Beginner traders don’t tend to think about whether the current market price is optimal. This often results in increased risk and lower profits. This is why experienced traders use pending orders. In this article, I will go into detail about this instrument. We will analyze the features of different types of order execution and when they should be used.

The article covers the following subjects:

Types of Orders

For those just starting out in stock trading, I will first explain what an order on the stock exchange is. This is important to understand before we go on further. An order - a market, limit, or stop order - is an instruction to buy or sell an asset.

In stock trading, there are several types:

| Type of order | Description |

|---|---|

| Market | Orders for opening a trade at the current price. (Buy market and Sell market) |

| Limit & Stop-Limit | Fulfilled under predetermined conditions. For example, it opens a buy position when the asset reaches a certain price (Buy limit, Sell limit, Buy stop, Sell stop, Stop limit) |

| Stop | Closes a position when the asset reaches a certain price (Stop loss, Take profit, Trailing stop) |

Market orders are used to instantly open a position at the current price. They are also often used in high-frequency trading. Pending orders, such as a Sell limit or Stop limit, are for more experienced traders. Such orders allow you to enter the market at the most convenient prices, with no need to be behind the computer all the time.

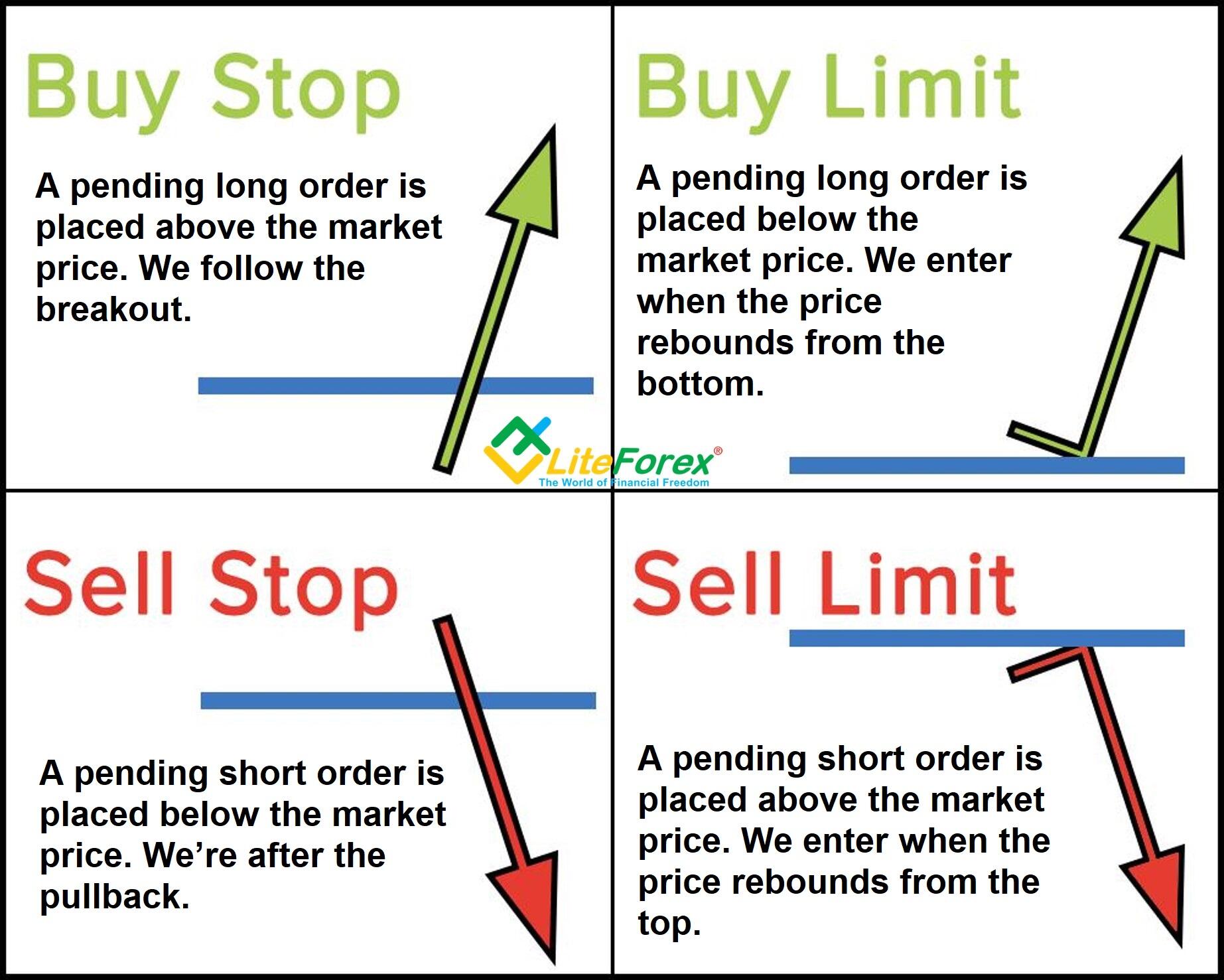

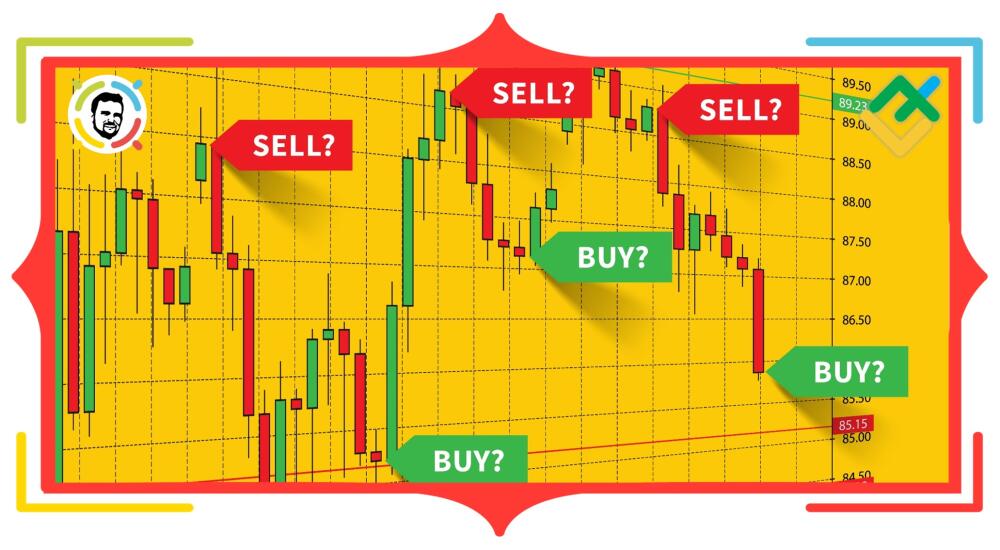

The chart above shows all possibilities for pending orders and how they are applied. We will talk more about each type below.

And finally, we will look at stop orders:

- Stop loss (also known as SL or Stop) is set to limit losses if the price moves against the trader's position.

- Take profit (TP or simply Take) will automatically close the position after it reaches the trader's set target.

Market Orders

To properly use orders, you need to learn what a Forex order is once and for all. In short, it is an order to execute a specified action - buying or selling an asset. Depending on the order type, it can be executed immediately or when the trader’s conditions are met.

Buy and Sell Orders

Let's look at the simplest orders. What are Sell and Buy? An order to buy at the current price (Buy market) is placed when a trader anticipates the asset’s further growth. It is instantly executed at the current market price, plus the spread.

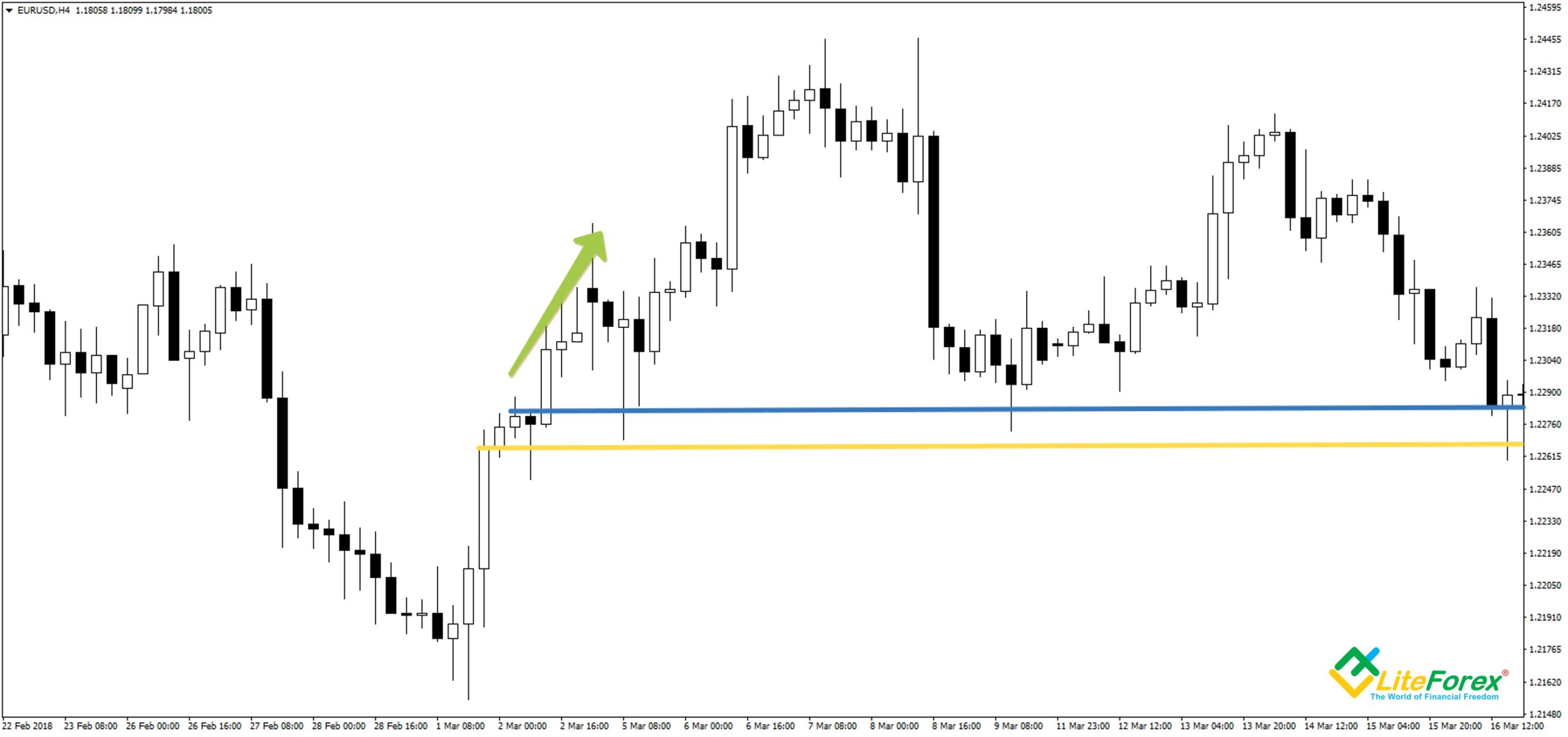

The yellow line on the line shows the EURUSD market price. The buy order itself is placed slightly above due to the spread (blue line). The green arrow shows the expected price direction. A market order is placed when there is a possibility of getting a decent profit and seizing the opportunity to open a position immediately based on the current market conditions.

A sell order is similar. The red arrow shows the expected price movement after entering the market.

Pending Orders

A pending order is a market order that is filled when the market meets certain conditions. For example, a trader doesn’t want to waste time manually opening a Buy position. Instead, they can place a pending order, which will be automatically triggered at the desired price. The difference between market and pending orders is how they are executed. The former are executed immediately, while the latter - under certain conditions.

Types of pending orders:

- Limit order

- Stop order

- Stop limit order

The chart above shows when pending Limit and Stop orders should be used.

Let's take a closer look at real examples of using pending orders in Metatrader 4.

Buy Stop Order

What is Buy stop, and how do you use it? This order involves buying at a higher price in a bullish trend.

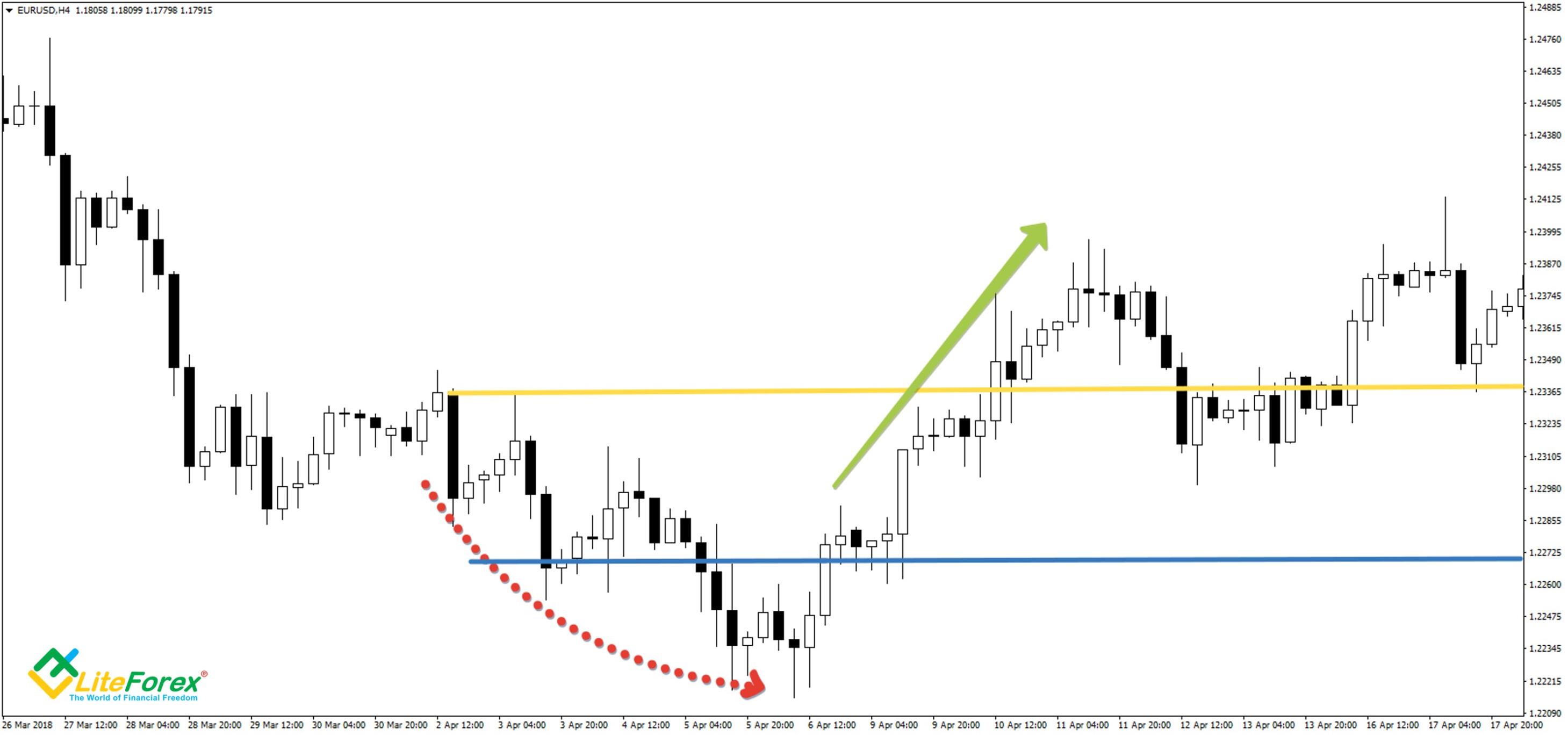

On the chart, the yellow line shows the EURUSD market value. During market consolidation, it is unclear whether the price will continue to grow. We believe that if the market reaches the blue line, there will be a bullish signal, so we set a Buy stop order to open a long position here.

Buy Limit Order

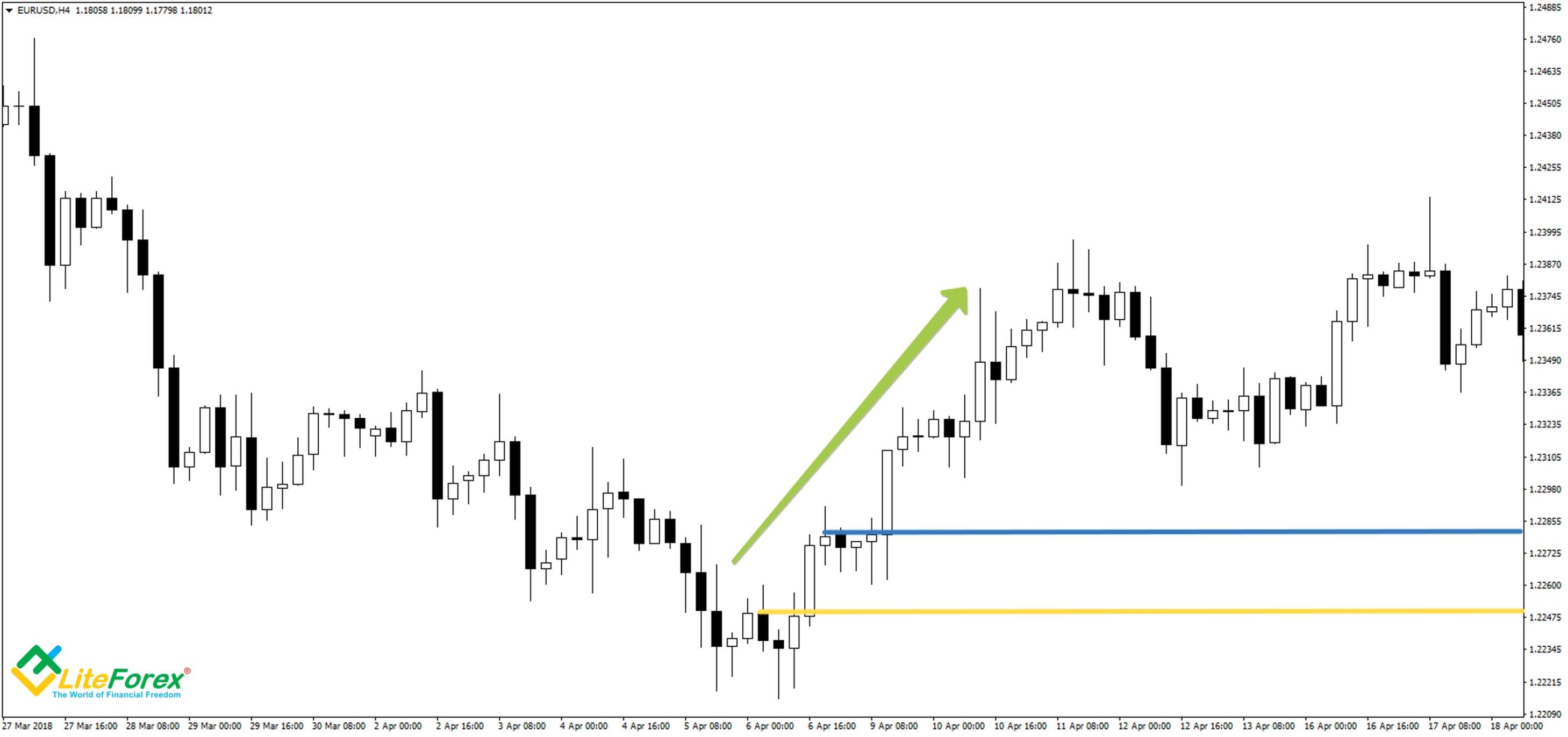

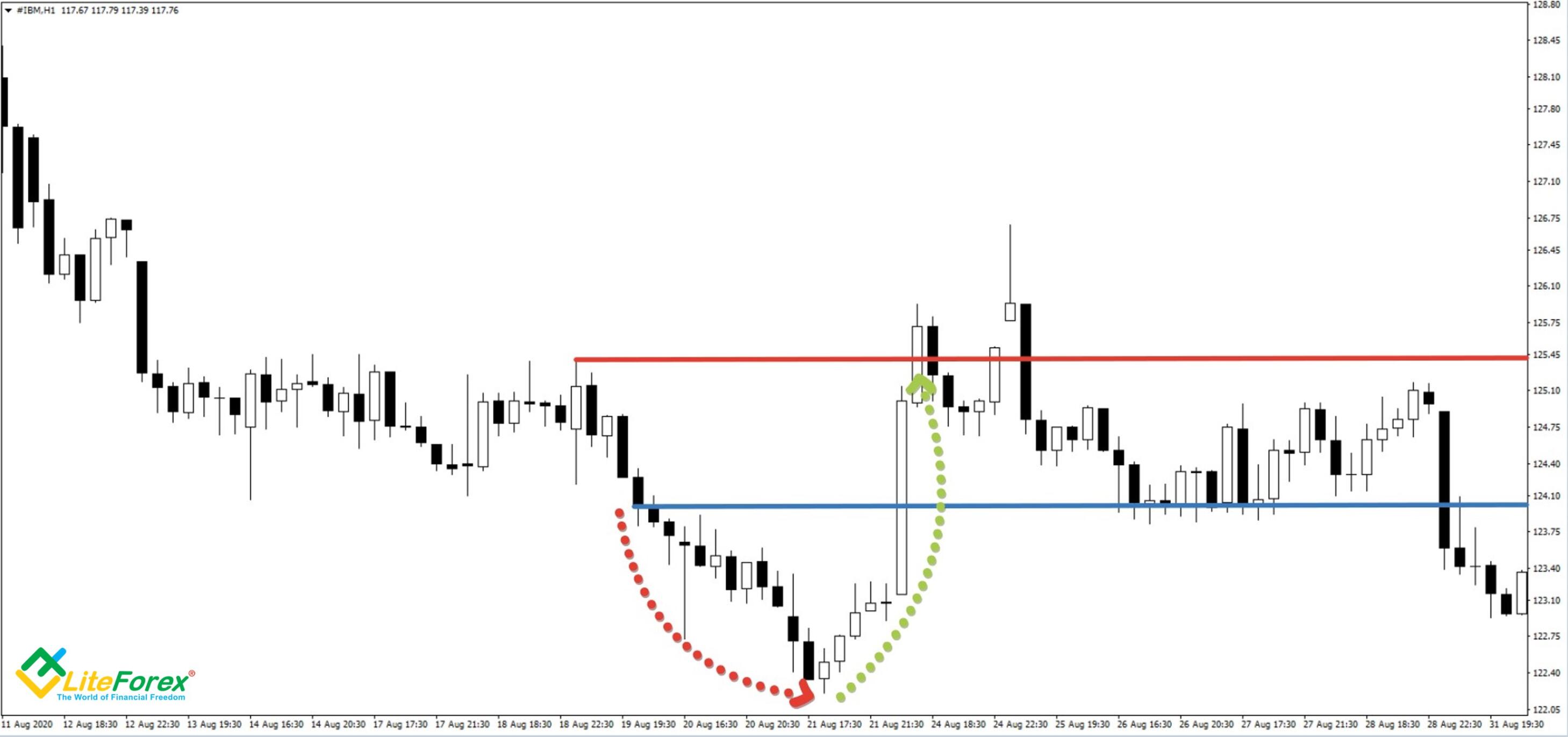

A Buy limit order is triggered after a drop in value, a local bottom breakout, and an upward reversal. We enter the market after the set level is crossed.

To fully understand the Buy limit and Buy stop, you need to see the difference between them. A Buy stop order is opened with an assumption that the trend is going to continue. A limit order is used if you expect a rapid trend reversal.

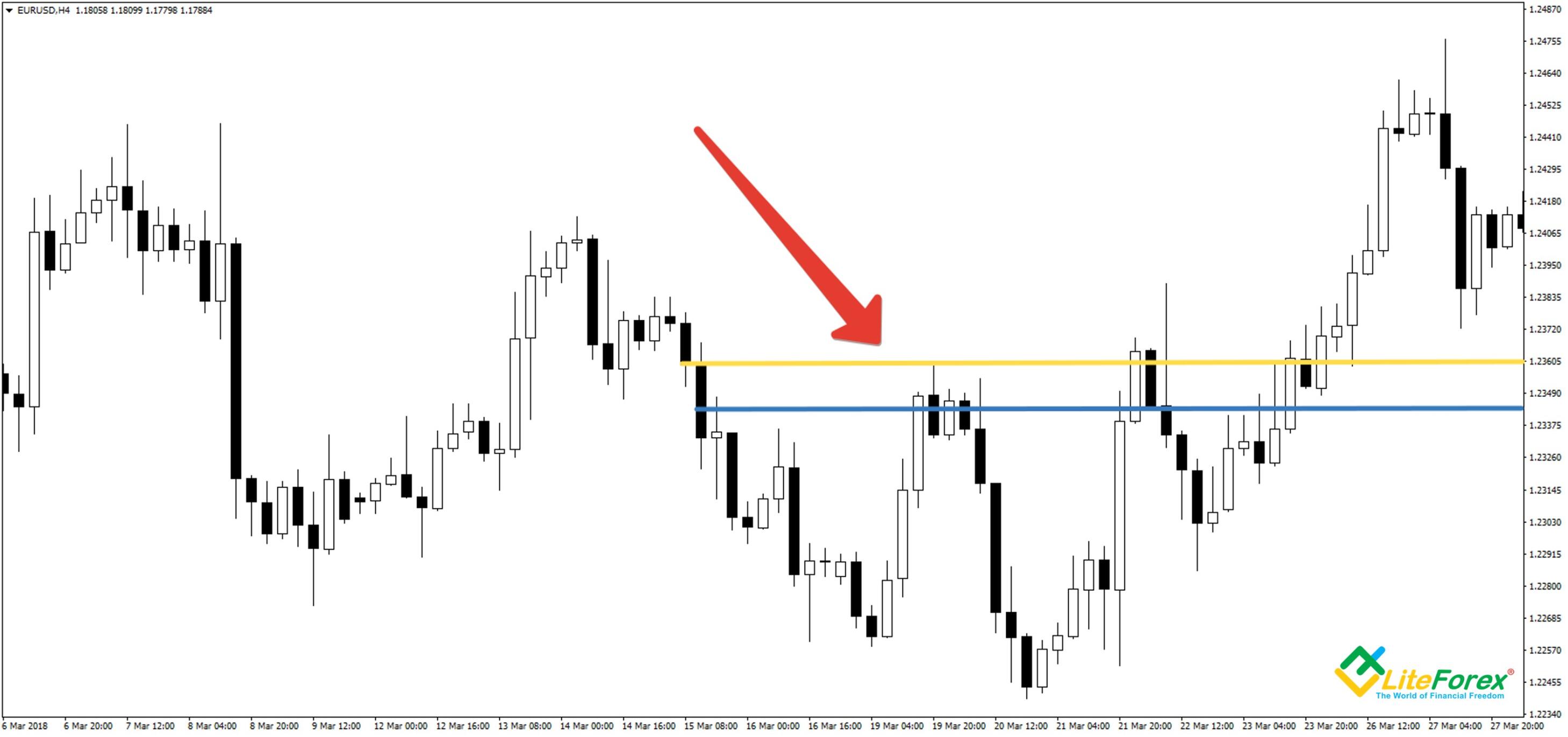

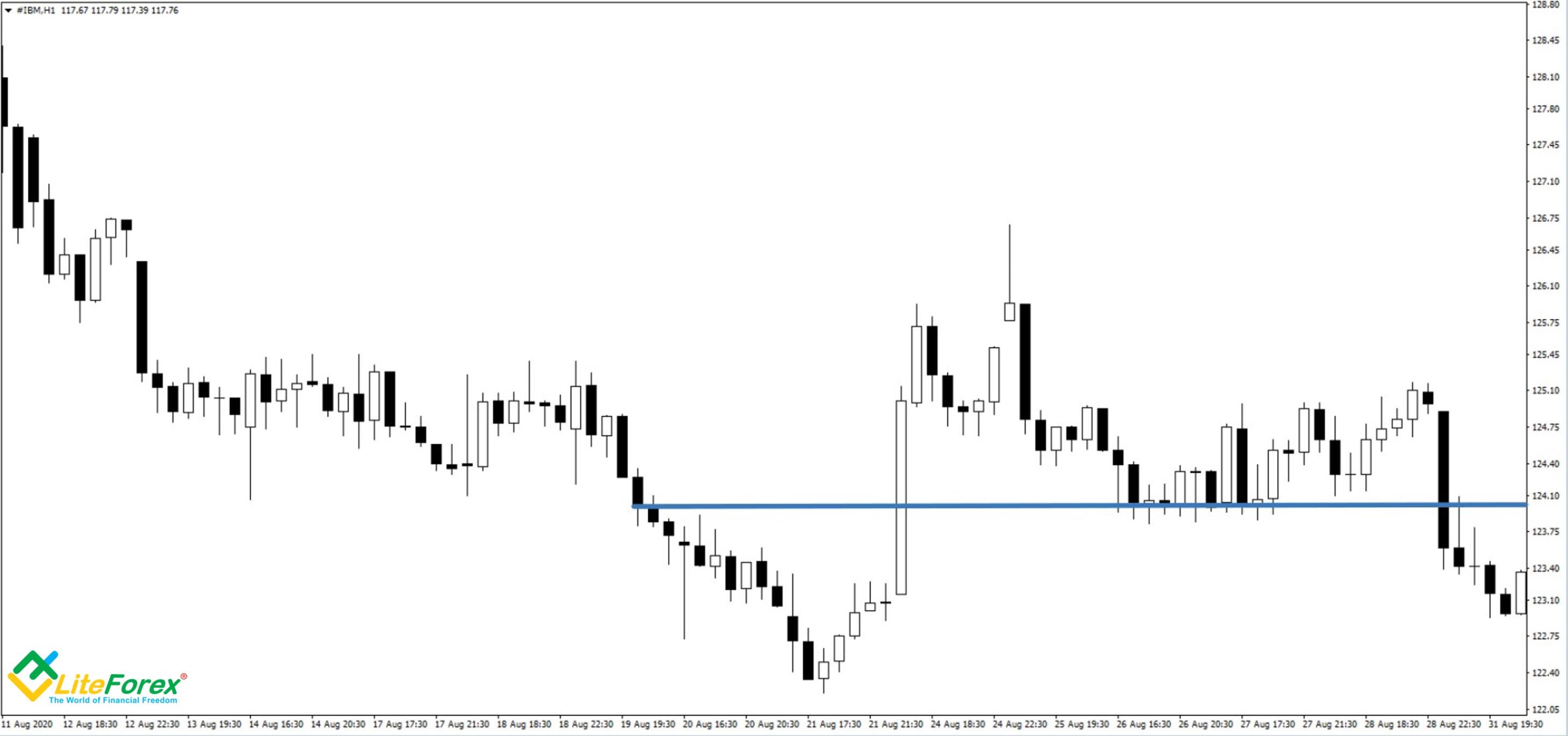

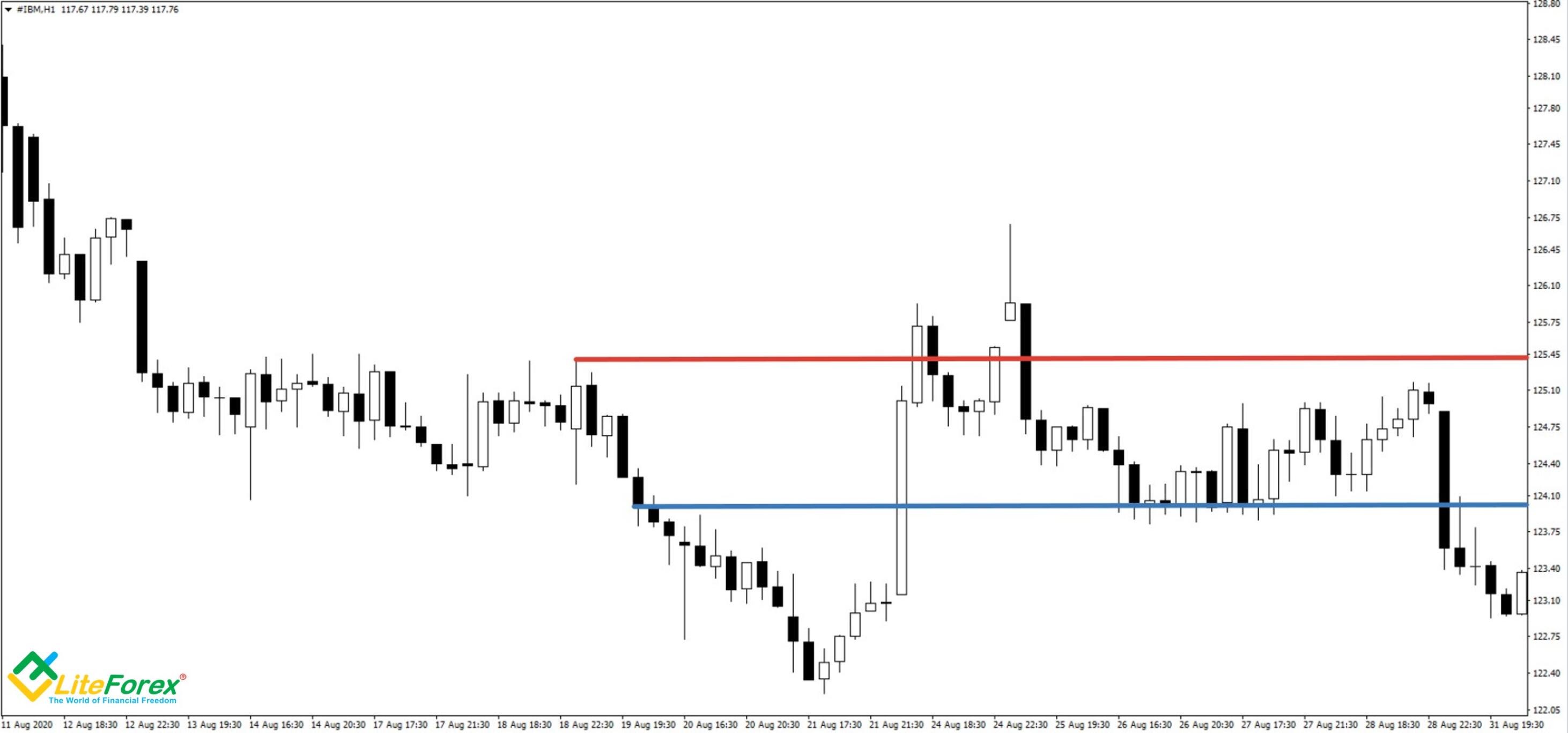

The figure above shows how the pending Buy limit order works. When the order is created, the price is at the yellow line. Meanwhile, the trader assumes that the downward movement is going to turn into an upward trend soon. To enter a long position at a reasonable price, they set the Buy limit at the blue line. But there is a risk of the market not reversing at the expected level but continuing to fall. The chart above shows that this level wasn’t the best for buying, and the EURUSD price dropped even lower before rising.

Let's examine this. A trader wants to buy Apple shares at $115 per share. However, the asset is now at $120.70. What orders should be placed: Limit order, Market order, Take profit, or Stop limit? Or will the simplest Buy market suffice?

The right solution would be to set a Buy limit order. For this order to be executed, the price needs to drop to $115 or lower. The price must go above the position opening level for the trade to be profitable.

Buy Stop Limit

Let's consider another situation.

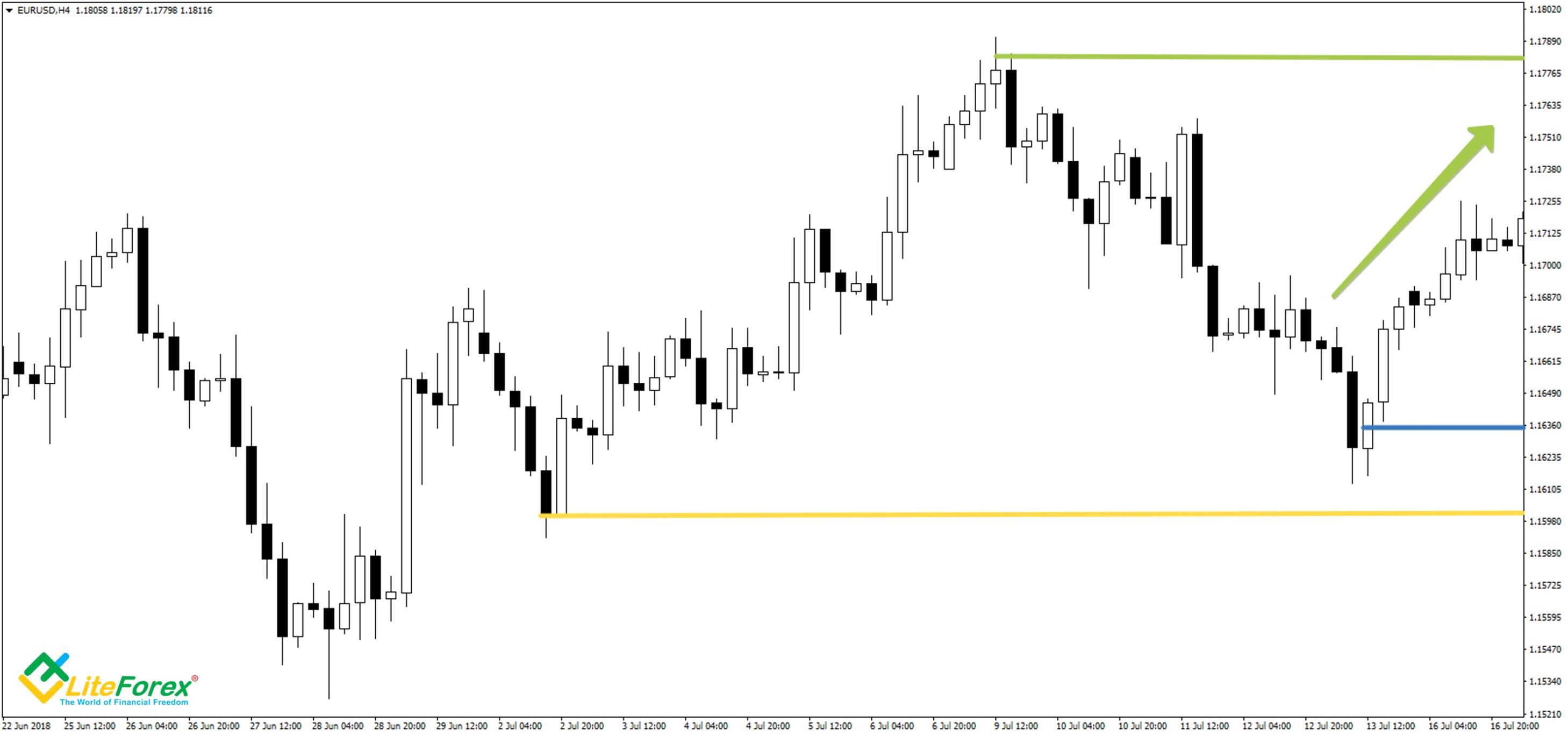

The EURUSD pair in Forex: the yellow line shows where the trader is at the moment. They assume the price won’t go above the green line, and there will be a pullback to the blue line. This is where they’d open a long position. What kind of order is more suitable? As you can guess, it’s the Buy Stop limit. This order combines stop and limit positions. It consists of two prices: stop (trigger) and limit prices. A limit order is created when the price reaches the trigger level. As soon as the chart reaches the limit, a long position will be opened automatically.

When you know what a Stop Limit is, trading becomes much easier. After all, a Buy stop limit can be used for a rollback scenario as well as to break through key levels. The trader only needs to set a limit order at the level lower than the stop price.

Sell Stop Order

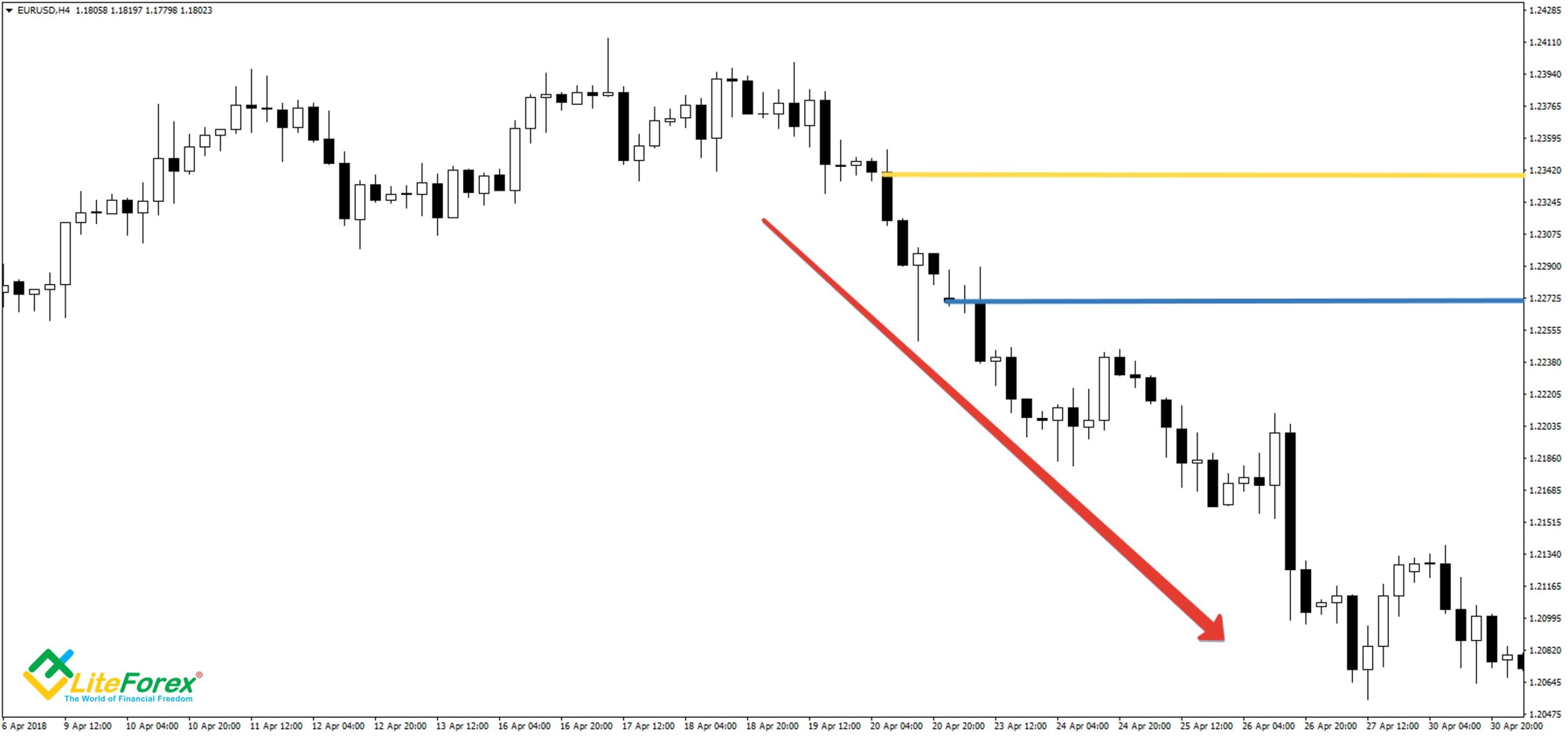

Buy/Sell stops follow the same concept. But with the Sell, the current market position is above the key level, with an expectation of a downward breakdown.

The image above illustrates when a trader expects a bearish trend. But because of a flat at the yellow line, they follow the scenario of a key level breakout at the blue line instead of entering the market. The trader believes that since the market has reached this value, it will continue to fall.

Sell Limit Order

Now, you can probably tell what order scenario is shown on the chart above. Judging from the trader's expectations to enter a short position at higher levels, it’s the Sell limit.

The differences between Sell limit / Sell stop and Buy limit / Buy stop are obvious. They follow the same concept but work in different directions. The first two are used for a falling market, and the other ones are for the growing ones.

Sell Stop Limit

We’ve covered the Buy stop limit. A Sell stop limit follows the same logic in any market. But this order serves to enter a short position. The chart above shows a common scenario. The trader is trading BTCUSD at the yellow line level and expects the price to stay below 10,000 USD and experience a pullback from that level. They place a Stop order at 10,000 USD (green line), and when it’s crossed, a pending Sell order will be placed at the blue line.

Why wouldn’t they go short at 10,000 USD using a simple Sell limit order? It’s the risks. There is a risk of the price continuing to rise after they enter a short position. The Sell stop limit eliminates the risk because market entry takes place after the rollback.

To be fair, the examples for Sell and Buy Stop limit orders are just a few of the many variations. The Stop order position can be placed anywhere - both above and below the market and pending orders. Stop level is only an additional condition for placing pending buy or sell orders.

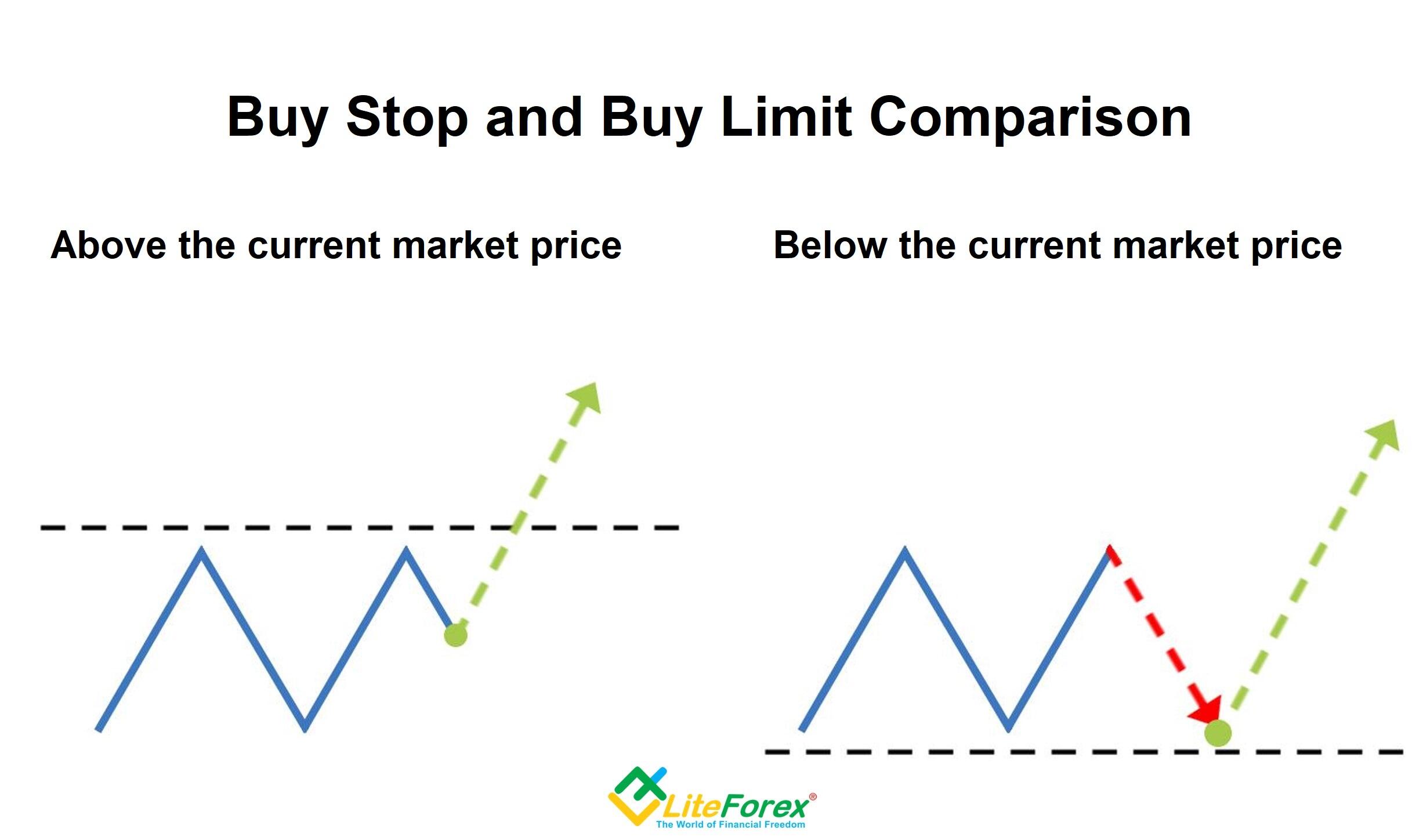

Buy Limit vs. Buy Stop Comparison - What's the Difference?

Now, it's time to examine how the Buy stop and Buy limit differ. The difference between Buy stop and Buy limit revolves around the price movement. Knowing what a Buy stop is, we build a scenario where:

- The current market position is below the key level;

- We expect an upward movement with a breakout of this level.

A Buy limit order is used when we expect a bullish rebound or a reversal of a bearish trend.

Based on how these orders work, a Buy limit is placed below the market, and a Buy stop - above.

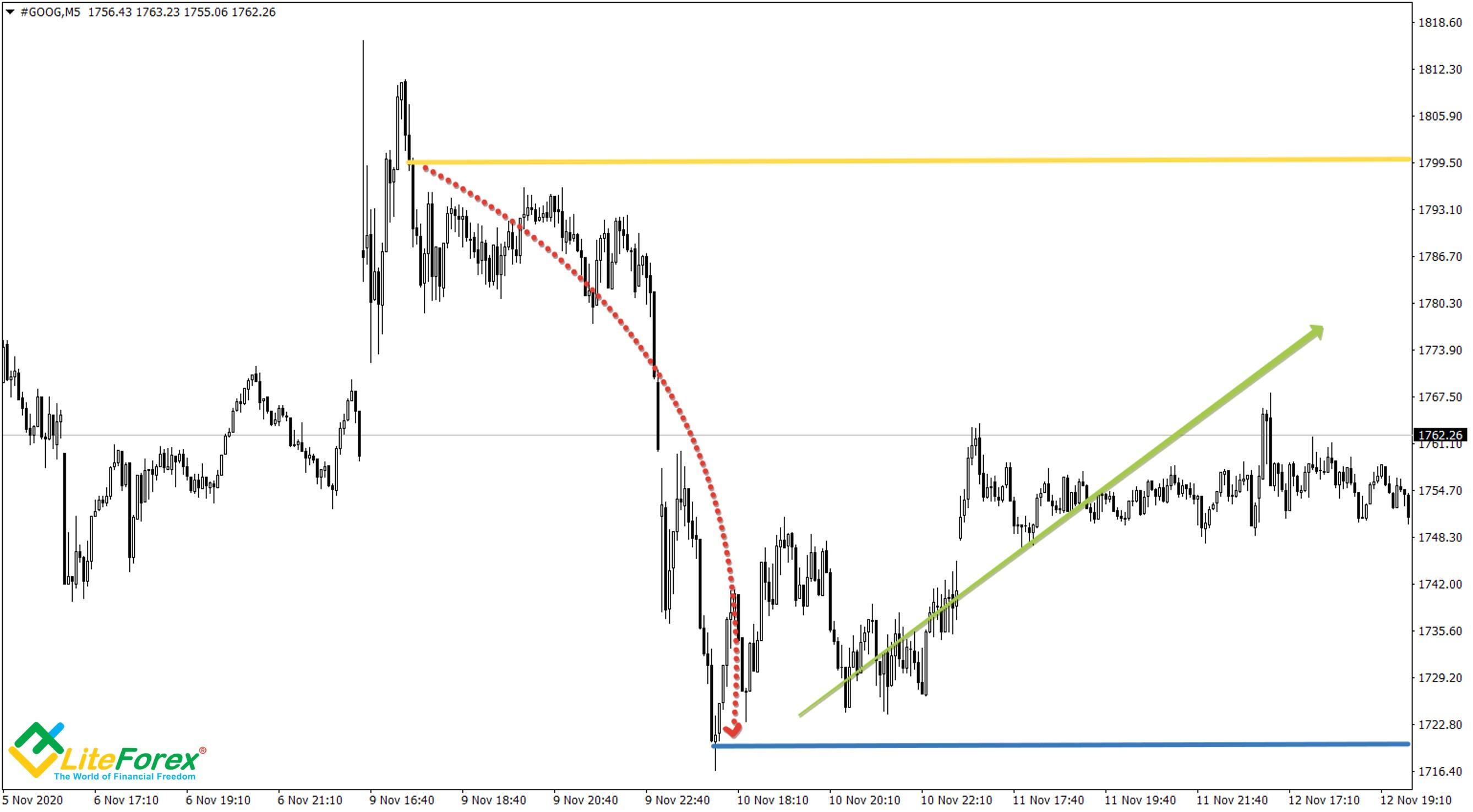

Here is a simple example. Let's say Google shares are trading at $1,800. The trader expects a bearish correction from the current levels but sees potential in the security and starts looking for good levels to maximize profits.

Not wanting to waste time, they set a Buy limit order at $1,720. This is where the trader expects the correction to end.

The chart shows that over time, the price reached this level, and the buy order was executed.

Take profit and stop loss orders

Stop loss and take profit orders are given to the broker in order to automatically close a trade when the price reaches a certain level. Read more on why traders need the in the article “Stop Loss and Take Profit in Forex”.

Take Profit

For some reason, beginners often confuse Take profit with Stop limit. In fact, they are applied completely differently and serve different purposes. So, now we will take a closer look at Take profit.

This order locks the profit when the price reaches a specified level. How does it work? The golden rule of trading is to always set targets for each trade. Take profit helps you catch the highly anticipated moment when the price reaches that target. This order's execution involves placing an opposite order - long position for a short one and vice versa. As a result, the remaining position goes to zero, and the trader fixes the difference between the buy and sell prices on their balance sheet as profit.

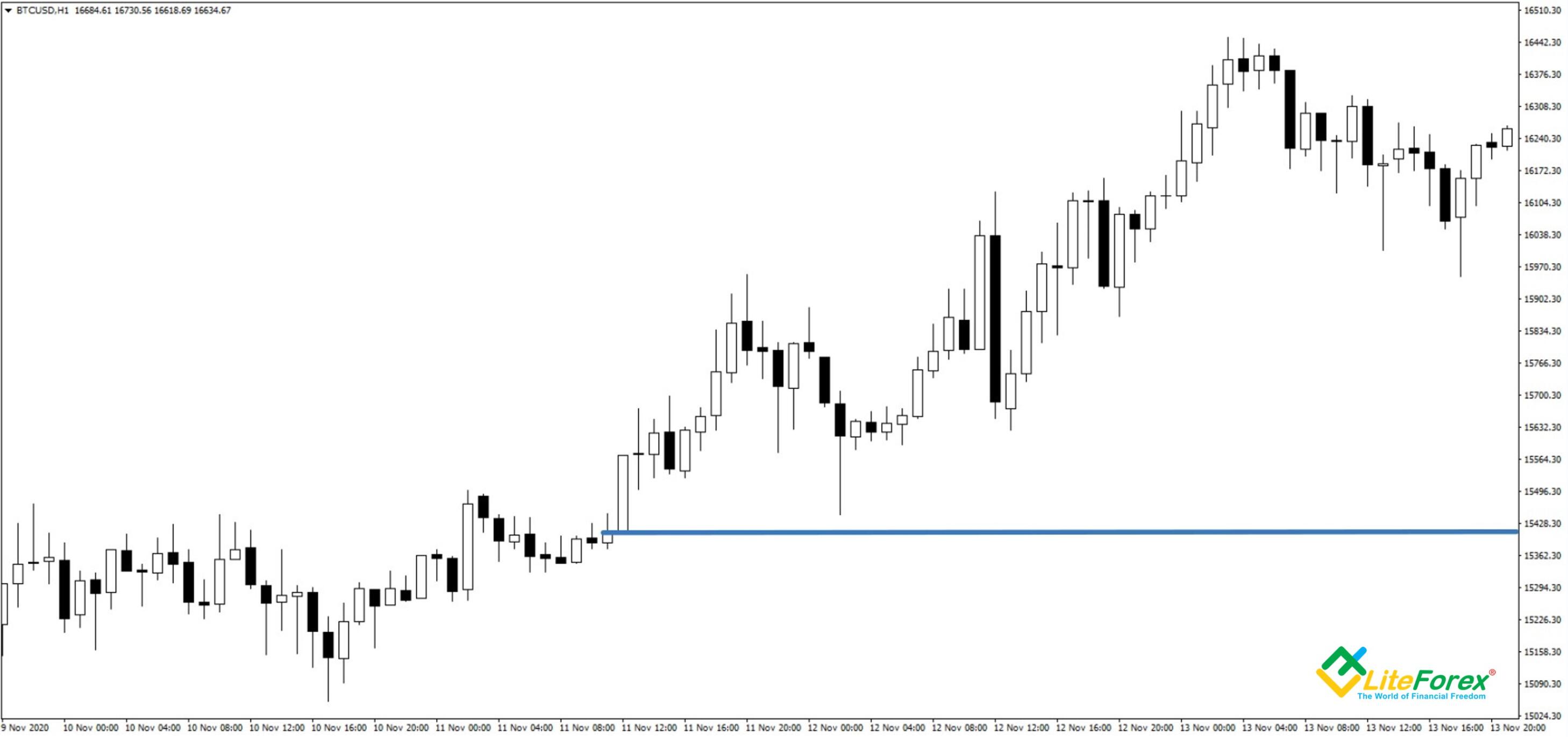

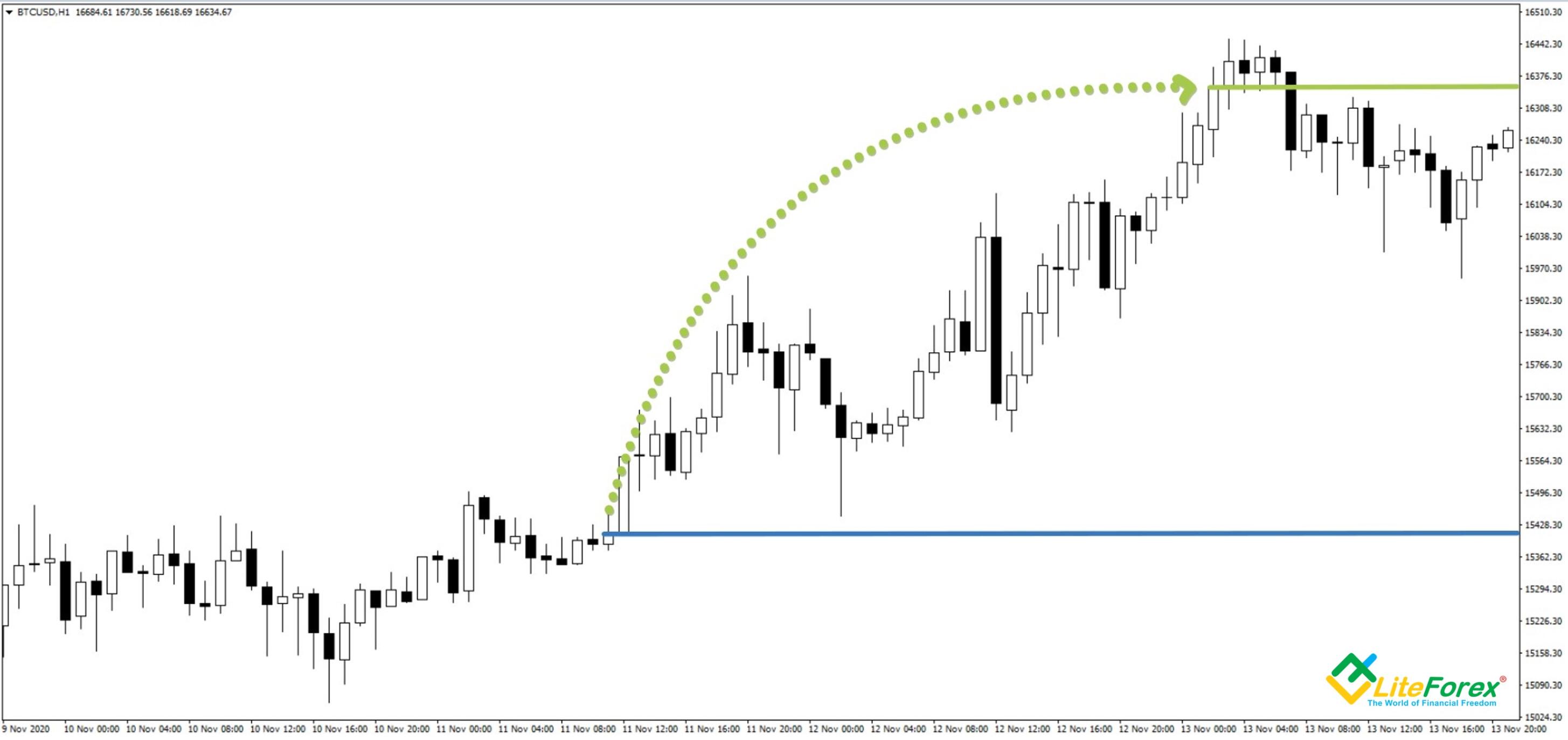

Take profit has two sides. On the one hand, it limits profits. On the other hand, it reduces the risk of losses during a trend reversal. Let's see how Take Profit works on the Bitcoin chart.

Expecting a further rise of BTCUSD, we enter the market at the blue line.

We believe that the price will rise steadily to 16,350 points. We set Take profit at this level (shown as the green line).

As soon as the price reaches the green line, the position will be closed automatically.

Read more on how to work with Take Profit here.

Stop Loss

A stop order is one of the basic trading orders. It limits losses if the market moves in the opposite direction from what was expected. In fact, it’s the opposite of Take profit. TP sets limits for profits, and SL - for losses. Similar to Take profit, when the price reaches a specified level, the order is triggered, automatically closing the position.

This order can be used for an open and pending position. Moreover, SL can be set for both short and long positions.

Let's illustrate this with an example.

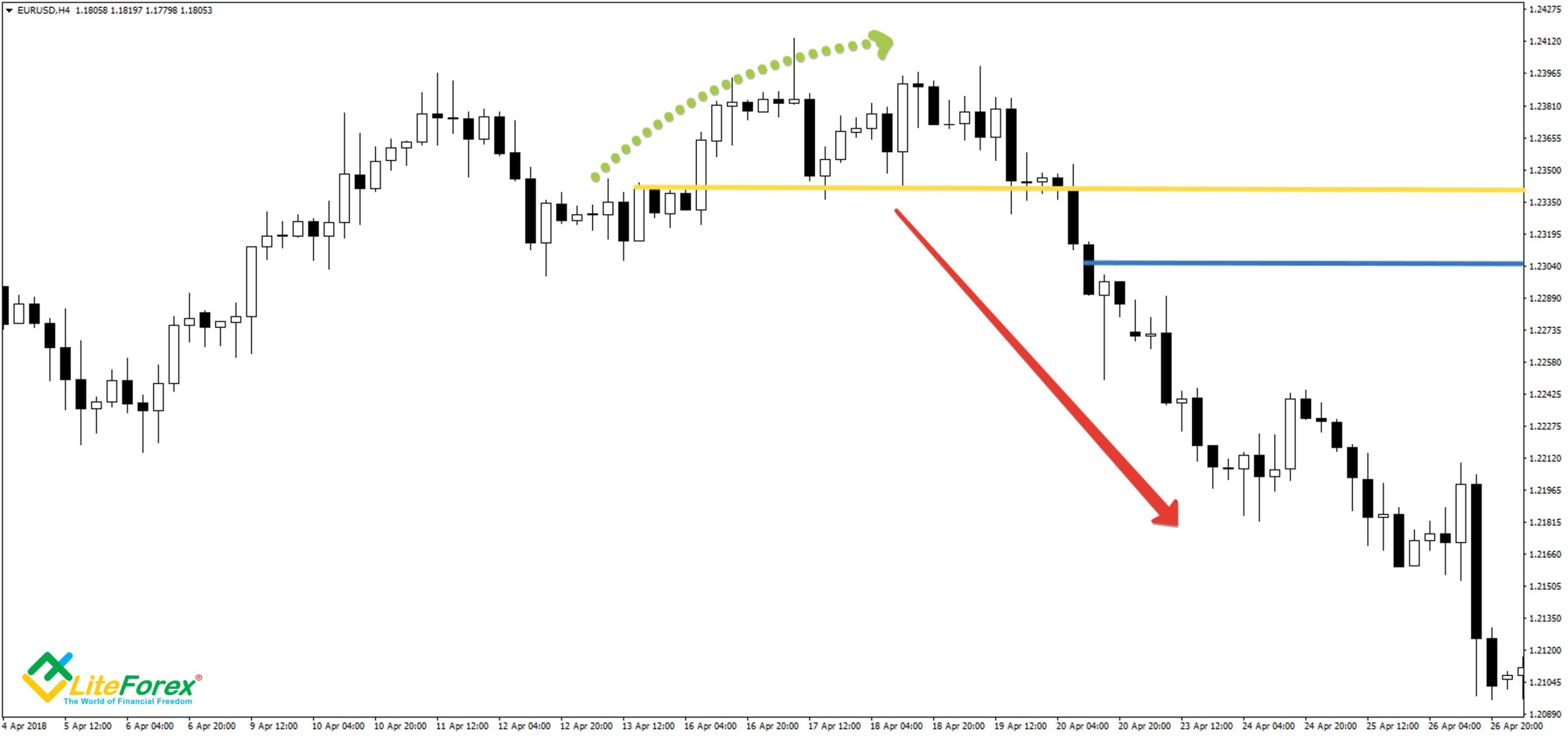

Suppose we expect the asset growth to continue and open a short position at the blue line.

To limit losses if the situation unravels differently, we set Stop loss at the red line.

The initial downward ended quickly, and a profitable position turned into a losing one. Then there was an upward reversal (green arrow), which led to the crossing of the Stop loss, position buyback, and fixed losses.

This example shows the importance of correctly determining SL andTP levels. Even one mistake can turn a successful trade into a losing one. At the same time, it’s also not recommended to neglect them. If you do, you can quickly lose control over risk and deplete your deposit.

Specifics of Order Execution

Buy market and Sell market, Stop loss and Stop limit, and the other orders described, are based on one simple idea. Imagine yourself purchasing goods in a store using one of two ways:

- At the seller's price

- Bargaining for a more reasonable price

In the first case, you will definitely receive the goods at a fixed price. In the second case, you can purchase at the desired price or better, but it might not take place. Exchange orders work similarly. Here, pending orders act as a trading instrument.

The order book is an important concept. All orders - buy and sell - are collected here. Like in the market, there are sellers of the same product at different prices. Let's say you've sent a 50-lot order to a liquidity provider. However, there are only 20 lots available for selling. Therefore, the remaining 30 lots will be executed at a lower price. In this case, the trader will experience slippage, and their position will be opened at the average cost.

In addition to pending orders, there are orders for immediate fill. If a broker agrees to the specified price, a position will be opened successfully. If it’s impossible to execute the order, the broker rejects it, and it offers a requote - the current asset price with guaranteed execution.

What else causes slippage? Imagine you’ve set a Sell stop at 308 pips. When the price reaches the target level, the broker will send a sell request to the supplier, which usually takes a split second. But even in such a short time, the asset value can change, e.g., reaching 310 points. Thus, the actual execution price will be 310, the price stated - 308, meaning the slippage will be 2 pips.

How to Place Stop and Limit Orders on MT4 / MT5

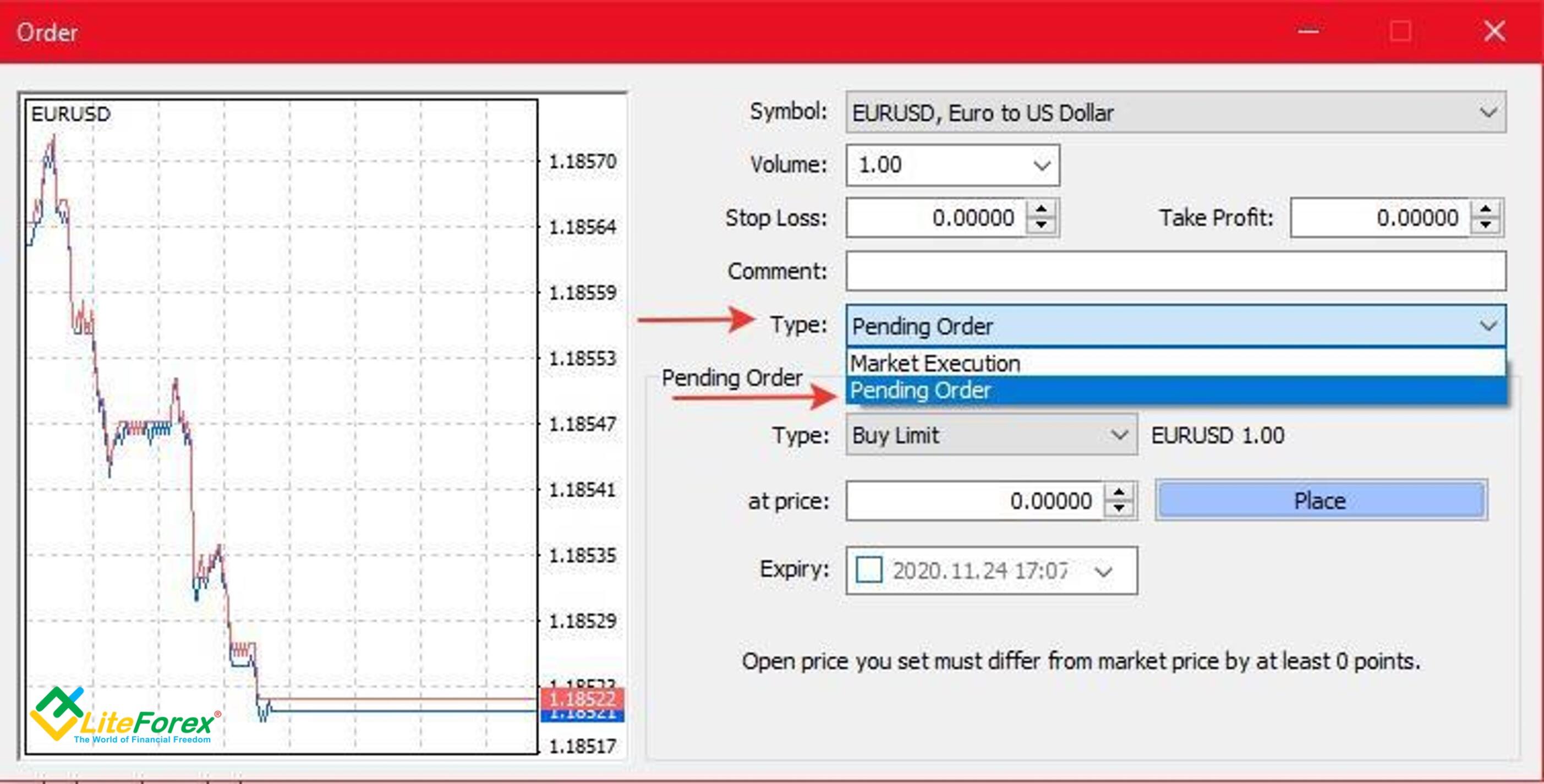

Creating pending orders in MT4 and MT5 is very easy. I will give you step-by-step instructions.

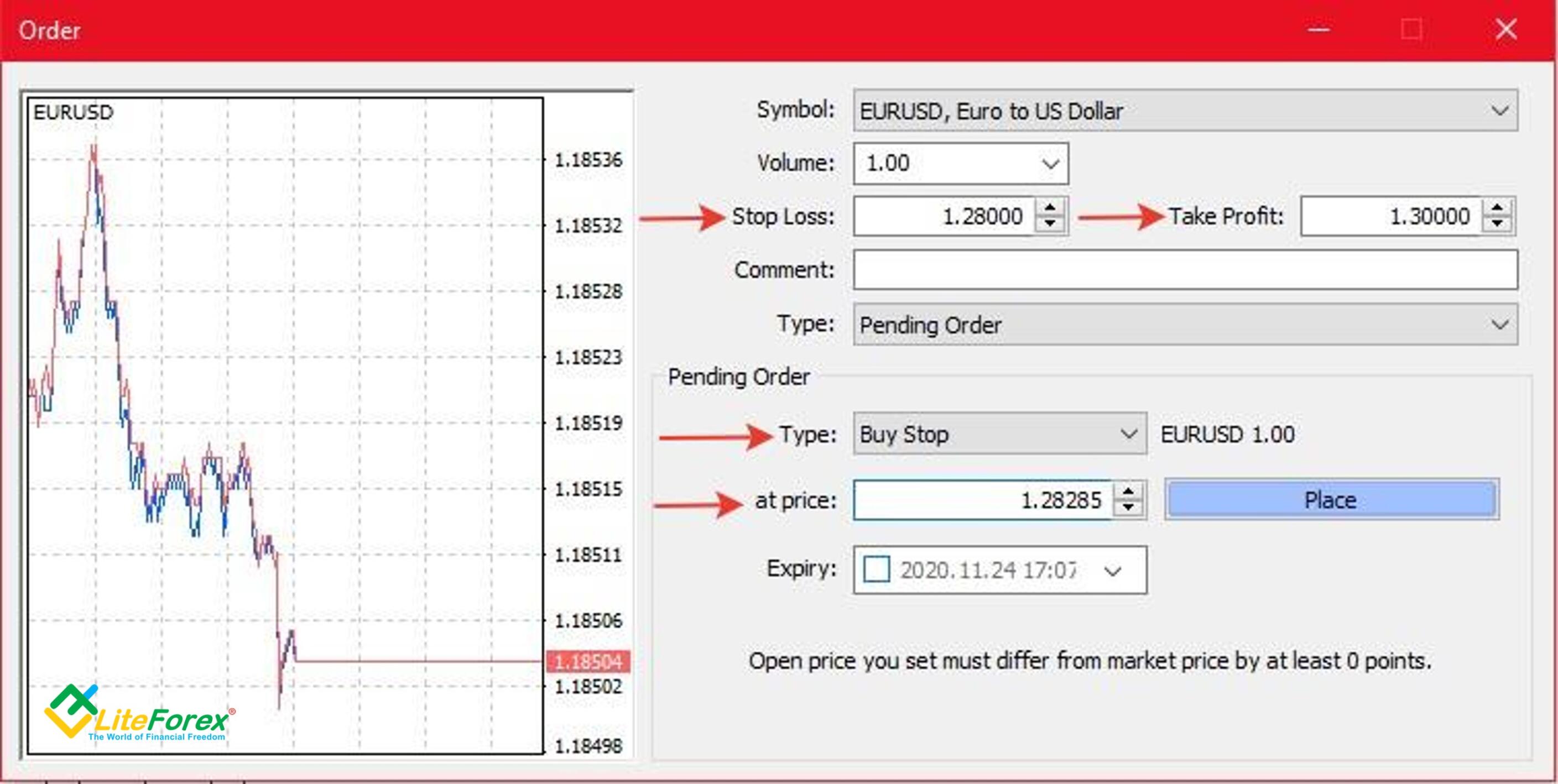

Click New order and the settings window will appear. Select In Pending order in the Type tab.

Then, select the type of pending order. Choose a Buy Stop order and specify the price for order execution. And, if necessary, set the goals and the level of acceptable losses.

When to Use Each Order Type: Strategy

I will give you another example to illustrate the difference between Stop and Limit orders in real trading.

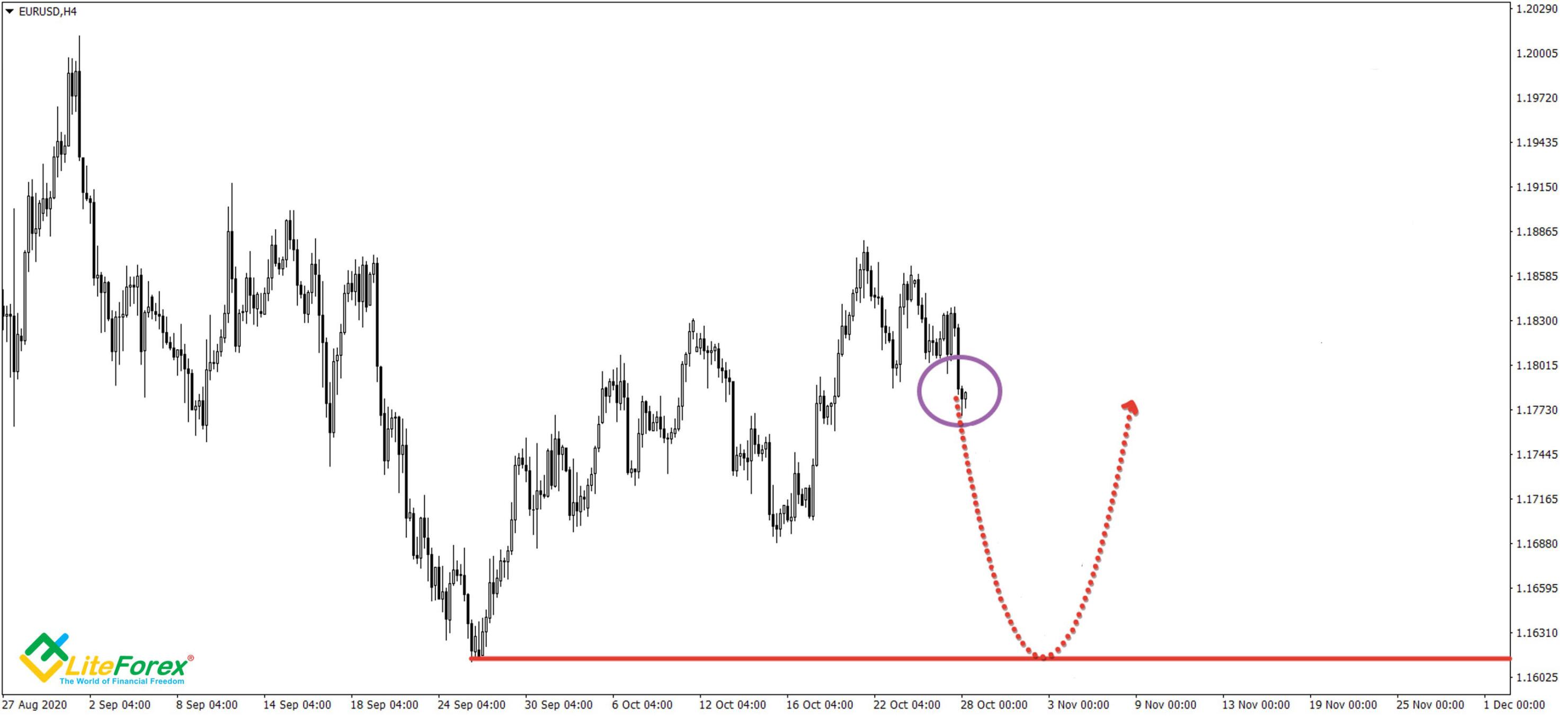

The purple oval shows where I am on the EURUSD chart. I see another correction wave after an unstable growth with no signs of a bullish movement.

At the same time, I see that, historically, there is a strong support level at 1.1600, and if the asset falls, it is likely to rebound from that level.

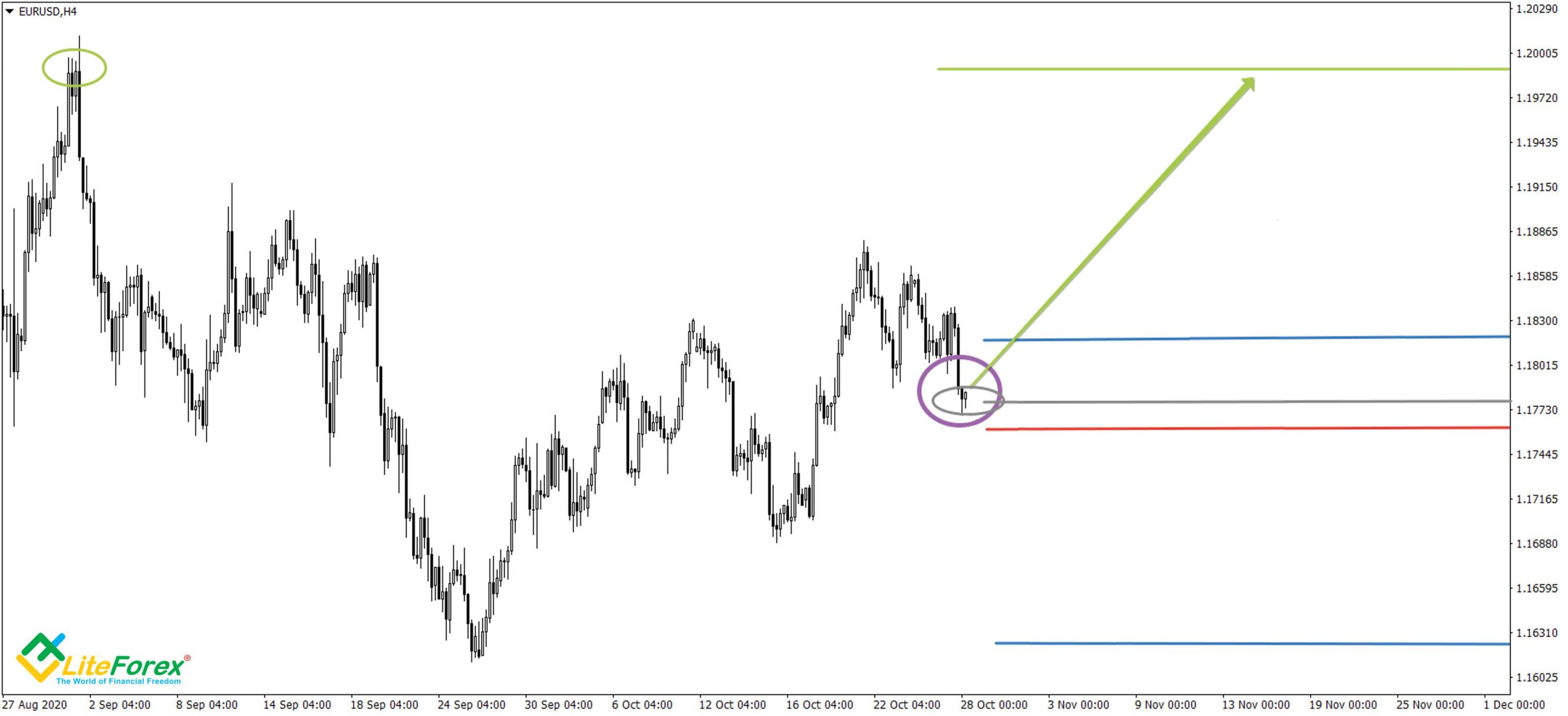

To catch this moment and avoid wasting time sitting in front of the terminal, I set the Buy limit at a price slightly higher than the previous minimum of 1.16250 - the blue line. Stop loss (red line) is placed below the support level, around 1.1590. I decided to set Take profit (green line) at 1.18250, based on the previous tops and trading channels (green ovals).

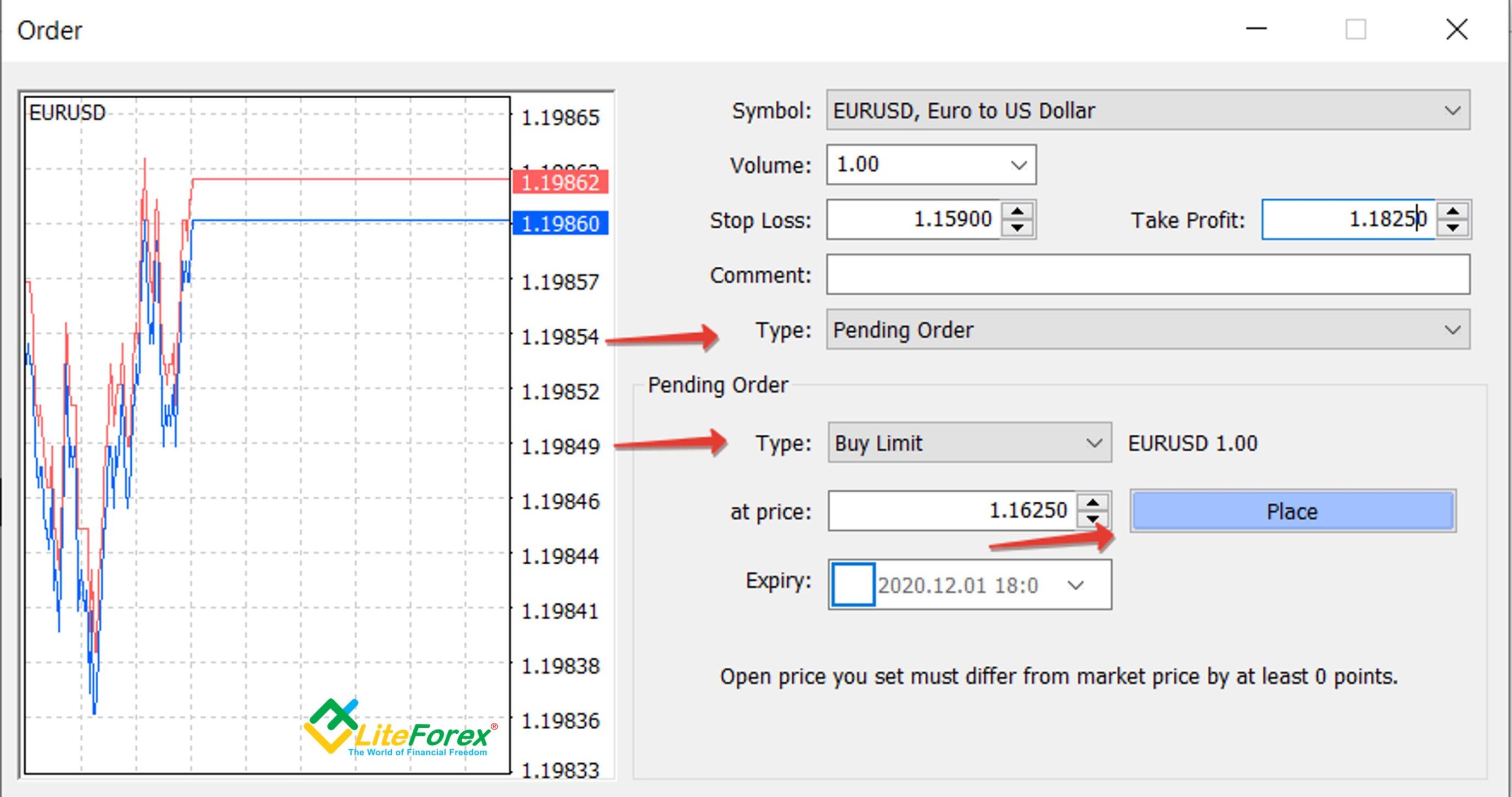

To avoid waiting for the reversal, I placed a Limit order by selecting Pending order - Buy Limit in the order settings window. I also made sure to set the lot size, SL, TP, and the price for order execution.

I counted on a rebound from the 1.16250 level and an increase to at least 1.18250.

Meanwhile, I only risk losing 350 pips with a profit of 2000 pips.

In addition to real risks, professionals also take into account alternative risks. In my case, it’s a situation where the market doesn’t reach the pending Buy limit order, makes a reversal earlier, and continues to grow.

The benefit of pending orders is that there can be an unlimited number of them. To hedge against an unexpected market move, such as early reversal, I placed a pending Buy stop order slightly above the market price. This is shown in the chart above.

We now have a simple two-order trading strategy. Real pros use four orders or more. For beginners, there is a risk of getting confused and canceling orders when there is no need for it.

In the chart above, you can see that the market followed the first scenario. The second Buy stop order serves no purpose and should be closed on time.

Conclusion

Having examined Limit orders, Stop loss, Take profit, and Stop limit in simple terms, we draw the unequivocal conclusion that pending orders are essential for successful trading. When used correctly, they save a lot of time. They allow you to control the risks of losses and fully manage your funds on the balance sheet.

The main difficulty is choosing the right order type and gaining experience in working with several orders at the same time. There isn’t much room for advice, except how to practice the skill of using different orders in real market conditions. You can do this risk-free in a LiteFinance demo account.

FAQ

A market order is an instruction to open or close a position. It indicates which action should be performed, the transaction volume, the asset value, and other parameters.

A limit order is a pending order that is executed or placed on the market when the price reaches a predetermined level. The goal is to catch a pullback or trend reversal.

A stop order is a pending order placed on the market if the market price reaches the trader's specified level. This one is typically used to follow a trend.

Buy stop is set above the current price when the trader expects further asset growth. When the asset value increases to the level set by the trader, it opens a long position.

Sell stop is placed below the current asset price when the trader expects the bearish trend to continue. When the price drops to the level specified by the trader, it opens a short position.

Stop limit is a pending order that is placed when the trader expects a market reversal. The main condition for a Limit order to be created is if the asset reaches the trigger price. When the chart reaches the specified limit, the trader enters the market.

Stop limit buy is a type of pending order. It involves setting the Buy limit after the chart crosses the trigger price on the Buy stop order. When the price reaches the limit, it opens a long position.

A limit order can be canceled until it is triggered. After the position is opened, it can only be closed at the current market price or if it reaches SL and TP levels.

Let's assume the current asset price is 400 pips, and it continues to rise. The trader expects a downward reversal. To avoid waiting for a bearish trend, they set the Sell limit at 410 points. When the price reaches the specified level, it automatically places a short order.

The trader opened a long position at 500 pips, assuming further growth to 800 points. To minimize losses if the market follows a bearish scenario, they set Stop loss at 400 pips. After the price drops to a certain limit, the trade is automatically closed with a loss of 100 points.

This order is placed below the current asset value. A short will be opened when the price drops to the specified level. Sell stop assumes that the price will continue to fall.

The activation price is the asset’s value. When the asset reaches this value, an order to buy or sell is placed with the trader’s parameters.

It’s recommended to set Stop loss below the local minimum, where there was a strong, substantial rebound.

A Sell limit order is placed near the expected reversal and is triggered when two conditions are met. Initially, the chart should move upward. After the bullish trend has exhausted itself, there is a reversal. When the price is falling, one of the candles crosses the position opening level, opening a sell trade.

A Buy stop order is set above the current price and is triggered when the asset value rises to the trader’s set level. To activate it, you need the chart to move down and an upward reversal. During an upward movement, a long position is opened when the set level is crossed.

It is a pending order where the price is expected to reach the Stop level. At this moment, the broker activates a limit order at the specified asset price. A position is opened when the limit is crossed.

Stop loss effectively minimizes losses for traders that can’t constantly monitor the market. If there is an undesirable situation, they can suffer significant losses. This order automatically closes the position at the specified level to control losses.

Market orders should be used when the current asset value allows you to get the maximum profit. If the market price isn’t suitable and moves in the opposite direction, it’s better to place a limit order. It will open a position at the most favorable moment after a reversal at a certain level.

Take profit is a pending order to close a trade when the price reaches a certain level. Take profit is useful when the investor is confident the asset will reach that level. Then, it may continue moving in the desired direction, but it may also reverse.

Take profit is set at a distance from an open position following the asset movement. With a long position, it will be set at a higher price, and with a short position, at a lower price. When the asset crosses one of the Take profit candles, the trader exits the market.

P.S. Did you like my article? Share it in social networks: it will be the best "thank you" :)

Ask me questions and comment below. I'll be glad to answer your questions and give necessary explanations.

Useful links:

- I recommend trying to trade with a reliable broker here. The system allows you to trade by yourself or copy successful traders from all across the globe.

- Use my promo code BLOG for getting deposit bonus 50% on LiteFinance platform. Just enter this code in the appropriate field while depositing your trading account.

- Telegram chat for traders: https://t.me/litefinancebrokerchat. We are sharing the signals and trading experience.

- Telegram channel with high-quality analytics, Forex reviews, training articles, and other useful things for traders https://t.me/litefinance

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.