Traders’ accounts have always been an attractive goal for fraudsters. To avoid risks and not lose your money, you need to follow some important rules.

With the Internet rise, web surfers became exposed to more risks. Not long ago, the Internet was a means of entertainment and communication, and now you can do almost everything through the network: from buying food to paying your utility bills. The Payments are made through bank cards and accounts.

However, for many, the only means of protection is standard software, which prevents only basic threats.

Even those who use the Internet for social nets and online games will have a lot of problems in case their password is stolen. If you are a trader, then Internet security is as important for you as in real life.

The article covers the following subjects:

- Major takeaways

- Forex client profile verification

- E-mail protection

- Password manager

- Two-factor authentication

- Active sessions

- Ways to protect your trading account. Intermediate conclusions

- Types of hackers' schemes you need to know to protect your account

- Main safety rules when working on Forex broker's client space

Major takeaways

- What are security threats in Forex trading?

Hacking threats target traders' accounts by exploiting internet security vulnerabilities. With the rise of the internet, users are exposed to more risks, especially in forex trading. Adhering to security rules is crucial to prevent hacking.

- Types of threats

1. Fake sites mimicking broker platforms.

2. Hackers impersonating support teams on social networks.

3. Hackers using email or phone, pretending to be the support team.

4. Hacks through leaked email password databases and further brute-force attacks.

All these methods aim to steal traders' funds.

- How do hacking schemes work?

Hackers create fake websites resembling broker platforms, impersonate support teams on social networks, and send deceptive emails or make phone calls. Their goal is to gather personal and payment details to hack trading accounts and client profiles.

- How to avoid hacking threats

Avoid fake websites and always check the domain name. Do not log in through suspicious links to prevent phishing attacks. Be cautious with investment offers, always verify the source, and communicate only through official support channels.

- Tips

Use strong passwords and change them regularly. Do not use the same password for different accounts, including email. Avoid storing copies of documents in email, enable two-factor authentication (2FA) via SMS, use password managers, employ reliable antivirus software, and be cautious with suspicious websites or communications.

There are several techniques necessary for a trader not to fall victim to scams.

Forex client profile verification

The main necessary procedure in Forex today is verification. Verification is the submission of a package of documents identifying a trader. The procedure is good for both traders and brokers. Nobody is surprised by an ID document request, for example, when buying a plane ticket.

Today people are verified even when registering on social networks. When making money transactions, there are much more reasons for verification. So, I’m in no way outraged when a broker requests verification. Actually, traders benefit from verification too. It is impossible to withdraw money from an account to third-party wallets if the account owner has passed verification. The support team will notice that a client’s verified name has been changed. A verified phone number cannot be changed as withdrawal confirmation codes are sent to the client on a verified phone number.

Of course, brokers try to secure a client and don’t withdraw money via systems different from those used for deposits.

But there are some cases when fraudsters get access to your email and personal data, including the documents if you have ever sent anybody their copies.

Owning this information, they contact the broker support service and claim that the purse used for making deposits is lost and the money has to be withdrawn to a new one.

In that case, the broker requests the documents issued in the name of the person that opened the client profile and calls him/her using the phone number specified when registering the profile. Of course, in most cases, the broker’s team will know the truth.

But what if you didn’t give your phone number and can be connected only through email? The broker waits until there is any additional information. Perhaps, if the purse was hacked, the real owner will turn up to restore the access to his/her profile changed by the fraudster. But the situation is still unpleasant, I may say.

Summing up:

- give your real personal information when you register with a broker;

- verify your name, address, and telephone number;

- don’t store the copies of your documents in your email account; delete sent letters.

E-mail protection

Email is one of a trader’s tools, so it also needs protection due to the reasons mentioned above.

The email account is usually hacked in order to sell it next to spammers. Moreover, the hack can cause further hacks of various accounts associated with your email address.

First of all, to secure your email account, you need to use your imagination and make up a complex password. Best of all, if it is a phrase with a random set of words, symbols like # / @, and so on. Periodic change of passwords will be good hack prevention.

It is important to remember the complex password by yourself. Especially for the forgetful, there are special programs to manage your passwords. To protect yourself against accidents, you’d better not keep in your email box the letters with passwords for the trading accounts and client's profile. Once you received the password, save it in the password manager and delete the letter.

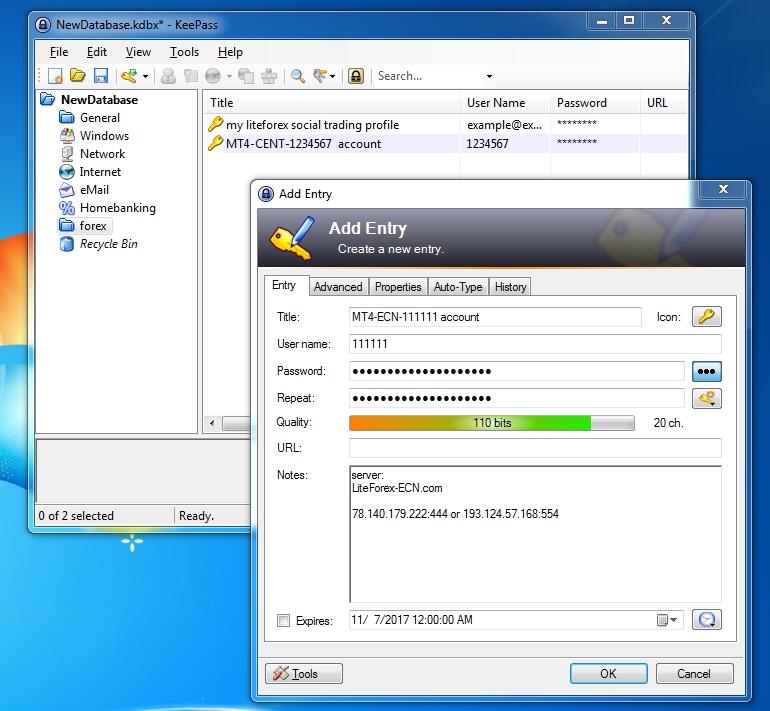

Password manager

Now, let’s speak about a password manager. It is software that stores passwords in encrypted form. Besides, it allows one to change passwords easily and stores data both on the computer and remotely.

Three most popular programs

1. KeePass will suit those who like using software for free. There are versions for Windows, OS X, Linux, iOS, Android, and Windows Phone. I myself like the program most of all. You can keep your password databases on a USB drive and launch them on any computer with KeePass. The password database can be conveniently divided into folders to find your access data easily.

After installing the program, you create a new password database, name it as you like, and create a Master Password, making access to the database available. As for me, it’s more convenient to remember one complex password than dozens of them.

2. LastPass Password Manager. There are three options for it.

Free — for free;

Premium — $2 per month;

Families — $4 per month.

The more expensive the subscription is, the more opportunities you have.

3. Dashlane password manager has an attractive interface, is simple to use, can change several passwords for different sites in a few steps

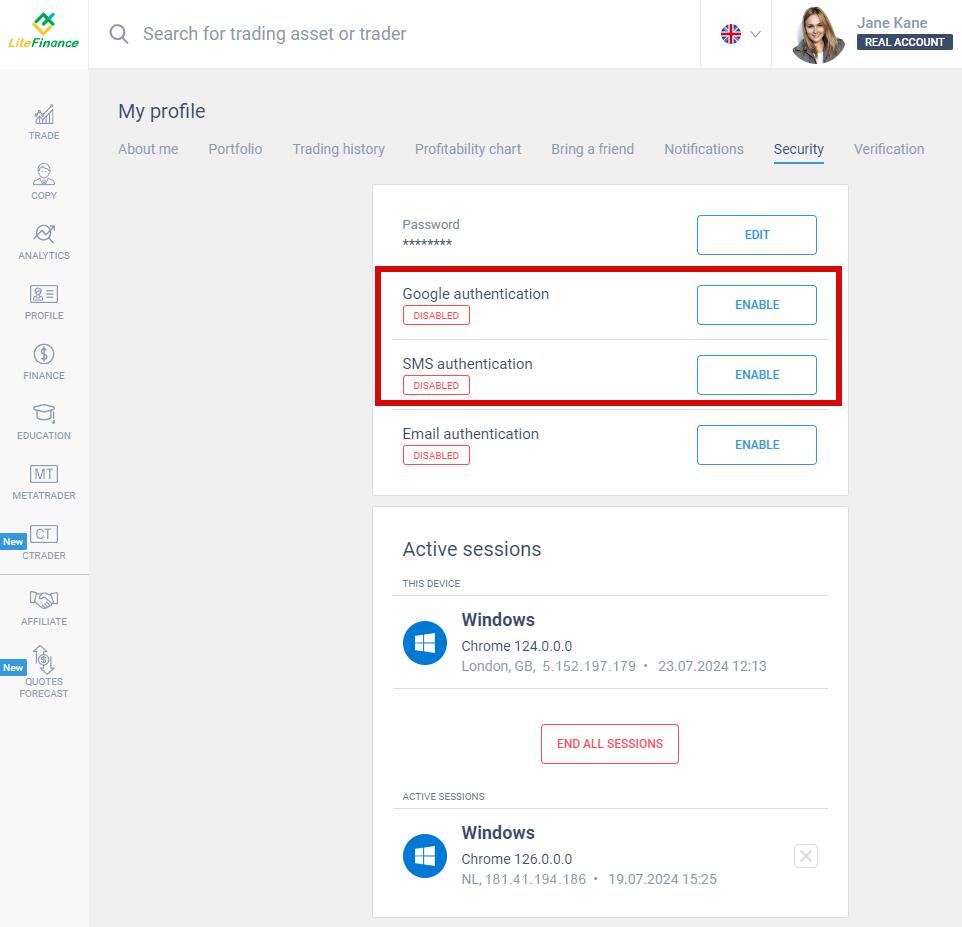

Two-factor authentication

Implementing Two-Factor Authentication (2FA) is a crucial step in enhancing the security of your trading account. By requiring an additional verification step beyond your password, 2FA significantly reduces the risk of unauthorized access. Here's how you can set it up:

Google Authentication

Google Authentication provides an additional layer of security for your trading account. After enabling it, you will need to enter a unique code generated by the Google Authenticator app on your smartphone each time you log in. This code changes every 30 seconds, making unauthorized access extremely difficult.

SMS Authentication

SMS Authentication involves receiving a unique code via SMS to your registered mobile number each time you attempt to log in. You must enter this code to access your account, adding an extra level of protection against hacking.

Active sessions

In your client profile, you can monitor your current active sessions. This feature allows you to see which devices and locations are accessing your account. If you accidentally forgot to log out on a shared or public computer, you can remotely end these active sessions. This functionality helps enhance the security of your account, preventing unauthorized access to your data and funds.

Start trading with a trustworthy broker

Ways to protect your trading account. Intermediate conclusions

To secure your money, follow these simple rules:

- don’t be afraid of verification;

- don't enter passwords for your accounts on a borrowed computer;

- use a complex password;

- enable Google authentication or SMS authentication;

- don’t store your identification or personal data in email;

- do not leave your terminal unattended;

- change your passwords from time to time;

- install reliable anti-virus software on your computer;

- use password managers.

Forex trading is a rather nervous job, and reliable protection reduces the stress. So, it is better to spare no time and money on security that will definitely pay off.

Types of hackers' schemes you need to know to protect your account

Internet scams have become more frequent in recent years. To steal clients' funds, some scam schemes have started using a broker's name. I want to explain to you how basic scam schemes work so that you could work safely with your money online.

Also, note that most of those schemes are used no matter what field is linked to finances.

Type 1. Scammers use fake sites

They use a broker's name or a part of its site address to register a domain name.

Then they copy the design and contents so that a fake site looks familiar to clients and that they could mix it up with the official site.

Such a fake site contains a fake login form, and an inattentive user may enter his or her login data into that form. Also, it contains a fake registration form where a user may type in his/her personal and payment information. Thus, a real broker won't receive the client's information.

Clients can also send money to fraudsters on a fake site, thinking it's a real broker site.

Phishing sites often aim at bank clients and provide fake forms for logging in to online banking systems.

What for?

For phishing. Scammers aim at stealing a broker's client database to log in to personal client profiles and withdraw money.

Also, those users who enter their personal and payment details on fake sites compromise their personal data and credit cards: they may type in their credit card details, including CVC codes, when attempting to make a payment or withdrawal, and scammers will then be able to steal money from the card.

How to identify scams

Always remember to check the domain name of the site you're navigating, especially when you got the link on Telegram or in chats. If you have already been registered with a broker, pay attention to the site you are on. Most often, scammers don't copy all the site pages; they just copy the main page. Also, check the login form carefully.

The easiest way to get to the right site is to google the broker's name: the real site will be on the top of search results.

Bookmarking your broker's site and client's personal space will be a good idea too.

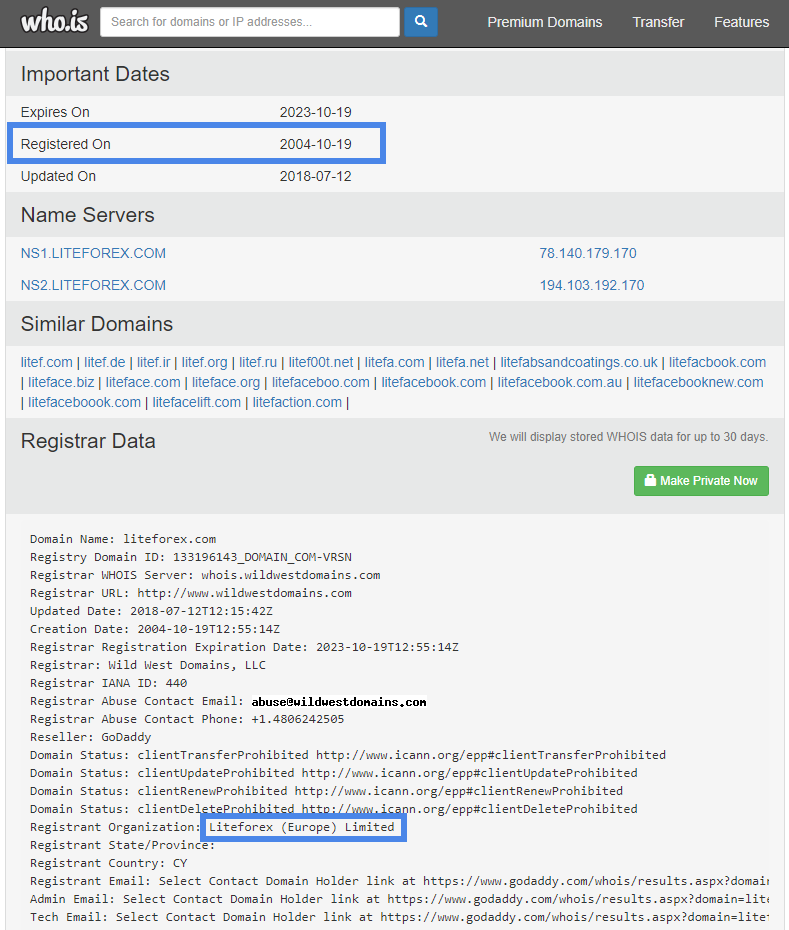

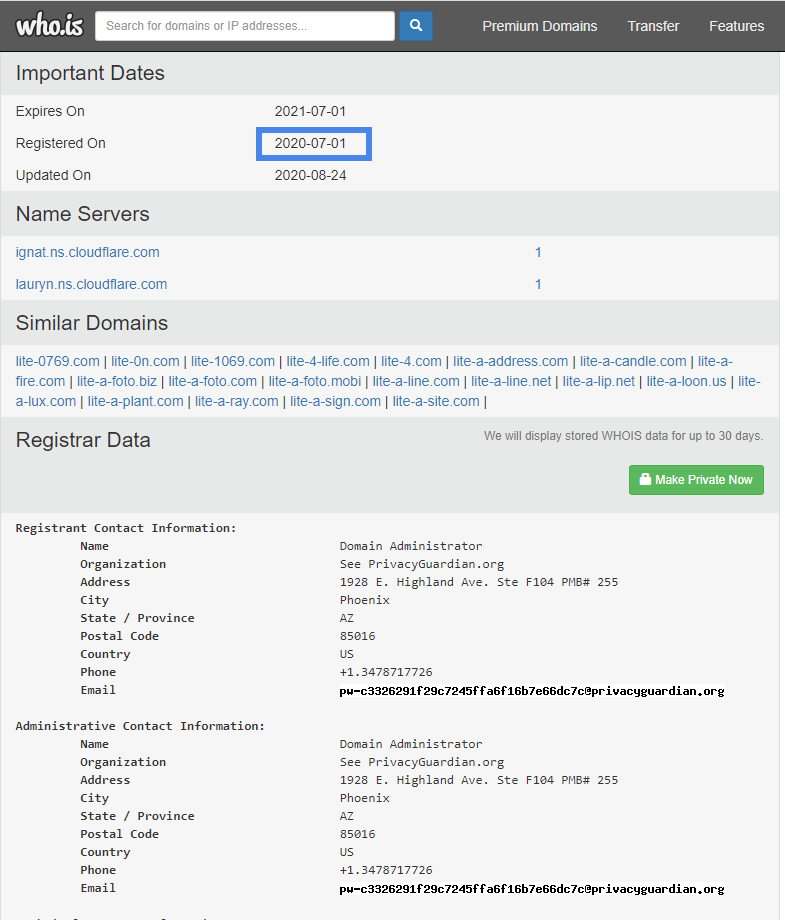

Also, you can check a domain name on Who Is. Fake sites don't usually provide any information on the domain name owner. You will see only the registration date and information on the domain name registrar. There will be no information on the site owner. As such sites don't exist for long, the registration date will be new. Companies always counteract scammers to protect their clients, but there can be bureaucratic red tape because of different jurisdictions.

Here's an example of a real broker's site:

You can see the real information on the company owner. The date of the company registration is quite old.

And here's a print screen of a fake site page:

That's a newly registered site, and there's no information on the owner.

How to protect yourself

After having registered with a broker, have your phone number verified so that a support team knows that your phone number is correct and belongs to you. The LiteFinance broker doesn't allow changing a verified phone number.

Why is it so important to verify a phone number? Let's suppose scammers got the login and password for your client profile. They will then face the following problem: money may be withdrawn only to the wallet used for making deposits. A real client may happen to lose access to an old wallet. In that case, a broker's support team will phone you using the verified phone number.

Also, you'll get an SMS with a confirmation code that you will need to use to withdraw money. As I said before, scammers cannot change a verified phone number, so your money will be safe.

Also, use Two Factor Authentication so that third parties won't be able to log in to your client space even if they got your login and password.

Please note that all deposits shall be made via a personal profile with the broker using the specified payment details.

Type 2. Scammers pretend to be support team and create fake pages on social networks

Lots of clients got used to communicating on social networks or messengers. Instead of contacting a broker via the official contact information, such as Live Chat, phone, or email, clients simply search the company's name on Facebook or Telegram.

Of course, every broker has its group on social networks. However, you'll find dozens of various groups when searching Facebook. Some of them will be official groups belonging to a broker and its partners, and some of them will be malicious. It's in fake groups on Facebook that scammers wait for existing clients' questions. Then they request clients' logins and passwords, pretending to need them to answer a client's question.

They may even suggest making a withdrawal right in the chat window, and they may request the whole of payment information, including an SMS confirmation code. Official support teams never do that.

As in the previous case, scammers aim to gather your personal and payment details to steal your money.

Fraudsters often mislead clients, promising extra profits and bonuses on such fake pages. As a result, clients top up fraudsters' accounts and not a broker's one.

How to protect yourself

First, remember that all deposits and withdrawals must be made via Client Profile.

Other protection methods are identical to the previous case: have your phone number verified by the broker and keep your payment details, login and password safe. Never share them with anyone!

Should scammers hack your personal profile and attempt to withdraw your money, you'll receive a confirmation code on your verified phone number and be aware of such suspicious activities.

Please note that all deposits shall be made via a personal profile with the broker using the specified payment details.

Type 3: Scammers email or phone you, pretending to be support team

Under the pretext of helping you withdraw money, for example, scammers try to get your login and password or suggest that you install a trading app or an adviser on your smartphone.

However, those aren't advisers or trading apps: instead, trustful users install remote access software, such as TeamViewer or Microsoft Remote Desktop. Or it can be malware.

Fraudsters can try to trick a client into topping up their accounts on the phone, providing them with false payment details.

How to protect yourself

Remember these simple rules: a broker's support team never phones clients first. A client has to request a call.

A real support team never requests passwords to verify a user’s identity, or bank card details. Suppose your phone number hasn't been verified. In that case, the support team needs to request the following information to identify you as a client: date of birth, email address, full name, trading account number, wallet number, the first six and the last four digits of your card number. Your password or CVC code must never be requested!

The client support team will never call you to suggest installing any app unless you demand that yourself. All the links to a broker's official applications are always provided on its site.

Please note that all deposits shall be made via a personal profile with the broker using the specified payment details.

Type 4: Broker's client "assistance" sites

Scammers create a scam site with reviews and offer to return money that a client lost in trading for a certain fee. A client may act emotionally and pay scammers, hoping to get the deposit back. Scammers won't help anyone. They simply want to make you pay them for non-existent services.

Such malicious companies usually promote their scam site using specific search queries, such as "broker's name" scam or "broker's name scammer."

How to protect yourself

First, you need to choose your broker with caution. If a dispute occurs, a legit broker will always try to resolve it in the client's best interest. If one blows a deposit because of high-risk trading, it's their fault. No one will be able to pay them their money back because those trades were covered with opposite trades. If your broker violates its own terms of use and account provision terms, contact official institutions that my colleague spoke of in detail in this article.

Please note that all deposits shall be made via a personal profile with the broker using the specified payment details.

Main safety rules when working on Forex broker's client space

Let's sum up the main points discussed in this article, which will keep your personal profile and money safe.

Always fill in your actual personal details and have your personal profile verified. Verifying your phone number and email is a must.

Create a strong password and keep it in special encryption software.

Install an antivirus program on your computer and smartphone.

Always check the domain name when logging into your personal client space.

Anaible and use Two Factor Authentication.

Have withdrawal confirmation codes sent to your phone number.

Never share your passwords for the client profile or trading account on social networks and messengers. The official support team will never request your passwords.

Remember that the company phones clients only if they have requested a phone call.

Check who you are talking to. Official support teams may contact you only through official communication channels, such as your phone number, email, or a broker's LiveChat.

The client support never contacts clients first on social networks and messengers. Scammers can use scam pages on social networks. Be cautious!

Remember that you can withdraw and deposit money only via your personal profile with a broker. An official support team will never request your full payment details, including CVC codes.

A broker's support team never asks clients to install any remote access software, such as TeamViewer or Microsoft Remote Desktop.

All Forex safety rules are identical to those that you observe when working with your online banking service. Keep yourself safe!

If you have any questions or comments on this article, let's talk in the comments section!

P.S. Did you like my article? Share it in social networks: it will be the best "thank you" :)

Ask me questions and comment below. I'll be glad to answer your questions and give necessary explanations.

Useful links:

- I recommend trying to trade with a reliable broker here. The system allows you to trade by yourself or copy successful traders from all across the globe.

- Use my promo code BLOG for getting deposit bonus 50% on LiteFinance platform. Just enter this code in the appropriate field while depositing your trading account.

- Telegram chat for traders: https://t.me/litefinancebrokerchat. We are sharing the signals and trading experience.

- Telegram channel with high-quality analytics, Forex reviews, training articles, and other useful things for traders https://t.me/litefinance

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.