What is micro-investing? Lately, I have been hearing a ton about micro-investing, so I thought an article on the topic would be great. My sister-in-law and editor, Ariel Gardner, has been using micro-investing apps for over a year, and today she is going to teach you all about this topic.

I heard about micro-investing for the first time a few years ago, and I was immediately intrigued.

The idea is that you’re investing on a small scale, and it’s meant to appeal to new investors who feel intimidated by traditional investing.

Maybe you feel like you don’t have enough money to start investing or investing just seems too difficult. There’s also the reality that the market goes up and down on a regular basis — also scary for anyone who’s new to investing.

Micro-investing aims to remove all of those barriers and teach you that investing is more accessible than you may have thought.

About a year after I learned about micro-investing, I decided to try it out and invest through a couple of different apps — Stash and Acorns.

Today, I’m going to tell you what I’ve learned through the process and about some of my favorite micro-investing apps available now.

A Beginner’s Guide to Micro-Investing

What is micro-investing?

The simplest micro-investing definition is that micro-investing is investing with small amounts of money.

Your money is used to purchase micro or fractional shares of stocks or ETFs instead of full shares.

Micro-investing has serious appeal to new or younger investors because one of the major barriers to investing can be the cost.

For example, a single share of a stock is $116.03. That means you would need $116.03 to purchase one stock.

Through a micro-investing app, you can purchase $5 worth of that $116 stock. And if you did have the full value to invest, you can spread it across multiple assets to diversify yourself. It’s lower cost, and in some cases, lower risk.

Another major appeal of micro-investing is that many of the top apps act as robo-advisors. You enter information about your age, income, target retirement age, etc., and the app recommends investments to help you reach your goals.

That’s where the reduced risk comes into play — micro-investing apps spread your dollars across multiple funds so you can have a balanced investment approach. You can realistically expect to have shares in dozens or even hundreds of different companies.

Traditionally, you would need a financial planner to help you determine the right asset allocation for your portfolio, or be savvy enough to diversify your investments on your own.

But micro-investing breaks down that barrier as well.

Related: How To Start Investing For Beginners With Little Money

How micro-investing apps work

Micro-investing is also known as spare change investing because many of these apps round up transactions from a linked bank account and allow you to invest the difference.

For example, if you use your debit card and spend $5.37 at your local coffee shop, the app will round that up to $6 and set aside the $0.63 difference for you to invest later.

Some of the apps let you apply multipliers, like 2x, 3x 5x, or 10x. If you had the 5x multiplier on, the $0.63 difference would become a $3.15 investment.

The apps all have some kind of overdraft identification software to avoid withdrawing money that isn’t there, but it’s not perfect. Fortunately, you can control the round-ups and multipliers and turn them on and off as needed.

Setting up recurring monthly deposits into your investment account is another option, and you can set these automatic transactions for as little as $5/month. You can also make one-time deposits.

Depending on which app you use, once your micro-investment account has funds in it, it automatically purchases investments that fit your portfolio. That’s the robo-advisor aspect, and some of these apps will periodically and automatically rebalance your account if you become too over or underweight in a specific asset class.

Some of the apps let you pick your investments, and the money sits in your account as uninvested cash until you purchase the micro-shares you want. Or, you can set a schedule for which investments you purchase.

Related: 20 Best Money Saving Apps

What you can expect from micro-investing

Logically speaking, if you’re investing with small amounts of money, you can expect small returns.

That doesn’t mean you can’t try it out. I think micro-investing can teach some very important investing lessons to people who would otherwise be put off by the high cost or perceived level of difficulty.

One of the hardest lessons for new investors to learn about is market volatility. This is the constant up and down that you see in the stock market. It’s incredibly normal, but that doesn’t mean it isn’t a little scary.

You will see market volatility in your micro-investment accounts, but on a smaller scale.

Micro-investing can help you get comfortable with how the market moves over time and show you why it’s so important to hold tight and ride the waves.

You’ll also learn about things like asset allocation, tax-loss harvesting, ETFs vs mutual funds, and more. You can do that while actively participating in the market, but you don’t need to make a major financial commitment to participate. It’s hands-on learning.

The cost of micro-investing

The way many brokerage accounts charge is based on a percentage of your investments, but most micro-investing apps use a subscription-based model. They charge anywhere from $1-$9/month based on the kind of services or accounts you’re having them manage.

When you don’t have a lot invested through the app, $1/month is actually pretty expensive. For example, if you only had $20 invested, $1 would be a 5% fee. That’s a lot.

Some traditional brokerages are making investing more accessible to new investors. Charles Schwab, for example, rolled out Schwab Stock Slices in June 2020, and Fidelity now offers Stocks by the Slice.

Both of those are micro-investment options, but what you’re really paying for with apps that specialize in micro-investing is the spare change, robo-advisor investing model.

Now that you have a good grasp about what micro-investing is and what to expect, I want to tell you about what I think are some of the best micro-investing apps.

4 of our favorite micro investing apps

What are some of our favorite micro-investing apps?

- Acorns

- Stash

- Betterment

- Twine

You can read further about each micro investing app below.

1. Acorns micro investing

Founded in 2012, Acorns is the original micro-investment app. Acorns allows users to link and round up transactions from both debit and credit cards. Acorns does 2x, 3x, and 10x multipliers on round-ups.

Acorns has five different portfolios for investors based on your financial goals and timeframe. The portfolios range from conservative to aggressive and are developed using Modern Portfolio Theory — an investment framework introduced by Nobel Prize winner Harry Markowitz.

You get a fully automated experience with Acorns. You make deposits in your investment account on a schedule or using round-ups, and then Acorns purchases micro-shares of ETFs for your portfolio.

There’s also a Found Money option, which allows you to earn money when you use your linked card with one of Acorns more than 350 partner companies. You earn a percentage of what you spend that’s then invested in your Acorns account 90 to 120 days after you’ve made a purchase.

Acorns has three different plans:

- Lite $1/month: This is a personal investment account

- Personal $3/month: A personal investment account, tax-advantaged retirement account, and a checking account

- Family $5/month: Everything that comes with Personal, and includes custodial accounts for your kids

I used Acorns for a little over a year to test out the app, and I nearly effortlessly grew my investment account to over $900 in less than a year. I had my account set for round-ups and automatic transfers of $50/month.

It was very much a set-it-and-forget-it experience, and there were times when I really did forget that it was connected to my bank account.

Like I said, I started an account to test it out, and I ended up cashing out and put those funds towards a vacation. Cashing out means you’re selling your assets, and it can take a few days to complete the process.

This isn’t a liquid emergency fund. Plus, selling shares is a taxable event. That means you will be responsible for paying taxes if you’ve made money from the sale of your shares.

You can click here to sign up for Acorns.

2. Stash fractional share investing

Stash was founded in 2015, and has built a flexible and informative investment platform for beginners.

Where Stash differs is that you can also choose how you invest your money, and you can purchase fractional shares of ETFs and stocks.

The ETFs you’ll find on Stash are well-known ones, but Stash has renamed them for their investors’ clarity. For example, Clean & Green ETF is Stash’s name for the iShares Global Clean Energy Fund.Some of Stash’s other ETF options include Women Who Lead, American Innovators, Combat Carbon, and more.

Stash has two plans for investors to choose from:

- Growth $3/month: Personal investment account and tax-advantaged Roth or Traditional IRA , and Smart Portfolio

- Stash+ $9/month : Everything in Growth, plus two investment accounts for your kids , 1% Stock-Back® Rewards1, monthly market insights, and $10,000 of life insurance coverage through Avibra2

All Stash accounts come with access to a banking account3, including the Stock-Back® Card, a Stock-Back® Card that earns you pieces of stock when you use it4.

You can click here to sign up for Stash.

Paid client testimonial. Not representative of all clients and not a guarantee. See Apple App Store and Google Play reviews. View important disclosures.

3. Betterment

Betterment is a true robo-advisor — you select your savings or investing goal and Betterment offers a strategic investment approach for you.

What you might like about Betterment is that it feels more like a traditional brokerage from its portfolio options, pricing, and financial advice packages.

Betterment’s charges management fees based on your invested balance. It’s 0.25% on investment and retirement accounts. Once your account hits $2 million invested, Betterment drops its fees to 0.15% annually.

For investors with more than $100,000 invested, you can pay 0.40% for Betterment Premium and gain unlimited access to Betterment’s Certified Financial Planners. The price of Premium drops to 0.30% for accounts of $2 million or more.

Betterment has personal investment accounts, joint accounts, IRAs (Traditional, Roth, and SEP) and 401(k) and 403(b) rollovers.

In addition to conservative through aggressive portfolios, Betterment offers additional portfolio strategies:

- Socially Responsible Investing: Choose from Broad Impact, Climate Impact, or Social Impact

- Goldman Sachs Smart Beta: Diversified strategy that’s built to outperform a conventional market-cap strategy

- BlackRock Target Income: 100% bond portfolio build for investors who are nearing retirement

Betterment doesn’t have round-ups or multipliers, you fund your account with recurring or one-time deposits.

I mentioned financial advice packages above — Betterment offers packages starting at $199. These packages are geared towards planning for different life events, like marriage, college savings, or retirement planning.

Betterment’s financial advice packages include a phone call with one of their Certified Financial Planners to review your income, goals, budget, etc. They work with you to develop a personalized plan that helps you meet your future goals.

You can click here to sign up for Betterment.

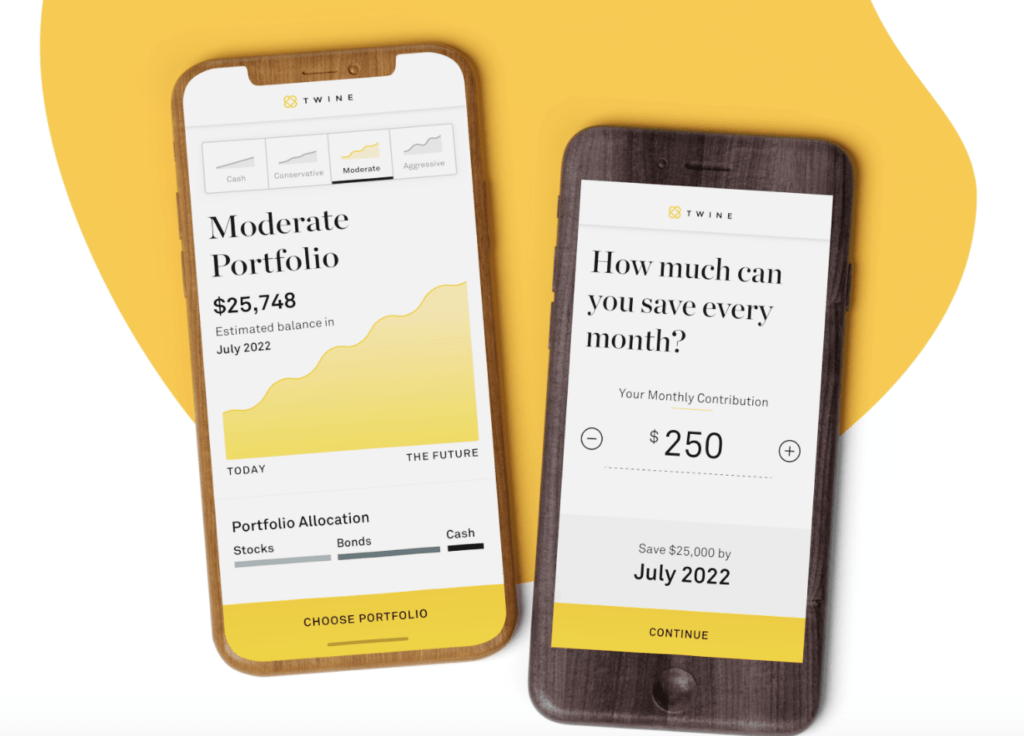

4. Twine

Twine was created in 2017 by insurance giant John Hancock. It’s a unique micro-investing and savings app because it’s developed for couples to save together.

You can save and invest money with your boyfriend, girlfriend, partner, or spouse. Twine doesn’t have rules on who you can save with, so technically you could save with a stranger!

This micro-investing app also has a super simple and straightforward pricing system. It’s free to save in cash — this is an online savings account that is FDIC insured for up to $250,000.

Or you can invest for $0.25/month for every $500 you invest with Twine.

The way Twine works is that you create an account and invite someone to start saving or investing with you. You set the goal — it can be a vacation, down payment on a house, new car, etc. — and decide how much you need to save and your timeline.

Twine asks questions about your financial situation, like income and net worth, and investing style, and then matches you with a portfolio. Twine’s portfolios are conservative, moderate, or aggressive, and they contain ETFs and mutual funds.

You set up recurring deposits so you can save enough to reach your goal, and you and your partner can contribute different amounts.

Twine keeps you and your investing partner’s contributions separate in individual brokerage accounts, and you only have access to the contributions you’ve made.

Is micro-investing worth it?

Let me start with this: I’m not a financial expert. At all.

Investing has intimidated me in the past, and I know there are a lot of other people who feel that too. Micro-investing was created to remove the intimidation factor and break down the barriers to traditional investing.

These apps prove that anyone can start investing.

You can start with as little as $5 per month, and that’s pretty cool.

The downside to micro-investing is that you can’t rely on the spare change model as a long-term investment strategy.

I have my two micro-investing accounts, with Stash and Acorns, but I also have investment accounts with another brokerage that are set up for long-term planning. What’s been great about these micro-investing apps is they’ve taught me a lot about the market, and I’m more confident now. I’ve gotten a solid grasp on what’s happening with my money and have taken more control over how I use it for future planning.

If you decide to try any of these apps out, learn as much as you can and pay attention to how the market works. Let these micro investing apps be a springboard for your larger investing plans.

Are you interested in trying out one of these best micro investing apps? What do you think of them?

Disclosures:

Paid non-client endorsement. See Apple App Store and Google Play reviews.

Nothing in this material should be construed as an offer, recommendation, or solicitation to buy or sell any security. All investments are subject to risk and may lose value

1 1% Stock-Back® rewards available only on Stash+ ($9/mo) and only for client’s first $1,000 of Qualifying Purchases in each calendar month program.

2Group life insurance coverage provided through Avibra, Inc. Stash is a paid partner of Avibra. Only individuals who opened Stash accounts after 11/6/20, aged 18-54 and who are residents of one of the 50 U.S. states or DC are eligible for group life insurance coverage, subject to availability. Individuals with certain pre-existing medical conditions may not be eligible for the full coverage above, but may instead receive less coverage. All insurance products are subject to state availability, issue limitations and contractual terms and conditions, any of which may change at any time and without notice. Please see Terms and Conditions for full details. Stash may receive compensation from business partners in connection with certain promotions in which Stash refers clients to such partners for the purchase of non-investment consumer products or services. This type of marketing partnership gives Stash an incentive to refer clients to business partners instead of to businesses that are not partners of Stash. This conflict of interest affects the ability of Stash to provide clients with unbiased, objective promotions concerning the products and services of its business partners. This could mean that the products and/or services of other businesses, that do not compensate Stash, may be more appropriate for a client than the products and/or services of Stash’s business partners. Clients are, however, not required to purchase the products and services Stash promotes

3 Stash Banking services provided by Stride Bank, N.A., Member FDIC. The Stash Stock-Back® Debit Mastercard® is issued by Stride Bank pursuant to license from Mastercard International. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated. Any earned stock rewards will be held in your Stash Invest account. Investment products and services provided by Stash Investments LLC and are Not FDIC Insured, Not Bank Guaranteed, and May Lose Value.

4 All rewards earned through use of the Stash Stock-Back® Debit Mastercard® will be fulfilled by Stash Investments LLC and are subject to Terms and Conditions. You will bear the standard fees and expenses reflected in the pricing of the investments that you earn, plus fees for various ancillary services charged by Stash. In order to earn stock in the program, the Stash Stock-Back® Debit Mastercard must be used to make a qualifying purchase. Stock rewards that are paid to participating customers via the Stash Stock Back program, are Not FDIC Insured, Not Bank Guaranteed, and May Lose Value.

A “Smart Portfolio” is a Discretionary Managed account whereby Stash has full authority to manage. Diversification and asset allocation do not guarantee a profit, nor do they eliminate the risk of loss of principal. Stash does not guarantee any level of performance or that any client will avoid losses in their account.

Leave a Reply