This Personal Capital review goes over the Personal Capital app, which is something that you need! This free financial app will allow you to manage your money better.

Do you understand your money? Are you properly managing it? Today, in this Personal Capital review, I am going to go over my favorite personal finance tool, and explain how it will help you improve your financial life.

Over 3,400,000 people use Personal Capital, and I am one of those people!

Personal Capital provides free personal finance software that is somewhat similar to Mint.com, but better. If you like using Mint, I highly recommend checking out Personal Capital.

I recommend that everyone sign up for Personal Capital, whether you’ve been investing for years or if you haven’t even started yet. There is something for everyone when it comes to this free financial software, and it is extremely beneficial. Plus, it is free, so there is nothing to lose.

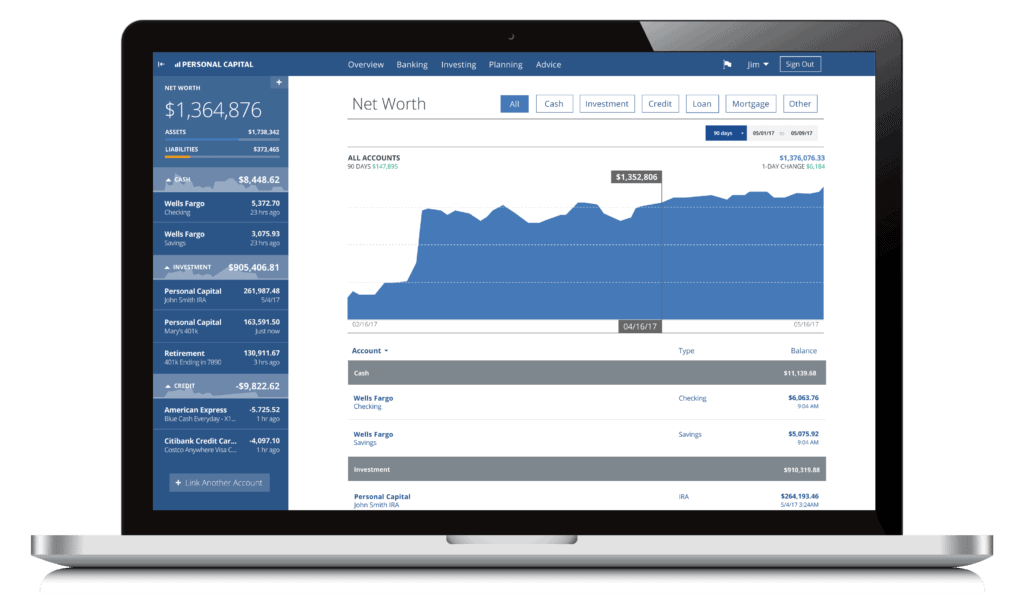

Quick summary of what Personal Capital is – their free personal finance software allows anyone to better manage their finances by allowing users to aggregate their financial accounts. You can connect accounts, such as your mortgage, bank, credit cards, investment portfolio, retirement, and more, and it is all FREE. You can track your cash flow, your spending, how much you’re saving, how your investments are doing, and more. With their free financial software, you can easily see all of your accounts in one place so that you can manage everything efficiently.

I’ll say it again. It’s free, and there’s no catch!

As you know, I’m all about making your finances as simple as possible so that you can focus on other areas of your life. Personal Capital allows you to manage all areas of your financial situation in one convenient place.

You can use Personal Capital via your computer, tablet, cell phone, and even a smart watch, which makes it great because you can stay up to date on your finances no matter where you are.

Personal Capital review.

Background information before we get into this Personal Capital review.

Personal Capital is growing in popularity, so I thought it was a great time to publish a Personal Capital review just in case any of you are interested in trying out their free personal finance software.

Personal Capital currently has over 3,400,000 registered users and over $20.5 billion assets under management.

If you’re interested in signing up for Personal Capital for free, please click here.

What can you do with Personal Capital?

With the Personal Capital app, there are many tools such as:

Net worth calculator

You can track your net worth and measure your progress. This will help you reach your financial goals and see how you are doing. This allows you to track changes, make educated decisions, and monitor and reduce your debt.

Cash flow

You can manage your cash flow, view your income, analyze your spending, view your bills, and more with the free Personal Capital app. You can also view your transactions so that you can see where your money is going, which helps you see what areas you need to work on when it comes to your spending.

Retirement planner

You can track your investment portfolio all in one place so that you can easily track your performance, see your investment allocations, and easily analyze everything related to your investments. The Personal Capital Retirement Planner will also tell you if you have saved enough for retirement.

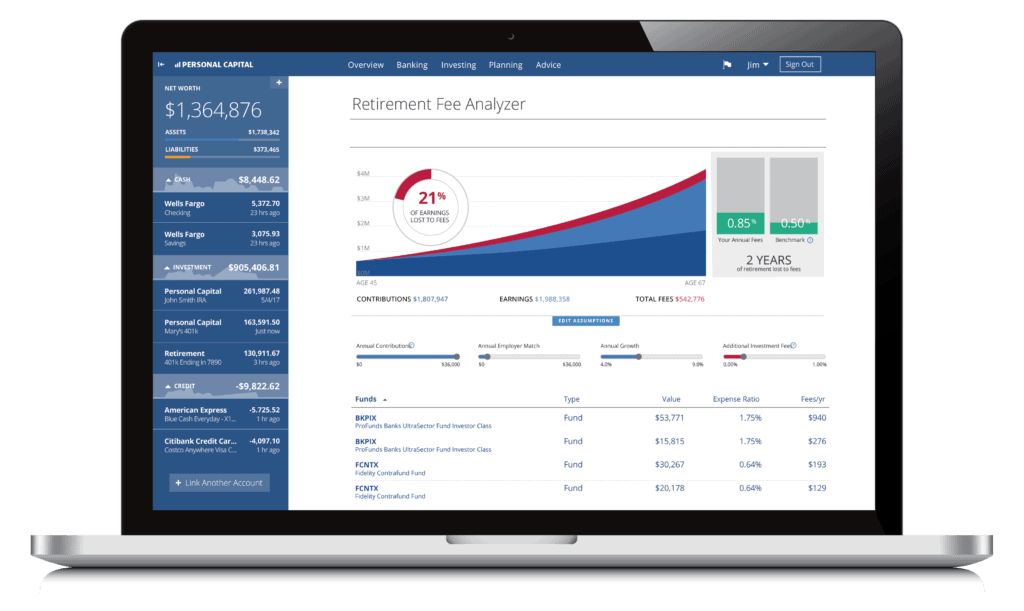

401k Fee analyzer

Do you know how much you are paying in fees for your various investments, such as with your 401k? There are often many fees that people pay for with portfolio management, but there are much cheaper options when it comes to investing your money.

With Personal Capital, you can easily see what fees you are paying, and Personal Capital shows you how this may be impacting your retirement plan.

Free investment checkup

You can receive a free investment checkup as well. You can see how your investments are performing, receive a free examination of your portfolio, and hear great advice so that you can improve your investment and retirement situation.

Their Investment Checkup tool creates a personal financial plan so that you can analyze your risk assessment and see how prepared you are for retirement.

How does Personal Capital make money?

So, after reading about all of the benefits in my Personal Capital review, I’m sure you’re probably wondering what the catch is and what the Personal Capital fees are.

Their core service, which is the Personal Capital platform, is free. If you choose to use their personalized investment strategy, they earn an income from their management fees, which are less than 1%. However, you don’t have to enroll in that service if you don’t want to. The free Personal Capital platform is all that I use, and it is a great service!

Again, you don’t have to pay for Personal Capital if you do not want to. All of the services I mentioned above are completely free. However, they are hoping that if you enjoy their services, you will eventually go a little further and let them manage your investments.

I just use their free version, and you can do the same to have access to all of their amazing free personal finance software. There’s no catch at all, it’s seriously free, and there are no hidden fees.

You can sign up for the free Personal Capital here.

Personal Capital security – Is Personal Capital safe?

The security of your financial information is very important, so, of course, I want to talk about this topic in my Personal Capital review.

Your information is very safe with Personal Capital. Here’s what Personal Capital says about their security:

“Data is encrypted with AES-256 with multi-layer key management, including rotating user-specific keys and salts. Strict internal access controls – no individual at Personal Capital has access to your credentials.”

Also, with Personal Capital, you can’t actually move any of your money through their system, and no one else can, so your information and money are safe in this way as well.

What’s my opinion on Personal Capital?

There are many pros of Personal Capital, which is why I decided to create this Personal Capital review. Some of the positives include:

- It’s free. What’s better than free?

- They have high-quality financial tools. Not only is it free, but the tools included with the free version of Personal Capital help you manage your money.

- Personal Capital is easy to use. You simply link your accounts, and Personal Capital does all of the analyzing for you. Personal Capital helps in so many different areas, and anyone can benefit from its easy to use platform.

- The variety of platforms makes it easy to use anywhere. You can access Personal Capital from your laptop, cell phone, or smart watch, which makes it easy to check in on your financial situation.

Personal Capital is a great service that I definitely recommend signing up for, and I wouldn’t write a Personal Capital review if I didn’t think so. Like I said, it’s free, and the financial tools are great.

You can sign up for Personal Capital here.

How do I use Personal Capital?

Signing up and using Personal Capital is very easy. After you create your account, you will be asked to link various financial accounts. Then, you can start using their free personal finance software right away. It’s really that easy!

Click here to sign up for Personal Capital.

Is Personal Capital worth using?

Yes, I think that Personal Capital is worth using. There are many investors, households, and people all over who enjoy using this tool.

The dashboard and platform are so very easy to use, and they also have advisory services that you can take advantage of. If you have investment accounts or are interested in starting to save for retirement, Personal Capital is a no-brainer tool.

Personal Capital works well for so many different types of people, whether you are brand new to saving or if you have been saving and investing for years.

The free financial tools that Personal Capital provides make it very easy to see how you are doing. They even have a mobile app so that you can check in whenever you’d like.

I hope you enjoyed my Personal Capital review! Please let me know if you have any questions about their money management tool.

What do you use to manage your finances?

Leave a Reply