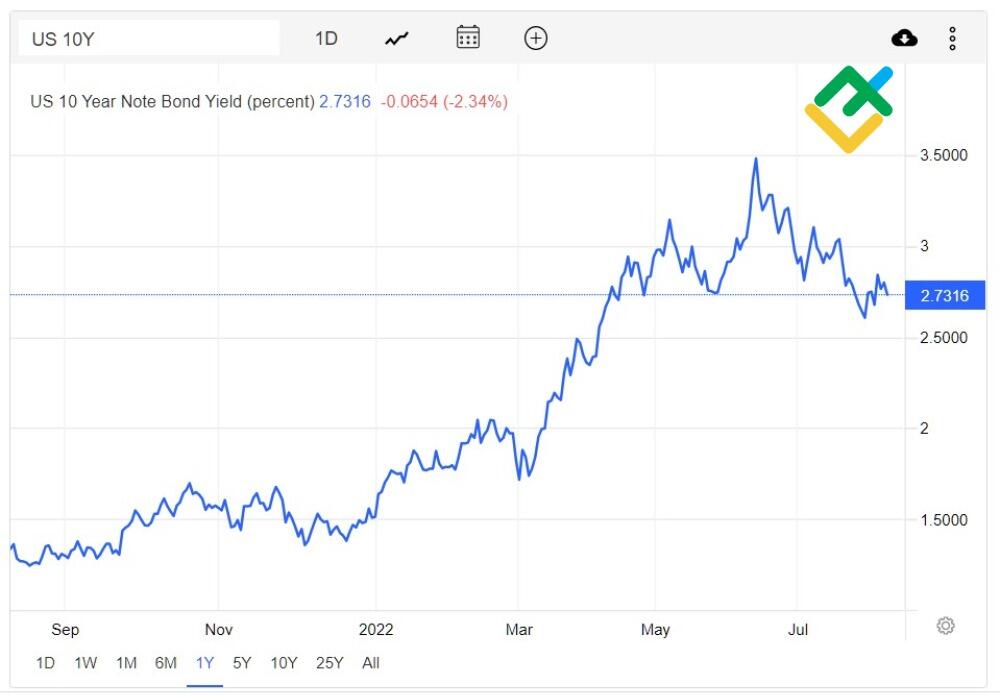

Silver has a stable inverse correlation with the US Treasuries.

US Treasuries vs Silver Chart:

The decline in yields on these bonds is accompanied by an increase in the price of silver and gold. An increase in profitability is associated with a fall in the price of silver and gold.

Stock quotes are also influenced by the volume of industrial production of silver products and the output volumes of silver mining companies. Production volumes indicate demand, and output volumes indicate supply. Thus, a simultaneous reduction in output and growth of production is likely to have a positive impact on the price growth.

How do you buy Silver

If you're a potential silver trader, here's a step-by-step instruction on how to buy silver with a broker:

Conclude an agreement with a broker that provides access to the market where you plan to trade silver (spot, futures, currency or precious metals market).

Download a trading terminal (for example, Metatrader 4) or go to the broker's online terminal on the website.

If you are using technical analysis, it is advisable to open a silver price chart and determine trade entry and exit points according to your trading strategy. For long-term transactions, you don’t have to analyze the chart as fundamental analysis will be your priority.

After the decision is made, place an order to buy or sell. If you are satisfied with the current price, the best option would be an order with instant execution. If you want a price higher or lower than the current one, you should place an order with a pending execution. Keep in mind that with a pending execution, the order will not be executed if the current price does not reach it.

From the moment of purchase, silver will be registered with the trader in an impersonal manner. This means that physical delivery is not possible.

Methods Compared: Trading vs Investing

Trading and investing differ in the types of trading operations. Investing only involves opening and closing long positions: the investor expects a higher future price of the purchased asset. In trading, in addition to long positions, short positions or their varieties are also used to be able to make a profit even when the asset value decreases.

Investing usually involves holding an open position for a long time, while a transaction in trading can be opened and closed within 1 day.

Short position | Trading with leverage | 24-hour trading | Additional commissions | |

Physical assets | x | x | x | storing |

Stock | some | v | x | x |

ETF | some | x | x | managing |

CFD | v | v | v* | x |

Futurs | v | v | v* | x |

Options | v | v | v* | x |

*The exchange usually takes a 1-hour break per day.

The most popular instruments for investing are physical silver, like bars or coins, and stocks. In trading, investment objects are more diverse. However, I have never seen a trader operating in bars or coins, especially within one day.

Traders working with a bearish market are better off trading CFDs, futures, or options. In the case of ETFs or stocks, generally only the most popular instruments are available for a short position.

Potential earnings will be higher if leverage trading is available. Physical investments and ETFs do not allow this.

For trading, from the point of view of risk management, the best option would be instruments that are traded around the clock. For other instruments, so-called price gaps are possible - this is a situation when the opening price of the next day differs significantly from the closing price of the previous one. If a trader decides to leave the trade open, due to the gap the next day it may close at a worse price than their stop loss.

If you invest in bullion, you will have to pay a commission for storage. In the case of ETF, you will also have to pay for the services of portfolio managers who manage the fund. Investing in other instruments is free of commission.

Choosing the right broker for Silver trading

The first thing to pay attention to is a license. Without it, the broker has no right to conduct business. Stock brokers get a license from the Central Bank of the country in which they are registered.

The second important criterion is how long the broker has been in business. The older the broker, the more reliable it is due to its experience. In addition, you can find more information, reviews and discussions about old brokerage companies online. The more information from customers, the better prepared you are.

Also pay attention to how broker representatives interact with clients online: how quick the response is, how polite the communication is, and whether the broker representative avoids uncomfortable questions.

Find out if the broker provides the opportunity to trade silver and in what form, which markets it gives access to. For example, it is unlikely that a stock broker will let you trade the XAGUSD or that a Forex broker will give you access to the silver futures market. The analogy is a little far-fetched, but the situation can be compared to public catering: it is better to order pizza at a pizzeria, and coffee at a coffee shop. You are likely to get the best product at the place that specializes in that product.

The next stage is somewhat mathematical. You need to compare the rates of the brokers you like. The most important criteria are the following:

account maintenance;

transaction fee;

commission for withdrawing funds from the account. Also check if the broker provides the withdrawal methods you need.

If the broker is an exchange, bear in mind that there will be additional commissions that the exchange itself takes. For example, for depository services.

The remaining criteria are optional and will be more of an advantage than a necessity:

presence / absence of training and theoretical materials. There are a lot of special terms in trading. In addition, silver has a number of features that are useful to know;

convenience of the trading platform / web-terminal / mobile application. Let us not point fingers, but there are terribly inconvenient ancient trading platforms. Some brokers use these terminals to this day. My recommendation: before trading silver with real money, download the terminal from a broker and make sure you like it;

24-hour tech support. This will allow you to quickly resolve any issue that suddenly arises.

Start trading with a trustworthy broker

XAGUSD trading FAQs

This is the purchase and sale of exchange instruments related to silver: coins, bars, shares of silver mining companies, futures, spot contracts, and CFDs.

You need to sign up with a broker that provides the opportunity to trade in silver-related instruments. Then open the trading terminal, select the desired instrument and start making trades to buy or sell.

Silver-related exchange instruments are traded at 4:30 am to 10:00 pm ET (*GMT +2). Silver CFDs can be traded between 00:00 and 23:00 (*GMT +2).

* LiteFinance trading terminal time

These are futures or spot contracts for silver. The former have an expiration date, the latter do not, which makes them more convenient for long-term investment. Stock market prices are quoted for 1 troy ounce of silver (approximately 31.1 grams).

The strategy for buying shares of silver mining companies should depend on the investment horizon. When investing long-term, look for companies that are the healthiest financially - show good profitability growth rates, have strong management, and have been in business for a long time. When trading and short-term investing, you should buy shares only if there is a signal for your trading strategy.

Yes, if there are no contradictions with Shariah. There is no unequivocal opinion about trading silver on Forex.

Through a broker that gives you access to the exchange. The transaction can be concluded only during the period of exchange trading. The purchased silver is not delivered to the buyer in physical form, but will be stored in the national clearing center.

Despite various myths about stability, silver is a standard asset with inherent risks. Therefore, a long-term investment should be made only after a comprehensive analysis of fundamental factors in the silver market. Short-term investments are made according to the rules of your trading strategy.

XAGUSD silver is currently trading at 28.409 USD per 1 oz on 02.09.2024.

Price chart of XAGUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.