Lot in Forex trading or on the exchange is a unit of measure for position volume, a fixed amount of the account base currency in the Forex market. The volume is always indicated in lots, and the position trade size directly affects the level of risk. The greater the volume of one lot in Forex, the greater the risk. Risk assessment (risk management) includes a model that allows you to accurately calculate the optimal amount of standard lot in the foreign exchange market based on the estimated account risk level, volatility (stop loss level), and leverage which comes with substantial risks. Read the article to find out about this model, how to use it, and how a trader’s position size calculator can help.

The article covers the following subjects:

- Major takeaways

- What is a lot in Forex?

- How to calculate lot size in Forex

- Maximum lot size in Forex

- What lot size to use in Forex: building an optimal risk management system

- What determines the lot size in Forex

- How does equity change depending on the lot size

- How to set the lot size in MT4

- What is a lot in other markets?

- Conclusion

- Forex Lot FAQ

Major takeaways

- In Forex, a lot is a standard unit for measuring the volume of a currency position opened by a trader, which directly impacts risk level.

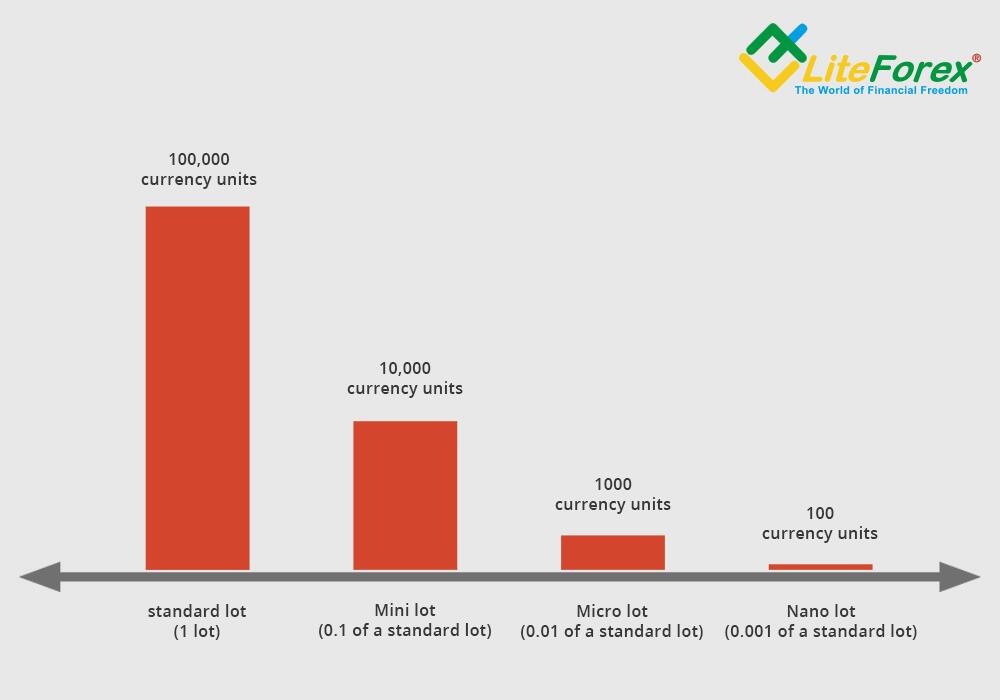

- One standard lot is typically 100,000 currency units of account base currency. There are smaller lot sizes, including mini (0.1 of a standard lot or 10,000 units), micro (0.01 of a standard lot or 1,000 units), and nano (0.001 of a standard lot or 100 units).

- Using smaller lot sizes depends on traders' risk management strategy and account type. For example, cent accounts allow for nano lot trades but with proportionally smaller profits.

- Brokers can provide different lot sizes, which helps reduce the minimum deposit amount even without using leverage.

- The concept of a lot extends beyond currency to other trading assets, such as oil. Traders must be aware of their broker's specifications and leverage rules when deciding on their position size.

What is a lot in Forex?

In the usual sense, a lot is a standard unit for measuring the volume of a currency position opened by a trader. That is the amount of money invested in the purchase of a currency in order to sell at a higher price later. Lot calculation is an element of the account risk management system. It is essential to know what is lot trade size to build a balanced trading system.

Let us find out what one lot in Forex market is.

The standard lot in Forex pairs is 100,000 currency units of account base currency. For example, if the EURUSD rate is 1.1845, you will need 118,450 quoted currency units to open the position of 1 lot. It means you will need 118,450 US dollars to buy 100,000 euros, which is the base currency.

The account base currency is the currency that is bought or sold for quote currency. It always comes first in the quote. The currency pair price is always expressed in the quote currency. For instance:

- 0.01 lot of the GBPUSD with a quote of 1.29412 means that you will pay 1 294.12 USD to buy 1 000 GBP.

- 0.01 lot of the EURAUD with the quote of 1.65981 means that you will pay 1 659.81 AUD to buy 1000 EUR.

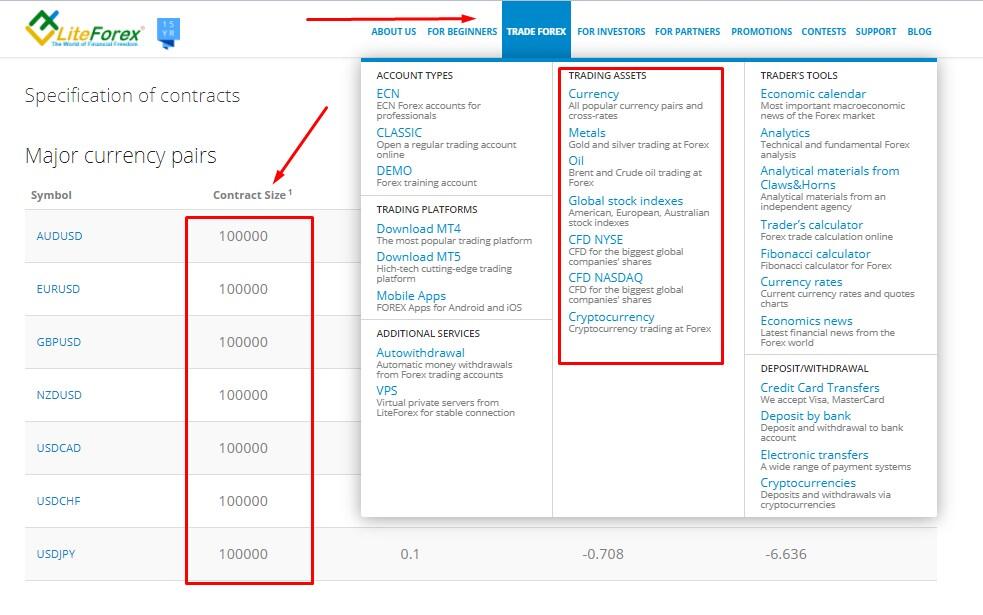

The value of 1 standard lot of 100,000 units of the account base currency is relevant for currencies. Other assets have a different position size meaning. For example, for stocks, this is the number of stocks. The number of stocks in a lot depends on what stock is meant. Oil is measured in barrels, gold - in troy ounces. You can see the lot value, the number of conventional currency units in one contract, in the specification.

A mini lot (it can be also written as minilot to mini lots) is 0.1 of a standard lot or 10,000 units of base currency.

A micro lot (it can also be written as microlot or micro-lot) is 0.01 of a standard lot or 1000 units of the base account currency.

- A nano lot (it can also be written as nanolot to nano-lot) is 0.001 of standard lot or 100 account base currency units. (You can rarely come across a nano lot in the brokers’ Forex trading conditions).

Most Forex traders set minimum and maximum lot volume for different types of trading accounts. The top limit is often at 100 lots; the bottom boundary is 0.01 lots. If we take the example above, the minimum investment will be $ 1184. If you use the leverage 1:100, then a minimum deposit of $11.84 will be enough to start.

However, it will be relevant provided that 100% of the money (which is unacceptable from the point of view of valid number account balance risk management) will be invested in the position. There is a second option - to use cent trading accounts (if the broker offers cent accounts). The only difference of cent accounts is that the calculations are in cents, not in dollars, so $11.84, in this case, is enough to buy the minimum micro lot without using leverage.

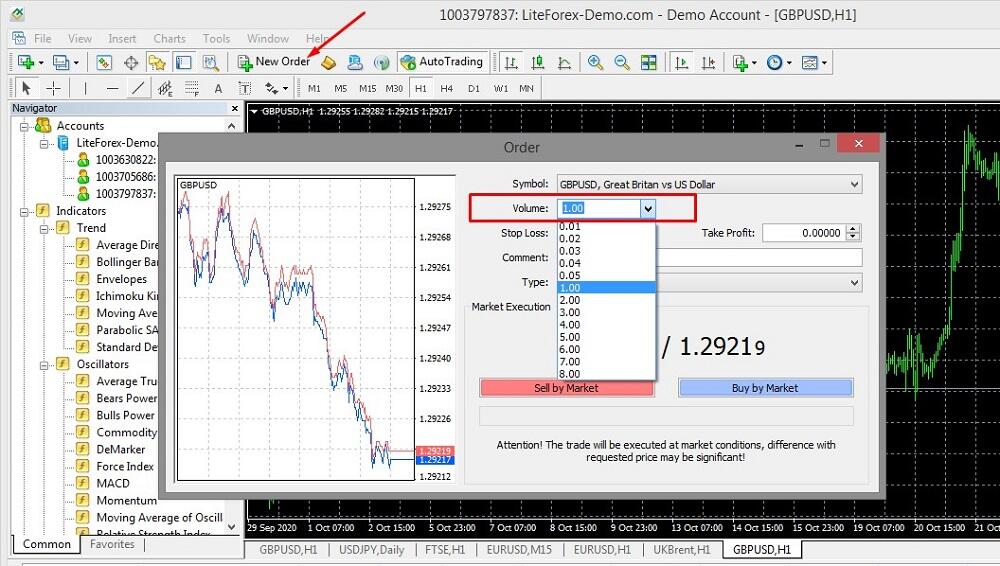

This screenshot displays an order being opened in the Forex trading terminal. You can select the different Forex currency pair lot sizes in the tab “Volume of a trade in lots.” The position size can be increased only step by step. The account specification determines the step size. For example, the minimum step trade size on the Classic account is 0.01 lots. The trader can manually enter the position volume accurate to the hundredth of a lot, for example, 0.06; 0.07 or 1.23 lots, and so on.

Important: Despite the standard terms, some brokers can use them differently. For example, one of the brokers has one lot equal to 10,000 base currency units. Perhaps this is intended to reduce the minimum amount of deposit currency without leverage. In any case, before you start to trade Forex, carefully read the offer, trading account details, and contracts specification.

How much is 1 Lot?

In the Forex market, you can only open positions in certain volumes of Forex trading units called lots. A trader cannot buy, for example, 1,000 euros exactly; they can buy 1 lot, 2 lots, or 0.01 lots, etc. According to the definition, lot is a term used to define the position size for a trading asset. It is the transaction trade size, the volume of the trading asset (currency trading, barrels of oil, and so on), which a trader could buy or sell.

Example. 1 barrel of oil is 40 USD. When a trader sets a buy or sell order, he/she does not specify the number of barrels; the single trade is defined in the number of lots. Lot is a contract size consisting of a fixed number of barrels, written in the contract specification. The position size of the contract for each broker can be different. One broker offers a lot of 10 barrels; another broker has a lot size of 100 barrels. In both cases, the transaction is made in the volume of 1 lot. In the first case, the trade means 10 barrels; in the second case – 100 barrels.

Mini Lot size

Mini lots are 10% of a standard lot. When you open a 1-lot single trade on a mini lot Forex trading account, you buy or sell 10,000 base currency units instead of 100,000 as with a standard lot. Mini lots are convenient as it requires less money to enter a trade, and so you need a smaller amount of deposit currency.

Micro Lot size

I will demonstrate a micro lot in a foreign exchange trading example.

The Forex trading asset is the EURUSD pair; the exchange rate is 1.1826. One standard lot is 100,000 of base currency. If you want to enter a single trade of one lot, you should spend 118,260 USD to buy 100,000 euros. If you are an individual trader, you are unlikely to have such capital at your free disposal. The minimum position size Forex under Forex trading conditions is 0.01. But even in this case, you need to invest $1,182.60. Risk management rules indicate an acceptable account risk per trade of 2% of the deposit currency amount. This means you need 1,182.60 * 50 = 59,130 USD for one minimum trade of 0.01 lot.

A micro lot is 1% of a standard lot. When you enter a EURUSD trade of 1 lot, you buy 1000 euros for 1 182.60 US dollars. A trade of 0.01 means you buy 10 euros for 11.83 dollars.

Nano Lot size

A nano lot is 0.1% of a standard lot. Nano-lot accounts are called cent accounts. One lot here corresponds to trade for 100 base currency units. If we take the example from the previous section, a trade based on 1 lot means buying/selling 100 EUR for 118.26 USD. The smallest possible transaction with a volume of 0.01 lot means buying 1 euro for 1.1826 US dollars

Regular accounts do not allow to make transactions for such small volumes. However, cent accounts have a drawback. Not only the transaction volume, i.e., investment, is 1000 times less, but also your potential profit is 1000 times less. So, professional Forex traders, who want to recoup the time spent and make real profit, do not use cent accounts.

Why could you use cent accounts?

To gain experience. The quotes on demo accounts are often different from real accounts. A Demat account is a kind of simulator, while the nano account is real trading in real market conditions. That is why beginner Forex traders, moving on from demo accounts, start from cent accounts.

To develop and upgrade currency trading strategies, test Expert Advisors on a real account. Forward testing will not give full confidence in the trading system’s performance in the real market. If the trading strategy is profitable on a cent account, it will work on a regular trading account as well.

To test new Forex trading tools, scripts, indicators (like pivot points, MA), and so on.

- To train emotional stability. It is more stressful to lose real money than to trade Forex pairs with virtual money.

Using Standard Lots

A standard position size is the maximum possible contract trade size provided by the broker's Forex trading conditions. Do not confuse the maximum lot with the standard one:

Standard lots, mini lots, micro lots – all these concepts define how many units are in one contract. For example, a standard lot is 10 barrels of oil or 100,000 euros in the EURUSD currency pair. A mini lot is correspondingly 1 barrel of oil or 10,000 euros.

A maximum lot is the maximum possible number of lots for a transaction. For example, 5 standard lots are 5 * 10 = 50 barrels of oil, 5 mini lots is 5 * 1 = 5 barrels of oil.

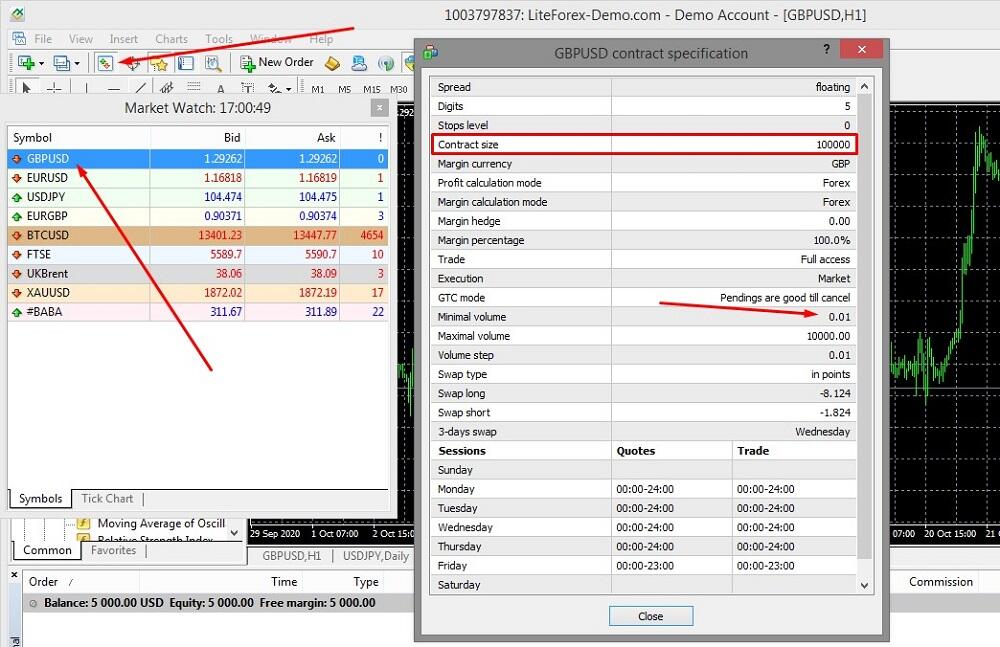

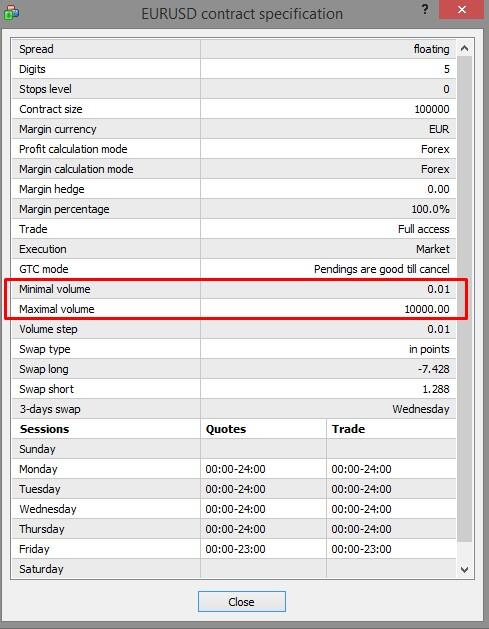

You can find the information about the lot type used on a Forex trading account in the MT4 contract specialization. In the Market Watch tab, right-click on the asset (currency pair) and select the Specification tab.

It is clear from the specification that the contract trade size is 100,000, so the lot is standard. The specification also reads that you can enter a trade of a minimum volume of 0.01 lot or the maximum volume of 10,000 lots. In MT4, the trade volume can be selected in the window of the position opening:

The minimum transaction volume for the GBPUSD pair is 0.01; the maximum is following the specification. The volume is not limited to 8 lots, as in the screenshot - you can enter any number up to 10,000 in 0.01 increment. For example, 10.02, 10.03, etc.

I will give an example to explain how the trade volume affects the deposit currency amount, margin, and profit/loss. To compare, I will open in the LiteFinance terminal two demo currency trading accounts with a deposit of 2,000 USD each, with a 1: 100 leverage. I will open positions with a volume of 1 and 0.1 lots.

I first open a trade based on 1 lot:

Out of 2000, the broker immediately blocks $ 1,174.47 as collateral, and a floating loss of -11.00 USD appears. There will not be enough money to open a second order with the same amount of money.

Now I open a position of 0.1 standard lot:

Of the 2000 USD, only 117.46 is reserved as collateral. I can use the remaining cash balance of 1880.64 to open new positions for the same or other assets. If you reduce the position size, you can open positions, but the financial result also decreases. For example, in this case, the floating loss is less, it is -1.50 USD.

So, the main takeaway is:

- The less is the transaction volume, the more positions you can open. For example, you can enter trades on different assets.

- The less is the transaction, the more free funds you will have on your account. So, you can stand with a more significant drawdown before the trades are stopped out.

- The less is the transaction, the less is a potential profit/loss.

If you are sure in your Forex trading decision to buy or sell, you can open a trade with a higher volume to increase the profit. If you have doubts, you’d better open a position with a smaller volume to reduce a potential loss. Aggressive strategies with a high risk percentage suggest entering trades with the maximum possible lot to increase the deposit currency amount. Conservative strategies suggest minimization of loss rather than chasing after the high profit, so they imply entering trades with a small volume.

How to calculate lot size in Forex

For whatever asset you enter a trade, it will in any case be made in the account currency. In most cases, it is the USD. Therefore, it is crucial for Forex traders to understand how much money they will actually have reserved in USD when opening a position, for example, for a cross rate. A cross rate is a currency pair that doesn’t contain the US dollar (for instance, when you trade Forex with the franc versus the yen).

The easiest way to use the trader position size calculator or Forex market lot calculator to find out the position size in Forex market:

Why should you accurately calculate the lot size:

To optimize the position volume in relation to the deposit amount, considering the risk percentage and the expected profit. I will help you develop a balanced trading system.

- To select the right position size and the system of the deposit increasing so that the total Forex trading position will be resilient to drawdowns, price corrections, pullbacks, and volatility (valid number stop loss level).

Remember, the leverage size does not affect the risk percentage if there is a clearly defined target for the position volume. With the same position size, the change in leverage affects only the amount of the collateral.

You should also note whether a direct or an indirect quote when calculating the pip. For example, the pip price in the EURUSD pair is 10 USD in the Forex currency pair standard lot. In the USDJPY pair, the pip price will already be 9 USD. The lot calculation formula will be is like this: (1 point *lot size)/market price.

Next, I will explain examples and formulas for calculating a position size in USD for different types of assets.

1. Example of lot size calculation in Forex

To easily calculate the lot size, follow the steps below:

Lot = contract size * trade volume * asset price

- Example 1. The contract size for a stock is 1; 1 lot is 1 stock. The stock price is 54 USD. 1 lot is 54 USD.

- Example 2. The contract size for the EURUSD Forex pair is 100,000; the price is 1.23456. Lot value = 1.23456 * 100,000 = $ 123,456.

2. For direct currency quotes:

Lot = contract size * trade volume

- Example. The contract trade size is 100,000; trade volume is 0.1 lot or 1000 base currency units. The rate of the USDCHF – 0.91070. Lot value in USD = 100,000 * 0.01 = 1,000. This means that with a trade volume of 0.01 lots, 9,107 CHF will be bought and 1,000 USD reserved by the broker.

3. For cross rates:

Lot = contract size * trade volume * asset price / quoted currency price

- Example. The contract size is 100 000, the trade volume is 0.01 lot or 1000 of the base currency units. The GBPCAD exchange rate is 1.72608, the base currency is (the first in the pair) GBP, the exchange rate of the USDCAD is 1.32972. The lot value is 100 000 * 0.01 * 1.76028 / 1.32972 = 1 298.08 USD

How to calculate the pip value?

Depending on what a trading unit is (lot, mini lot, or micro lot), and also depending on what is meant by it, the price of a pip is determined. The pip value is the profit or loss that a trader receives in the currency of the deposit when the price passes 1 pip (point) in one direction or another. The pip is also very easy to recalculate using the trader position size calculator mentioned above.

The pip value for one full lot (trade of 1 lot):

- Standard lot: 1 pip yields a profit of 10 USD.

- Mini lot: 1 pip yields a profit of 1 USD.

- Micro lot: 1 pip yields a profit of 10 cents.

- Nano lot: 1 pip yields a profit of 1 cent.

If you enter a trade of 0.1 lot, the pip amount decreases ten times correspondingly. With a standard lot, one pip yields a $1 profit. Differently put, the gain of one pip in a trade of 0.1 standard lot is equal to the profit of 1 pip in a trade of 1 mini lot.

Example of lot size calculation on Forex

There are the following input parameters for the position size calculator:

Deposit: 3000 USD.

Risk Percentage — 5% per trade.

Leverage — 1:100.

- Valid number stop loss — 50 pips.

The position amount will be 3000 * 100 = $300,000. If we are going to start trading 100% of the money in one trade, then the maximum volume of the lot will be 2.4 lots given the EURUSD rate at 1.2500. But we are going to stick to the risk management rules. Allowable risk percentage per trade will be 3000 * 0.05 = $150. Since we can afford a maximum drawdown of 50 points, the maximum allowable price of one point is 150/50 = $3. Let me remind you that for one standard lot, the outlay of one point is $10. Hence the maximum permissible lot is 0.3. The minimum is 0.01. Since for 0.3 lots we need $37,500, we are trading $375 (12.5% of the deposit, which is in accordance with the risk calculator management rules) and use a leverage of 1:100.

Thus, the lot volume depends on the drawdown the trader allows in the position size calculator. Here, the simple model in Excel will show the dependence of the lot on the drawdown (or stop loss).

The second calculation method using leverage says that all open positions’ maximum risk should be no more than 15%. 3000 * 0.15 = $450, which with a leverage of 1:100 is $45,000. We divide the trading position by the current rate (say, 1.2500 for the EURUSD). 45,000/125,000 = 0.36 lots. The result is almost the same as the previous one, but I don’t like this method. It does not take the drawdown into account.

If the trader adheres to the rigid rule “a fixed percentage of the deposit per transaction” and “a fixed percentage of the deposit for all transactions in the market,” then the leverage is not essential. The greater the volume of the lot, the higher the pip value, and the faster the deposit will disappear in case of price reversal.

Managing the volume of open positions includes the following:

Identifying the optimal ratio of the volume of open trades and risk calculator level. High volatility can deplete the deposit quickly; the trader's task is to choose the optimal ratio of the open trades’ volume to the deposit, taking into account the risk. In financial markets with a strong trend, the management of trade volumes should involve the use of lot increase coefficients (an element of the Martingale strategy).

- Evaluation of the viability of the total position in the market. “Should I close unprofitable trades or wait out?” This is a classic Forex market problem that you can solve by managing the volume of trades. The risk calculator strategy includes a model that would allow selecting the optimal resistance and support levels without reaching a stop out by adjusting the position volume and leverage. In other words, there is a stop-out level, and there is a strong level where the price will change direction with a high probability. The model will allow you to choose the optimal position volume at which the deposit will withstand the drawdown to the main level without reaching stop out.

Maximum lot size in Forex

Regardless of what type of lot is indicated in account’s Forex trading conditions, there is always its minimum and maximum value. You can find out the maximum position size in the contract specification in, for example, in MT4.

Example 1.

This is the screenshot of the contract specialization of the EURUSD currency pair. The contract trade size is 100,000. It means that the standard lot is used on the account.

The minimum possible trade is 0.01. It means that you can only buy a minimum of 1,000 euros, which would require $ 1,182.4 at the rate of 1.1824.

The maximum lot is 10,000. It means that you can buy 100,000 * 10,000 = 1,000,000,000 euros, for which you only need 1,182,450,000 USD.

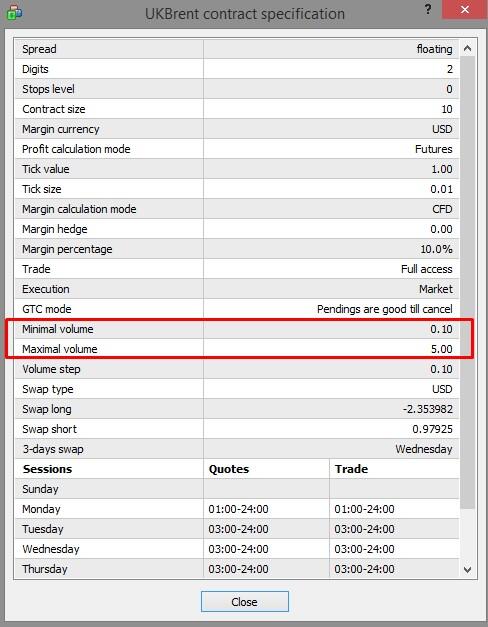

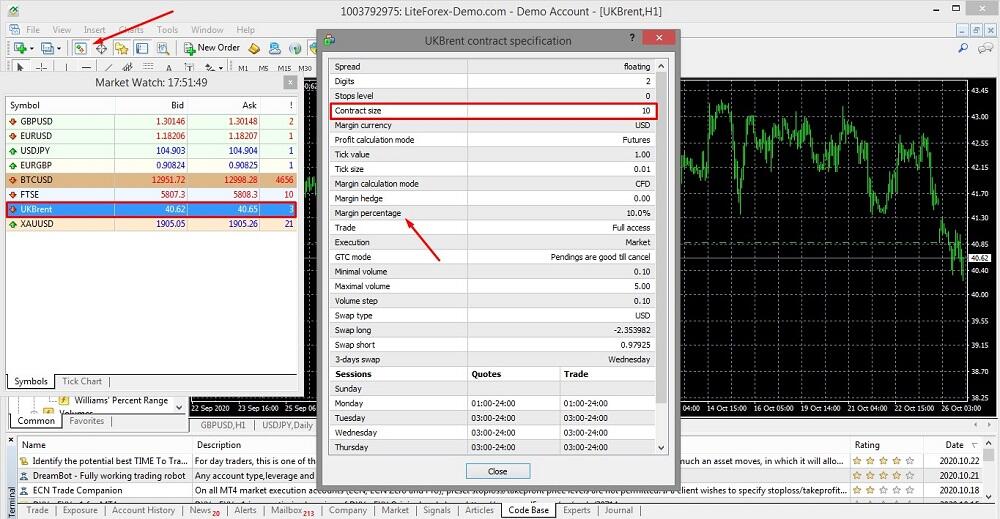

Example 2.

This is the contract specification on the UKBrent, oil contracts. One standard lot is 10 barrels, one barrel costs 41.07 USD.

The minimum lot is 0.1. This means that you can buy at least 1 barrel for $ 41.07. You can’t trade Forex pairs with a smaller volume.

The maximum lot is 5. It means that you can buy 5 * 10 = 50 barrels, which will require 41.07 * 50 = $2,053.50.

Important! These calculations do not take into account the use of leverage and the specified margin percentage. Leverage reduces the required trading amount however implies some substantial risks.

What lot size to use in Forex: building an optimal risk management system

An optimal risk management model should answer the following questions:

What level of risk is the trader willing to take on? What is his risk tolerance? What losses are acceptable according to profit targets? The greater is the risk; the greater is the potential profit. Conversely, the amount of potential loss also increases. Everyone determines the optimal balance for themselves. Alternatively, a combination of conservative and aggressive strategies is possible.

What volume of the transaction must be in order to comply with the rules of the risk management system? Risk management rules are based on mathematical probability and progression. The transaction volume is accurately calculated based on the average and current volatility (stop loss levels), the amount of the deposit, and the leverage that reduces the amount of the collateral blocked by the broker however comes with substantial risks.

What is the level of allowable drawdown and at what level should you place your stop loss? Based on the volume of the position and, accordingly, the value of the point, the trader estimates the level of volatility (stop loss levels) and determines the valid number stop loss point.

Input parameters for building a Forex trading model that affect the level of risk are the following: Transaction volume in lots and lot type, leverage, pip value, stop loss level, spread level, risk calculator per transaction, the total risk level of all open transactions in relation to the deposit, deposit amount, target profits.

Models for calculating the optimal trading position size manually and using a position size calculator:

Nearly all trader’s position size calculators have the same problem: you cannot accurately calculate the lot volume with regard to the risk level, although this is precisely the point of planning trading volumes. I suggest that you use the following formula as a risk calculator:

% risk is the amount of the deposit that the trader is willing to allocate for the trade (the notorious recommended 5%, which I have mentioned above). A is a coefficient equal to 1 for a long trading position and -1 for a short trading position. Price 1 and Price 2 - the opening price and the stop loss level. The stop loss level in this case is one of the options for averaged or maximum volatility, which I also mentioned above.

What determines the lot size in Forex

The standard position size in currency pairs is a constant value, 100,000 basic currency units. However, the amount of money locked by the broker as a margin to maintain Forex trading positions is different; it depends on the asset value and the trade size of the opened position. You can enter two trades of 1 lot each; the different sums will be blocked. The higher is the asset price, the more significant sum will be taken as a margin, and the higher will be the risk for a trade.

You should choose the lot size trade based on the following factors:

- The volatility of the asset and its assessment method (stop loss level).

- The acceptable risk level for all open trades, which each trader determines for themselves.

- Deposit amount.

- Leverage (depending on the calculation method).

How does equity change depending on the lot size

Trading account equity in the Forex currency pair market is free funds on a trader's account available for Forex trading. The amount of free funds changes during the trading process due to the margin used to maintain opened positions and the amount of floating profit or loss. Remember, the pip value for the EURUSD pair is easily calculated according to the formula: 0.0001 * 100,000 * trade volume. The increase in the pip value means an increase in potential profit or loss. With a minimum position size, the trading account equity changes slowly, gradually. If you increase the position volume, the rise, or the plummet in the trading account equity becomes sharper and faster.

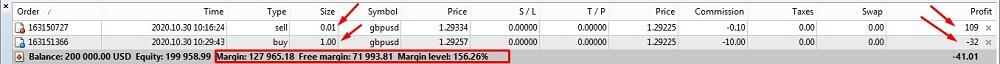

- Example. There is a demo account with a deposit of 200,000 USD and a 1:1 leverage. I open two EURUSD positions. One is of 0.01 lot. Another position is opened a few minutes later with a volume of one lot.

The margin is a little more than 1000 USD. There is a small profit of 1.07 USD (after we deduct the spread) from the first minutes. Next, I open the second position of 1 lot.

The Margin (assets used) sharply increases; the Margin Level decreases. All trades could be stopped out as a result of such an unwise strategy. The loss of a few dozens of cents turns into a few dozens of dollars.

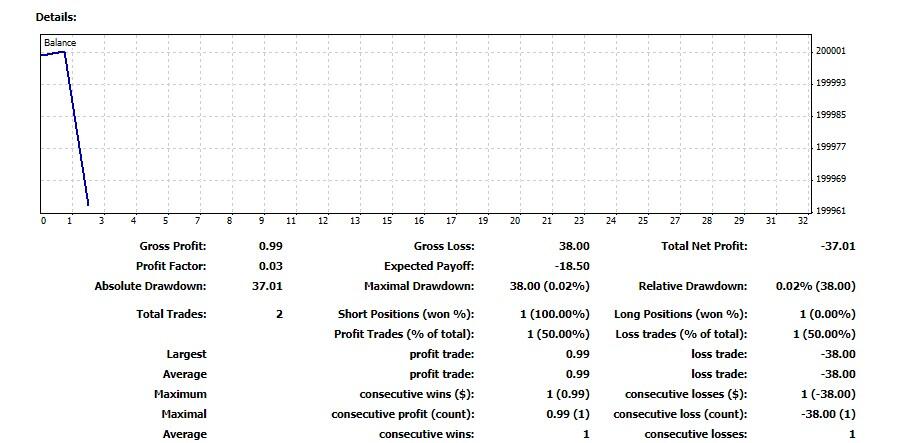

I exit the trade. In MT4, I open the Account History tab and right-click on it. I select the option Save as a detailed account.

This is the Balance change. After entering the first trade of 0.01, I made a small profit. It is the short section of the blue line in the chart, which is directed upward. Next, there has been an opposite trading position of 1.0 lot. The instant loss is shown by a sharp drop in trading account equity.

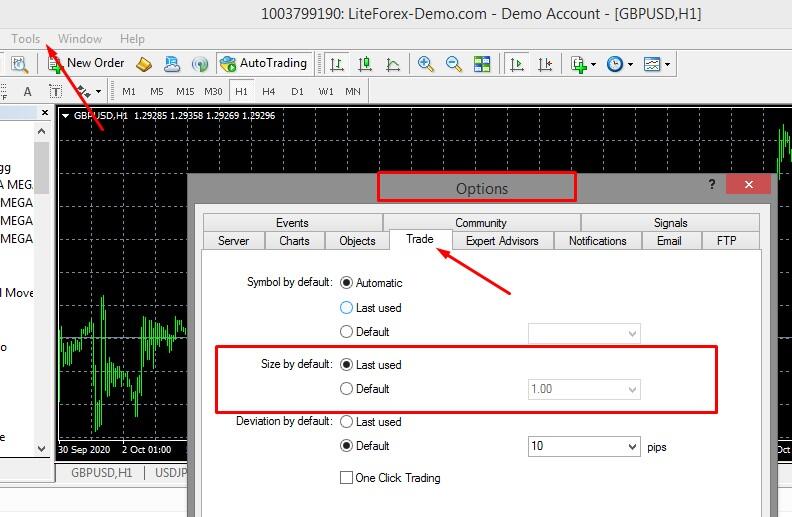

How to set the lot size in MT4

When you open a new order in MT4, the default lot size is 1.0. When it is about split seconds, it is impossible to change the trade volume constantly. If you always enter trades with the same volume, you can set the position volume as follows: Tools – Trade - position Size by default.

In the Expert Advisers, the initial size of the lot is set in the Lots parameter. You can also use the system of automated position size calculator by enabling the UseMoneyManagement parameter. You should specify the risk level with the risk calculator and the maximum size of the lot.

What is a lot in other markets?

A lot in any market is a contract. The only difference is in the measurements and quantity of the asset included in 1 lot. For currency pairs, the lot is the number of base currency units, for gold - a troy ounce, for oil — barrels. For stock indices, one lot is the price of one share.

1 lot of oil

The position size calculator in commodity markets is similar. You follow these steps:

Step 1. Open specification to see the contract trade size for the instrument. You can do it in the following ways:

- Open the contract specification on the LiteFinance website via this link.

- Open the contract specification in MT4. First, add the instrument into the Market Watch window (View/Symbols/Oil, add UkBrent). Next, find the "Market Watch" icon on the toolbar, right-click on the UkBrent asset and call the contract specification.

The specification on the LiteFinance website or in MT4 says the contract size is 10.

Step 2. We calculate the amount required to enter a trade of 1 standard lot. The oil price per barrel is $41. The contract size in the specification means that 1 lot is equal to 10 barrels of oil, which means 41 * 10 = 410. So, you will need 410 USD to open a trading position of 1 lot.

Note! If you open a trading position of 1 lot in the LiteFinance terminal, you will need 41 USD instead of 410 USD, i.e., the price of one barrel.

Reason. In the MT4 specification is a Margin Percentage line; the value is 10%. It is different for different assets. The margin percentage is similar to the leverage, which in this case is equal to 10%. In other words, when trading using leverage, there is a trading position opened with a 1:10 leverage, which is ten times less than the size of the lot.

Important moment: no matter what leverage you set for the account (1: 1 or 1: 100), the trading position on CFDs on oil, metals, and stocks will be opened with the leverage written in the specification in the Margin Percentage line. You can read more about margin percentage and Forex currency pair trading using leverage in the article What is Leverage in Trading: Ultimate Guide for Beginners.

Start trading with a trustworthy broker

1 lot gold

One standard lot XAU is easily calculated in the same way as one lot of oil. The specification states that the size of the contract is 100 troy ounces. If the cost of one ounce of XAUUSD is $1902, then the trader will need 1902 * 100 = $19,029 to buy one standard lot of gold. Again, we look at the Margin Percentage in the specification. The margin percentage is 1%, which corresponds to a leverage of 1: 100. This means you can open a trading position of 1 standard lot (100 ounces) at the price of 1 ounce.

Note! The margin percentage allows you to open a trading position of a higher volume than your deposit can afford, but the point price is higher.

Lot and stock indexes

Brokers have different approaches to determining the contract size for the stock CFD. On the LiteFinance trading platform with a user-friendly interface, the size of one full standard lot for all indices corresponds to one contract. But when you calculate the value of a lot, you need to consider the margin percentage and the currency of the contract, the trade size and value of the tick.

Example:

The MT4 specification indicates a margin percentage of 1%, which corresponds to a leverage of 1: 100; tick size is 0.1; tick value is 0. The specification on the LiteFinance website reads that the contract currency is GBP; the current GBPUSD rate is 1.29492. The cost of 1 full standard lot will be: 1.29492 * 5576.2 * 0.1 / 100 = 7.22 USD. This will be the amount of the collateral that the broker will block.

How many shares are in a lot

The number of shares in a lot depends on whether you work with an exchange or a broker. In the stock market, 1 lot size can be both 1 share and 1000. LiteFinance has 1 lot equal to 1 share.

What is a lot in the exchange?

Since the price of shares may be in the corridor from a few cents to thousands of US dollars, the approach to the lot’s terminology is different here. In most cases, NYSE and NASDAQ set the value as “1 lot = 100 shares”, and it is almost impossible to buy a fraction of a lot.

It is easier to invest through a Forex pairs broker. Trading with a broker, you can also invest in securities of the world's leading companies and stock indices. There are a number of advantages in comparison with stock trading:

Smaller contract sizes. For individual securities, the size of a standard lot is equal to one share. A small deposit is enough to open a deal, while on the stock exchange, the minimum trade volume can be from USD 1,000 and more.

Greater leverage.

You can open short trading positions.

You can’t buy a lot of less than 1 share on the exchange. A broker allows trading stock CFDs so that you can split a lot.

You can try the functions of the brokerage trading platform free here. After the registration that takes a couple of minutes, you can open a demo account and enter trades on any instruments. Try, it is easy and exciting!

Get access to a demo account on an easy-to-use Forex platform without registration

Conclusion

Assessing the risk level and calculating the maximum allowable lot volume is one of the risk management system’s foundations. Deviations are acceptable. In volatile markets, it makes sense to lower the risk level for each new trade, but at the same time, increase the length of the stop loss. On the contrary, in trend markets, it makes sense to put short stop signals and use the method of increasing the trading position. Before you start trading, you should calculate the minimum, average and maximum length of stop loss in the historical period (separately for each instrument). You can prepare a model that will allow you to quickly change the input data and adjust the trade volume in case of changing market conditions. If you have questions, please ask them in the comments. Good luck in your trading!

Forex Lot FAQ

Trading involves substantial risks and to mitigate them, follow general rules of risk management:

- When you trade Forex pairs, the trade volume should not be more than 2%-5% percent of the deposit amount. It is about the amount of money that is blocked by the broker as collateral.

- The total risk should not exceed 10-15% of the deposit. The risk means the maximum possible loss. It depends on the size of the stop loss and the pip value. For example, with a $100 deposit and a $1 pip value, the maximum stop length is 10-15 pips.

- Assess the level of the current volatility in comparison with the average value. At times of increased volatility, reduce the volume of transactions, put stop loss levels.

- Focus on the trading strategy type and the chance of the roundup forecast error.

Go through the following steps:

1. See the contract size in the specification.

2.Calculate the lot size according to the following formula:

- For indirect quotes and CFDs: contract size * base currency price.

- For direct quotes: the lot is equal to the size of the contract.

- For cross rates: contract size * asset price / quoted currency price to USD.

How many units are in one full lot depends on the lot type:

- Standard lot - 100,000 base units.

- Mini lot - 10,000 base units.

- Micro lot - 1,000 base units.

- Nano lot - 100 base units.

Example of the value of 1 standard lot in Forex pairs:

- 1 lot EURUSD = 100 000 EUR.

- 1 lot USDJPY = 100 000 USD.

- 1 lot NZDCAD = 100 000 NZD.

It means that you enter a trade with the volume twice as much as 1 lot.

For example:

NZDCAD micro lot. 1 micro lot means a trade volume of 1000 NZD. When entering a long trade of 1 lot, you buy 1000 NZD. 2 micro lots: the trade volume is 2000 NZD.

EURUSD standard lot. 1 lot means a trade with a volume of 100,000 EUR. When you open a long position, you buy 100 000 EUR. The position volume of two lots means you buy 200,000 EUR.

Brent/USD standard lot. 1 lot means a trade of 10 barrels, 2 lots means 20 barrels.

It depends on the asset value, leverage, and risk management strategy. For example:

- FTSE Index. The price of 1 lot is 7.2 USD. If the risk per trade is 5%, it is allowed to open a trading position of 10 USD. Therefore, the permissible transaction volume is 1 standard lot (in indices, lot splitting is not allowed).

- UKBrent. The cost of 0.1 lot is $ 3.71 for 37.11 per barrel. You can open a trade with a volume of 0.3 lots for $ 11.15.

- EURUSD. With a leverage of 1: 100, the cost of a 0.01 standard lot would be just over $ 11. This is the optimal trading position size.

- XAGUSD. The price of a minimum lot size of 0.01 is 11.6 USD. This is almost in line with the risk management policy.

There can't be the best or the worst size of the lot in the Forex market. The appropriate trading position size depends on:

- Deposit amount.

- Risk management rules and the allowable level of risk (use a risk calculator).

- Trading conditions for the account (a standard lot, mini, micro lot, cent accounts).

- Profit targets. The larger the size of the lot, the greater the potential profit. However, the pip value will increase in this case, and so, the greater will be the level of risk.

- Trading instrument and conditions written in the contract specification.

- Your investment objectives and personality trades.

This is the volume of the asset that you buy/sell for the currency of the deposit. For instance:

- 1 standard lot of GBPUSD at the rate of 1.3056 means that you buy 100,000 GBP (GBP is the base currency) for 130,560 USD. Or when you sell one lot, you get the corresponding amount in USD.

- 1 GBP USD mini lot at the rate of 1.3056 means that you buy 10,000 GBP for 13,056 USD.

- 1 standard lot for Brent/USD at $ 41per barrel means buying 10 barrels of oil for $ 410.

- 1 standard lot for XAUUSD for $ 1902 per ounce means you buy 100 ounces for $190,200.

The broker’s trading conditions determine the minimum and the maximum trade volume in lots find them out in the offer, trading account conditions, or specification in MT4. For example, for currency pairs, the minimum position size is 0.01, the maximum is 100. For oil CFDs, the minimum lot is 0.1, and the maximum is 5. Check the minimum and maximum position size values for a particular instrument from the broker's support service or trading platform.

The value of 1 lot depends on two parameters: the type of lot and the underlying asset. For example, in currencies, 1 standard lot is equal to 100,000 base currency units, 1 mini-lot is 10,000 units, and a micro-lot is 1,000 units.

Under LiteFinance trading conditions in terms of financial assets, 1 standard lot is equal to:

- Currencies - 100,000 units.

- Oil - 10 barrels.

- Gold - 100 troy ounces.

- Silver - 5000 troy ounces.

A mini lot is 0.1 of a standard lot. For example, if a trade of 1 standard lot of Brent crude oil is 10 barrels, then 1 mini lot corresponds to trade of 1 barrel. 0.1 mini lot is equal to 0.01 standard lot or 1 micro lot.

1 standard lot = 10 barrels;

1 mini lot = 0,1 standard lot = 1 barrel;

1 micro lot= 0,01 standard lot = 0,1 mini lot = 0,1 barrels.

A micro lot is 0.01 standard lots or 0.1 mini lots. For example, if the EURUSD change rate is 1.02, a standard lot will be 100,000 base units, a micro lot is 1,000 base units. A trade with a volume of 1 micro lot means that it will take $1,020 to buy 1000 EUR.

1 standard lot = 100,000 EUR.

1 mini lot = 0,1 standard lot = 10,000 EUR.

1 micro lot = 0,01 standard lot = 0,1 mini lot = 1,000 EUR.

1 standard lot in USD = current_pair_price × 100,000.

1 standard lot is equal to:

- for currencies - 100,000 units of base currency ( 1 EURUSD lot = 100,000 EUR), to know the price in the quote currency (USD) you should multiply the position size by the price of pair;

- for Oil — the price of 10 barrels in USD;

- for Gold — the price of 100 troy ounces in USD;

- for Silver - the price of 5000 troy ounces in USD;

- for Shares - the price of 1 share in USD.

P.S. Did you like my article? Share it in social networks: it will be the best "thank you" :)

Ask me questions and comment below. I'll be glad to answer your questions and give necessary explanations.

Useful links:

- I recommend trying to trade with a reliable broker here. The system allows you to trade by yourself or copy successful traders from all across the globe.

- Use my promo code BLOG for getting deposit bonus 50% on LiteFinance platform. Just enter this code in the appropriate field while depositing your trading account.

- Telegram chat for traders: https://t.me/litefinancebrokerchat. We are sharing the signals and trading experience.

- Telegram channel with high-quality analytics, Forex reviews, training articles, and other useful things for traders https://t.me/litefinance

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.